The gap between supply and demand for high-class office property is being fueled by positive economic dynamics and steadily rising employment levels

Ukraine’s office property market can be characterized by significant undersupply of quality office space, accompanied by high rental rates and low availability of vacant premises, especially in large cities and the capital, industry insiders say.

The main trend insider have observed on the office property market, particularly in cities with populations of over one million, is that demand for higher-quality office premises (the so-called A and B classes) overwhelmingly exceeds supply.

According to Nick Cotton, managing director at DTZ in Ukraine, as of the second quarter of 2007, the market-wide vacancy of office space in Ukraine was estimated at around 1.95 percent, which points to a noticeable deficit of quality space on the market. Vacancy is likely to remain in the range of 1.2-2 percent throughout 2007 and is unlikely to change considerably in the short-term period “until more speculative space is released,” Cotton said.

DTZ is a leading global property adviser that was the first international property adviser to operate in Ukraine. DTZ has offered a full range of consultancy and agency services in real estate segment in Ukraine since 1994. The company’s headquarters are located in London, UK.

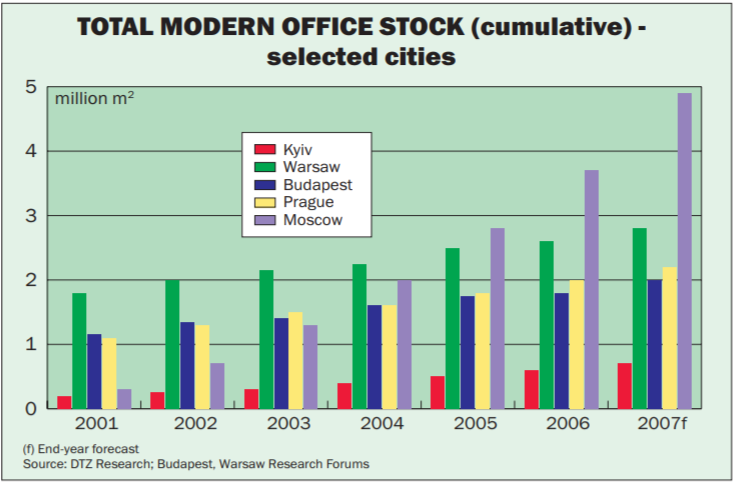

“The aggregate supply of office space of class A and B is still very low in capital Kyiv, compared to other major cities like Warsaw, Prague and Budapest,” said Gerald Bowers, a partner in DEOL Partners, a commercial real estate company based in Kyiv. His company is one of the first in Ukraine to be accredited in international standards for commercial real estate investment management.

According to Bowers, available office space in Kyiv equaled 680 thousand square meters at end of 2006. He said that according to developers’ plans for 2007 and 2008, an additional 200 thousand square meters will be added. DEOL’s forecast is less optimistic at about 150 thousand square meters. Nevertheless, Bowers said demand is estimated to be 400 thousand square meters, illustrating the situation with insufficient supply.

The gap between supply and demand for high-class office property is being fuelled by positive economic dynamics and steadily rising employment levels in the private sector, which results in high and sometimes overstated prices for office space. Some experts believe that prices do reflect market value as Ukraine is becoming an increasingly attractive place to do business.

According to Oleksandr Nosachenko, managing director with Colliers International (Ukraine), rental rates for all classes of office premises in Kyiv office market increased by 18 percent in the first half of 2007.

Colliers International is a leading internationalconsultancy in the commercial real estate sector with over 250 offices in 55 countries worldwide. The company first opened its doors in Ukraine in 1997.

“It is also being observed that the growing demand from international as well as local companies outstrips even the most optimistic supply projections,” said DTZ’s Cotton. He added that there is a shortage of sizeable development sites in Kyiv’s city centre and that office property values have grown to be $5,000-$7,000 per square meter.

He also said that a growing number of tenants are specifying more sophisticated requirements for office space, including larger than average floor plates.

Among the forces driving the office development market in Ukraine, industry insiders mentioned rapid business growth and promising prospects. In addition, many international and foreign companies have switched from maintaining representative offices in Ukraine to establishing fully commercial offices in the country, which contributes to increased demand.

Market insiders believe that the situation with continuously growing prices for high-class premises due to the undersupply of office property in Ukraine will not change significantly in the coming several years.

“The situation will only change when and if enough supply can meet demand, but that may happen in four to five years from now,” said Ruslan Oleksenko, managing partner of DEOL Partners. In his opinion, prices for space in Kyiv’s city center will continue to be high and will become the norm.

“Kyiv is a place where people want to do business,” said Oleksenko.

Despite constantly rising demand and deficit of quality supply, the office property market in Ukraine is not saturated with players and competition remains low due to a lack of professional companies that can manage demand in Ukraine. The other factors that prevent healthier competition are connected to problems with legislation and government bureaucracy.

“The market is not saturated and represented mainly by local players,” said DTZ’s Cotton. “The entrance of foreign players is hindered by legislation gaps and high level of bureaucracy at all levels”.

Speaking about short-term perspectives, industry insiders agree that the office property market will continue to grow consistently in Ukraine over the course of the next four to five years. They also agree that demand for prime office space in large cities like Kyiv will remain stable and high.

According to Cotton, DTZ’s forecast is that demand for office space will increase due to supply, more business activity, economic development and growing demand from companies that have established having full commercial offices in Ukraine.

“Rents will remain high with more upward pressure in the medium-term as the vacancy rate will continue to remain low over the course of 2007,” added Cotton.

In addition, many larger companies will look at the option of being located in the emerging business parks outside large cities or in their suburbs.

“The trends are likely to follow other major European cities”, said Oleksenko of DEOL Partners. “For example, an insurance company employing thousands of people will find it attractive to locate outside the city centre in an attractive location in a “greener” business park with adequate parking and staff facilities like health clubs, restaurants and good transport links”, said Oleksenko, adding that this trend will continues as more business parks are built near major cities.