Financial services industry tops list of survey findings.

Ukraine’s notoriously high levels of corruption stretch beyond businesses’ dealings with officials.

A recently published survey shows that the rot has also spread to the core of the corporate world.

Experts say that it is not uncommon for regular audits to fail to detect such violations.

According to the Global Economic Crime Survey, released last December by PwC, a leading international consulting and auditing firm, 36 percent of Ukrainian organizations that took part in their survey experienced economic crime last year.

Not only is this figure higher than the global average for 78 countries surveyed by PwC, but the number of internal frauds reported by the respondents alarmingly increased by 22 percent last year.

As a result, 56 percent of all economic crime in 2011 was taking place inside companies.

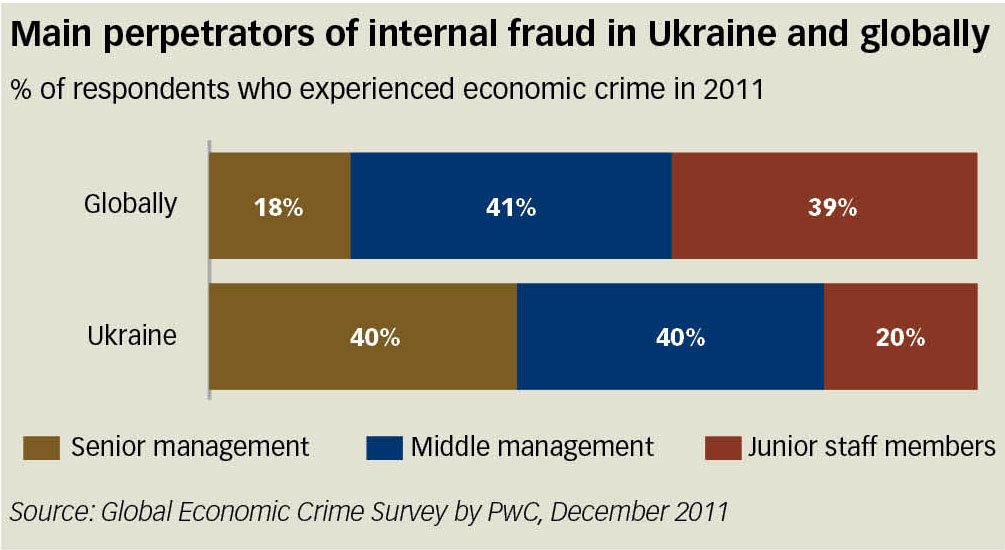

What makes Ukraine’s corporate economic crime truly unique from a global standpoint is the nature of its perpetrators.

According to PwC, business in Ukraine starts to rot from the very top, as 40 percent of the respondents named their companies’ senior managers as the main perpetrators.

This is two times higher than in the rest of the world, where most fraudulent actions are committed by mid- and junior-level managers.

Especially bad news is the typical way in which Ukrainian company owners respond to fraud.

While the average damages caused by economic crime in Ukraine is reported to reach $5 million, 20 percent of respondents said that no action had been taken against perpetrators, representing an almost sevenfold increase compared to 2009, while 43 percent said they continue having business relations with a fraudster.

Fraud has come “to be viewed as an inherent feature of doing business in Ukraine, which leads organizations down a worrying path where the organizations themselves provide a rationale for potential fraudsters, and therefore increase the probability of a fraud,” the PwC report reads.

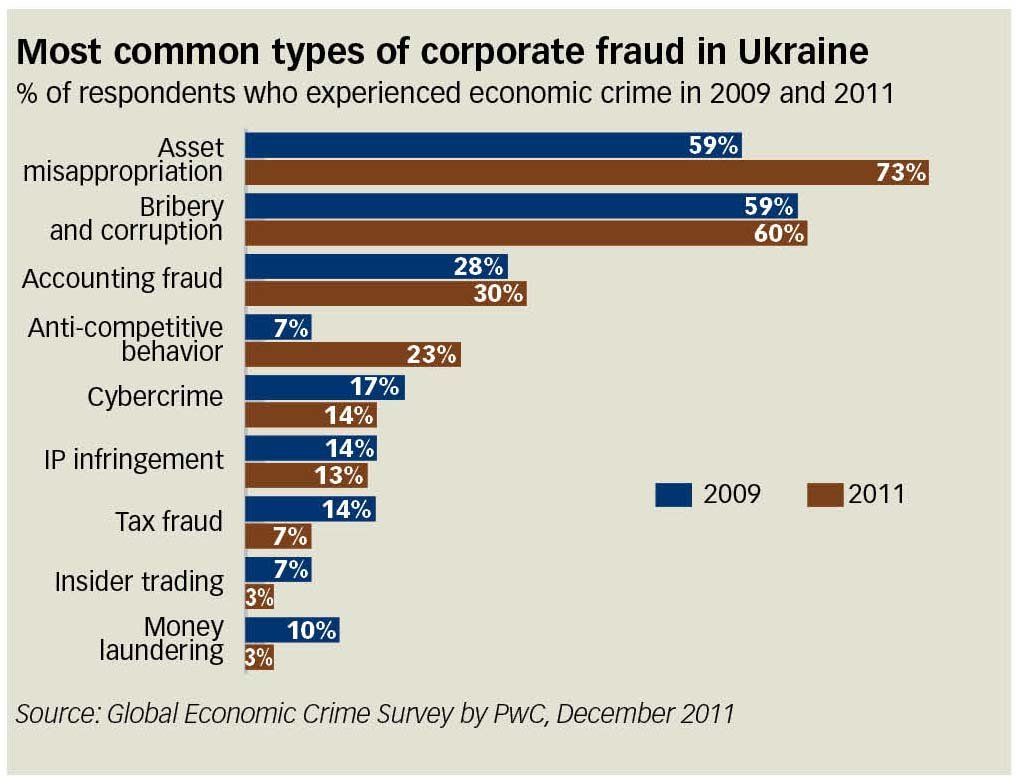

Among the most frequently occurring types of economic crimes in Ukraine, PwC names asset misappropriation, corruption and bribery, as well as accounting fraud.

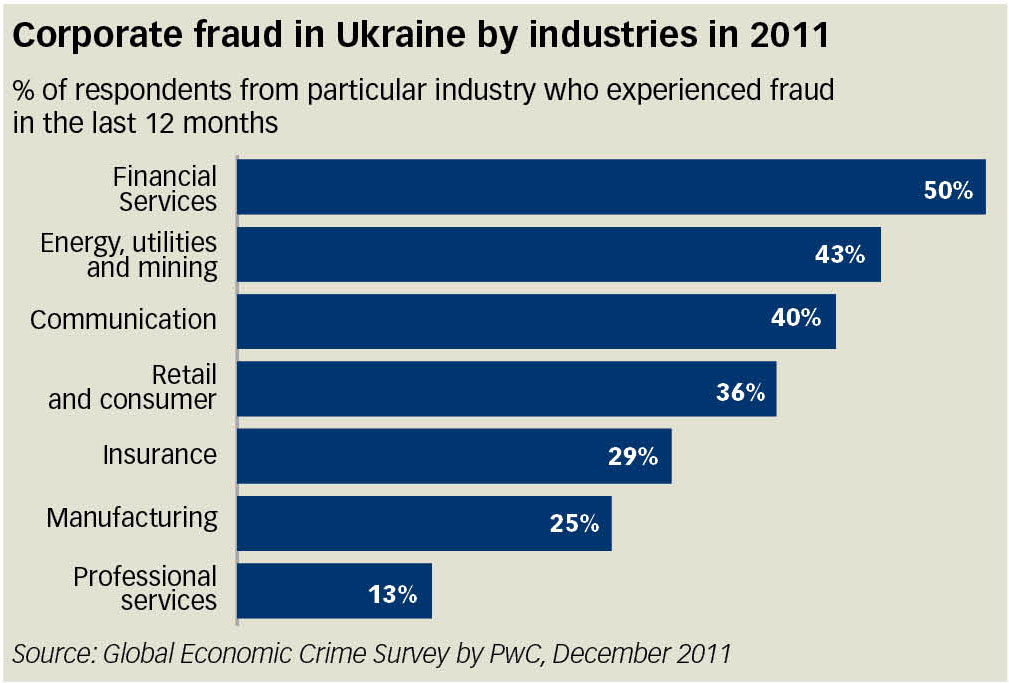

Financial services, energy, mining, utilities and communications top the list of industries where fraud most often occurs.

In the financial sector, for example, this could mean that senior management gives out loans with little or no collateral, or under significantly lower interest rates – all in exchange for cash kickbacks or other favors.

In some instances, the companies receiving such easy cash could be closely affiliated with either the top managers themselves, their relatives, or friends.

In some less sophisticated – yet very popular – examples of fraud, experts name buying an expensive car, which later mysteriously disappears from a company’s inventory as having completely depreciated.

The car simply ends up in the garage of the company’s top manager.

Ihor Olekhov, a partner at leading international law firm Baker & McKenzie, noted another alarming trend.

According to his observations, it’s not so uncommon to see that in large, formerly state-owned companies with several shareholders, none of which owns a controlling stake, some of the owners collude with the top manager to strip assets or siphon off profits.

“Speaking directly, they just rob minority shareholders,” Olekhov said.

Alexey Khomyakov, counsel at Asters law firm, said corporate fraud in Ukraine has reached a peak, as more and more cases of economic crimes become if not fully public, then, at least, known to the insider community.

Weak laws and an opaque court system make the prosecution of wrongdoers unlikely, he said, but part of the problem may also be the tendency of hiring former government officials to run private businesses. “They are bringing their ethics to their new jobs,” Khomyakov said.

A quarter of the respondents in Ukraine that took part in PwC’s survey represent publicly listed organizations, which are required to undergo annual audits by a major and respected auditing company. But experts say fraud is sometimes not picked up by audits.

Olekhov said companies sometimes try to limit the disclosure of documents that might contain evidence of wrongdoing. At the same time auditors say that a regular audit cannot be considered a tool for uncovering fraud.

Olena Isaeva, head of fraud investigation at auditing and consulting giant Ernst & Young, said fraud very often has a “cumulative nature ” that is “hardly possible to detect through a regular audit.” Isaeva explains that to succeed in uncovering corporate fraud, one would have to use more detailed procedures: investigations, electronic evidence discovery and review of financial reports.

Khomyakov said the human factor is impossible to eliminate, no matter what procedures are in place.

“An audit done according to the International Financial Reporting Standards allows around 70 percent of instances of fraud to be uncovered,” Khomyakov said. “The remaining 30 percent is about the top management and their ethical standards of behavior.”

Kyiv Post staff writer Vlad Lavrov can be reached at [email protected].