Ukraine’s central bank started testing a new national electronic payment system this month that it says will bring it closer to the international standards used by such systems as Visa and MasterCard.

But major banks are still waiting to see whether their concerns are addressed before they decide to use it.

In early June, the National Bank of Ukraine announced the launch of a four-month pilot project designed to upgrade an existing payment system that is in limited use. Ukraine’s officials expect that the system eventually will be an important player on the domestic payments market.

However, it seems that many upgrades still have to be made before that happens, particularly when it comes to the system’s security.

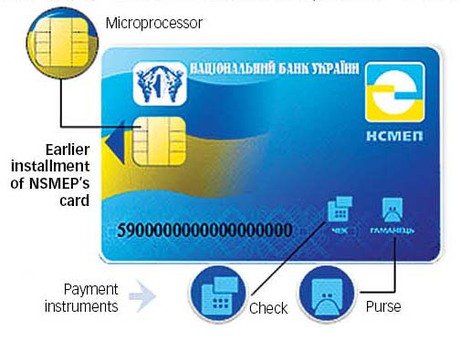

The first prototype of the National Mass E-Payments System (NSMEP) was launched in 2000. The first NSMEP payment cards were issued in 2001, but commercial usage of the system did not start until 2004. Between 2008 and now, 58 banks and nine other institutions joined it, including state-owned postal service Ukrposhta.

But with NSMEP cards not accepted by regular card readers, the initiative was largely stillborn. Card owners were forced to look for special terminals, making the process of withdrawing money and paying for services awkward and frustrating.

A total 9.5 million cards have been issued so far, of which 6 million went to clients of the USSR’s savings bank Oshchad Bank to be able to withdraw a portion of their Soviet-era savings. By comparison, about 21 million Visa cards and 11 million MasterCards have been issued in Ukraine, according to Kommersant newspaper.

To make the system more viable, the central bank launched an overhaul. Inna Tiutiun, deputy director of the department responsible for payment systems, says the NBU is introducing several major improvements.

The clearing house and processing center are both being enhanced, after which cards can be re-issued. The new cards will feature a regular magnetic strip and more secure EMV-chips, like those used by Visa and MasterCard. No details have emerged about the project’s costs, though. The central bank didn’t answer the Kyiv Post’s information request by the time the paper went to print.

According to government statistics, up to 96 percent of card-based transactions from Ukraine-based accounts take place within Ukraine’s borders, said UkrGazBank first deputy board chairman Stanislav Shlapak. That’s why, he believes, “the core market for cards is the local market.”

He said most card payments in Ukraine are routed though Visa and MasterCard sites located abroad, which means foreign companies are paid for services even on domestic transactions.

“Using NSMEP, banks will also be able to avoid making deposits abroad to ensure the inter-bank transactions on international payment systems’ cards, despite the fact that most of the cards are served on the territory of Ukraine,” Shlapak says.

The national payment system could also drive prices down for card payments, some bankers say.

“This system is intended to bring an additional player to the market, which will increase competition and possibly lead to lower rates. This, in turn, can reduce the cost of services for end-users – the cardholders,” says Volodymyr Lavrenchuk, board chairman of Raiffeisen Bank Aval.

However, neither Raiffeisen Aval, nor other top private banks in Ukraine have joined the national payment system. Usage of the previous version and its cards was too costly, Lavrenchuk explains. The bank is waiting to see the newly enhanced product to decide if it’s worth revisiting the NSMEP.

According to the Independent Association of Ukrainian Banks, the NSMEP controls less than 10 percent of card transactions at the moment, with Visa and Mastercard accounting for the bulk of the rest. According to IAUB, it would be more logical to use NSMEP cards in such cases as paying pensions, salaries or stipends for students, because they are designed primarily for payments inside Ukraine.

But there are plenty of disadvantages, too. “Key market players have already invested in the development of card businesses based on Visa and MasterCard products, and benefits to migrate over to the NSMEP cards are not obvious,” says Valeriy Patsuy, head of the card business development department of First Ukrainian International Bank.

The cards cannot be used for payments abroad. And even at home, the potential for using them is currently limited because many terminals only accept cards of international payment systems, Patsuy says.

But the biggest concern is the system’s security. “If the system is built without really strong – read expensive – data security, there is always the risk that that data could be stolen,” Steven Parker, head of Visa operations in Southeastern and Eastern Europe, Russia and Central Asia told Kyiv Post in September 2012. “There’s an exact correlation between how much you spend on a system and how secure it is.”

“The reliability of Visa’s and MasterCard’s equipment, as well as the control of its stability, is supported by decades of international practice and experience. But it still remains to be seen how secure the NSMEP system will be, considering the massive growth of turnover and the number of transactions,” Patsuy said.

Experts from IAUB think that payment security with new NSMEP cards at automatic teller machines and POS-terminals will conform to international standards. It’s such issues as the security of online payments that are still under question. However, UDAR lawmaker Olga Bielkova emphasizes that together with developing NSMEP, the NBU also should ensure a competitive environment on the national payment market. Among other things, banks should have the right to accept any cards issued by Ukrainian banks, and use the same fee structure.

Kyiv Post staff writer Kateryna Kapliuk can be reached at [email protected].