As Ukraine recovers from a series of dramatic political events, the new Ukrainian Government is forced to take tough decisions to stabilise the Ukrainian economy and demonstrate its credibility in order to attract new investment and financial aid.

On 27 March 2014, the Ukrainian Parliament adopted the Law “On Prevention of Financial Catastrophe and Creating Opportunities for Economic Growth in Ukraine” (the “Law”), introducing important amendments to the Ukrainian Tax Code and a number of social security laws. Given the urgency, the Law came into force on 1 April 2014, though some of its provisions will take effect later.

The Law aims to reduce budget expenditures and decrease budget revenues. As the main target groups of the Law, its provisions have caused dissatisfaction among some categories of civil servants and tax payers (both individuals and corporate entities). However, there are some provisions in the Law that should be positively received by agriculture exporters and users of subsoil resources.

Social benefits

The Law reduces or limits a number of social benefits guaranteed to certain categories of civil servants and employees of budget-funded entities (prosecutors and investigators of prosecution authorities; military servants, including reservists; militia; employees of the State Service for Specialised Communication and Protection of Information of Ukraine, civil defence agency and emergency response services; and certain categories of social workers engaged in the areas of education, health care, culture, etc.).

Additionally, the Law: (i) reduces the number of persons working in the prosecution authorities, State Security Service of Ukraine and internal affairs agencies; (ii) reduces retirement pensions paid to people’s deputies, public officials, judges, prosecutors and investigators of prosecution authorities, diplomatic officials, military servants and officials of self-government bodies; and (iii) amends the child benefit scheme by increasing the first child payment and cancelling increases in payments for every subsequent child.

Social payments in Crimea

Social insurance payments guaranteed to unemployed persons, or in case of an employee’s death, work accident and professional disease resulting in partial or full loss of ability to work, and pensions will now be paid to Ukrainian nationals residing in Crimea solely from funds collected within the Crimean territory. Additionally, pensions will only be paid to those Ukrainian nationals residing in Crimea who refuse to draw a pension and other social payments offered by the Russian Federation. Although the Law sends a clear message that Crimea continues to be Ukrainian territory and that Ukrainian nationals willing to stay with Ukraine shall not lose the protection of the Ukrainian Government, it states that all budget social payments are to be made on account of funds received from Crimea and shall not be subsidised by the other territory of Ukraine.

Payments to the Pension Fund

The Law imposes a mandatory contribution to the state pension fund of 0.5%, payable by individuals and legal entities from transactions for the purchase of foreign currency.

Changes to the Tax Code

Changes to the Tax Code of Ukraine imposed by the Law can be divided into the following categories:

– basic taxes: corporate profit tax (CPT), VAT and personal income tax;

– excise duty and environmental tax;

– subsoil use fee;

– land and real estate related taxes; and

– miscellaneous: gas tariff surcharge, fee for using radio frequencies, fee for special water use.

Basic taxes

The Law:

– repeals the gradual decrease of the CPT rate to 17 % on 1 January 2015 and 16% on 1 January 2016. The current rate of 18% will now be permanent. The VAT rate will not be decreased to 17% from 1 January 2015 and will continue at 20%;

– introduces a new 7% VAT for pharmaceutical products, which are permitted for use and production in Ukraine and are included into the State Register of Pharmaceutical Products or list of goods used for medical purposes approved by the Cabinet of Ministers of Ukraine. Previously these pharmaceutical products were taxed at a zero VAT rate;

– decreases the threshold for VAT-free import of goods from EUR 300 to EUR 150 per one shipment, including delivery costs; and

– introduces a gradual rate for personal income tax starting from 1 July 2014. Depending on the taxable income individuals will pay 15% (17% for private entrepreneurs who have not applied for the simplified taxation scheme for independent professional practitioners), 20% or 25%. Also, personal income tax will be levied on pensions exceeding UAH 10,000. The gradual personal income tax rate will also apply to profit received as interest from savings accounts, savings certificates, deposits with credit unions, mortgage-backed securities, dividends, etc.

At the same time, operations on the export and supply to the territory of Ukraine of grain and technical crops will be temporarily (until 1 October 2014) VAT exempt. The exemption does not apply to producers and primary suppliers (suppliers that purchase crops directly from producers to sell them in Ukraine).

Excise duty and environmental taxes

The Law increases:

– excise duties (roughly by 20%-40%) on alcohol and spirits (effective from 1 May 2014 and 1 September 2014, depending on the category), tobacco (effective from 1 July 2014), on import of new motor vehicles, including motorcycles, and their bodies;

– payment for the first registration of motor vehicles and motor boats; and

– environmental tax applying to pollution of air by stationary sources and mobile sources (paid by gasoline traders), pollution of water bodies, disposal of waste, generation and storage of radioactive waste.

Subsoil use fee

The legislators have revised the object of taxation. From now on the subsoil use fee will be levied on the volume of marketable commodity (i.e., that which meets certain industry standards), rather than the volume of the mineral resource extracted from subsoil in raw state. This means that producers should not pay a subsoil use fee for minerals lost during extraction or processing (so-called technological losses, such as flaring).

At the same time, the valuation principles for determining the taxable value of the mineral resources remain largely unchanged; producers should not expect any increase of the tax assessment base.

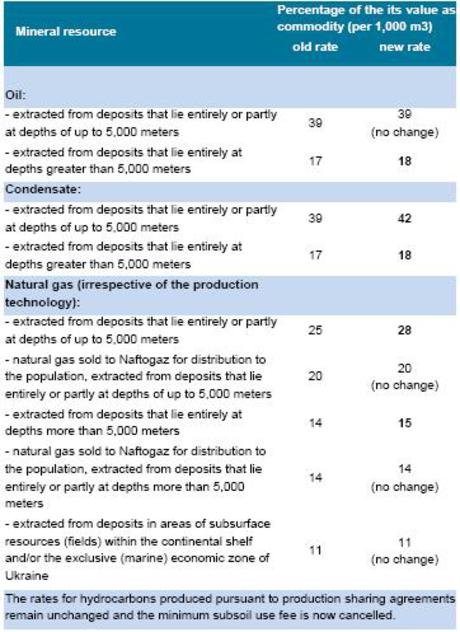

In general, the subsoil use fee rates were considerably increased for ore mineral resources. From 1 April 2014, the rates for hydrocarbons are as follows (see the table).

The Law also increases subsoil use fee rates (by about 10%) for using the subsurface for purposes not related to the production of mineral resources (e.g., storing hydrocarbons, wares etc.).

Additionally, the subsoil use fee will also be paid by land owners or tenants extracting underground waters: (i) under special water use permits; or (ii) with the help of electric equipment in volumes exceeding 13 cubic meters per month. The rates of the subsoil use fee shall correspond to the rates of the special water use fee for the extraction of underground waters.

Land and real estate related taxes

The Law increases the land tax rates, for land plots located within populated areas that have not undergone normative monetary land evaluation, by approximately 8%.

Additionally, the minimum rent payment for land plots, which was previously differentiated for agricultural and other lands and based on the amount of land tax, is now fixed at 3% of the normative monetary land evaluation.

From 1 January 2015, the fixed agricultural tax will be subject to indexation. The indexation method will be identical to the indexation of the normative monetary land evaluation.

The changes have also affected the real estate tax, with the total area of the relevant premises (not only the living area) now being taken into account for the purpose of its assessment.

Miscellaneous

The “special-purpose surcharge to the current tariff for natural gas” (gas tariff surcharge) amounting to 2% (4% if the gas is supplied to the population) of the value of natural gas supplied is required to be paid by suppliers of natural gas, although suppliers usually include this within the gas supply tariff and the surcharge is actually paid by gas consumers. According to the Law, the gas tariff surcharge will now also be paid by entities independently importing natural gas for their own consumption and natural gas producers consuming their own gas.

The Law also doubles the fee for using radio frequency, and increases the fee for special water use by roughly 10%.

* * *

Due to recent political changes in the country we expect more amendments to the tax legislation and will keep you informed of any new developments.

LAW: No.1166-VII “On Prevention of Financial Catastrophe and Creating Opportunities for Economic Growth in Ukraine” dated 27 March 2014

Authors:

Daniel Bilak, Managing Partner, [email protected]

Olexander Martinenko, Senior Partner, [email protected]

Victoria Kaplan, Senior Associate, [email protected]

Volodymyr Kolvakh, Lawyer, [email protected]