Influx of foreign investors panic domestic Ukrainian bankers

Ukraine’s banking sector has seen quite a bit of investment activity recent activity recently, as majority stakes in three of the country’s largest banks were sold to Western banking groups. The sudden eastward advance of big Western banking conglomerates onto the Ukrainian market is destined to fuel continued growth. But it has also triggered panic among many of Ukraine’s smaller banks, who fear they will not be able to compete with the giant newcomers.

Eastward advance

Within the last seven months, a controlling stake in Aval Bank was sold to Austria’s Raiffeisen Banking Group for just over $1 billion, followed by a 51 percent stake in Ukrsibbank, which was sold to France’s BNP Paribas for about half a billion dollars. Italy’s Banca Intesa inked a deal earlier this year to purchase more than 85 percent in Ukrsotsbank for just over $1 billion.

In all three sales, Ukrainian tycoons sold their stakes to Western banking groups for top dollar. True, Ukraine still has more than 140 banks, most of which remain Ukrainian-owned. But analysts and insiders predict that more of them, particularly the largest ones, will be sold to Western or Russian banks soon.

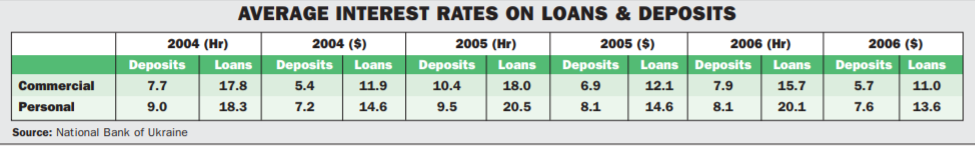

The three recent sales and future acquisitions are likely to shake up the market, fueling competition and lowering rates on loans while increasing returns on deposits.

The three acquisitions will likely have an immediate impact, as they increased the share of foreign capital in Ukraine’s banking system from below 10 percent to nearly 25 percent. Aval, Ukrsotsbank and Ukrsibbank ranked as three of the largest five Ukrainian banks in terms of net assets and branch network size. The top five control more than a quarter of the market, as the lion’s share of Ukraine’s banks serve as so-called pocket banks, servicing business groups which control them, rather than Ukrainian household and corporate clients.

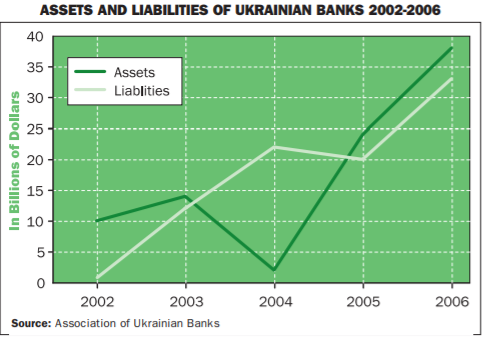

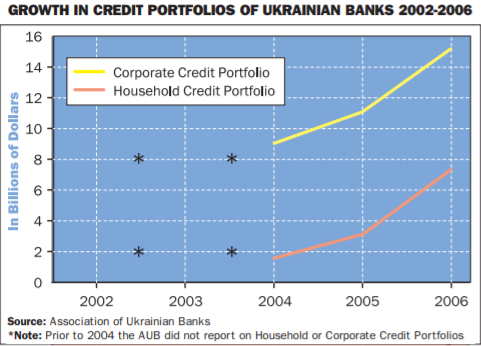

While foreign capital has increased, so has the overall capital of Ukraine’s banks, growing from approximately $2.4 billion at the beginning of 2004 to $13.2 billion at the beginning of this year. The credit and deposit portfolios of Ukraine’s banks also increased significantly since 2004. Personal credit portfolios more than doubled, for example.

Badly needed help

The influx of foreign banks would be a good thing according to Oleksiy Plotnikov, a professor at Kyiv’s Institute of World Economy and International Relations. Plotnikov said that the coming of large-scale foreign banks will promote competition and better integrate Ukraine’s banking sector with the international financial world, which will, among other things, positively influence Ukraine’s investment rating.

The challenges are big.

With half of the country’s economy still in the shadows, Ukraine’s banking sector remains small compared to markets out West. What’s more, interest rates remain comparably high, above 10 percent, and they haven’t changed much in the past several years.

The arrival of Western banking groups is expected to further fuel already impressive growth posted in recent years. While it remains unclear if Ukraine’s banking sector will end up majority controlled by foreign interests, as happened in Poland, the timing of their advance is perfect.

Untimely are recent calls to limit the entrance of foreign banks onto the market.

Protectionist play

While competition may be good for the consumer in that it will drive interest rates down, and will be beneficial for the sector as a whole, this is apparently not what many of the local banks want, as they lobby to control the foreign advance onto the market.

On March 9, Communist Party deputies Pylyp Buzhdyhan and Serhiy Chychkanov submitted a bill which, if passed and signed into law, would achieve just this.

The bill proposes blocking all foreign banking groups from entering the country, while allowing those which recently entered the market to stay.

The bill also proposes forbidding non-residents from participating in Ukrainian banks, a seemingly impossible requirement, considering that many of the country’s banks controlled by local tycoons are owned through non-resident offshore firms.

“As you know we are going through elections now, and this is populism politics,” said Jacques Mounier, president of Calyon Bank Ukraine, an affiliate of the Calyon French banking group.

“If the bill passes, President Viktor Yushchenko will have but one choice. He will have to veto it,” Mounier said, adding that such protectionist policies would halt Ukraine’s efforts to join the World Trade Organization.

While passage of such a hard-line bill is nearly impossible and represents more of a populist political move ahead of the elections, there are yet more realistic efforts to curtail Western involvement: Ukraine’s top banking officials have expressed plans to control the activity of foreign banking interests on the market, and the Ukrainian Association of Banks, an advocacy group which represents the interests of the sector, is also pushing for a modicum of restrictions.

Oleksandr Zholud, a banking expert at the International Center for Policy Studies, a Kyiv-based think tank, said the unfair panic is being fueled by many smaller Ukrainian banks that fear serious competitors from abroad.

“The amount of foreign capital in the Ukrainian banking sector is one of the lowest in Central and Eastern Europe, and this influx of new foreign capital is rather bothersome to domestic bankers, because foreign banks are more effective, and their arrival increases competition,” he said.

Mounier said Ukraine needs more of a foreign presence on its banking sector to fuel growth, buts adds that the process should be controlled.

“The Ukrainian banking sector needs to have a certain number of foreign investors to come in to ensure that the sector develops,” Mounier said.

“But I continue to support the position I have held in the past, which is that of the Association of Ukrainian Banks, that it would be better for a country to have the capacity to maintain a portion of its financial sector domestically-owned. This gives a kind of lever to a country. It is not to be achieved by legislation or regulation, but by entrepreneurs in an open environment,” added Mounier.

“The main argument of those who oppose the arrival of non-resident banks is their fear of an increase in economic influence and their disinterest in the development of the local economy. Ukrainian bankers are also afraid that foreign banks will use their brand to attract the most profitable clients,” said Zholud.

Fair treatment

The Association of Ukrainian Banks stepped up efforts to protect their members on March 13, calling for “equal conditions of competition on the Ukrainian market.” The association called for a level playing field, calling for other countries to open their markets to Ukrainian banking groups, allowing them to open affiliates on their turf, too.

With more than 140 Ukrainian banks, the possibility of mergers between Ukrainian banks and foreign counterparts is vast, according to the association.

Some, however, doubt such expansion plans are genuine, questioning whether many Ukrainian-owned banks are seriously eager and capable of investing in the local market.

“I can see neither the will nor the capacity for the local owners of banks to develop the sector to what is really efficient for the economy,” Mounier said adding that many of the country’s banks are mere pocket banks, servicing the interests of business groups who own them.

The difference between large foreign capital and smaller Ukrainian banks lies in their ability to withstand periods of crisis while continuing to provide services at a competitive level – to weather storms in the market.

Zholud said such overly protective attitudes and policies, which may or may not be implemented, could derail investor sentiment, slowing down the flood of badly needed capital. According to him, the Central European experience of foreign investment in the banking sector has done two things: It has both increased the growth of the sector and also brought stability to it. Referring to efforts by Ukraine’s banking lobby to curb expansion of foreign banks onto the market, Zholud says: “It would be a win for domestic bankers at the expense of society as a whole.”