France’s Bel Group and the Shostka City Milk Plant, in northern Sumy Region, signed a purchase agreement on April 16.

One of the world’s largest cheese producers has announced the purchase of a major Ukrainian cheese maker, in a deal estimated to be worth up to $60 million.

France’s Bel Group and the Shostka City Milk Plant, in northern Sumy Region, signed a purchase agreement on April 16.

The deal follows the recent entrance of another French-based dairy giant, Danone Group, which acquired a small Ukrainian dairy plant last September for an estimated $10 million in a bid to reduce dairy product imports into the country from its facilities in neighboring Russia.

Bel Group’s President and Chief Executive Officer Gerard Boivin said that his company’s acquisition of the Shostka plant will allow it to strengthen its positions in Eastern Europe.

Established in 1865, Bel Group has operations in 120 countries across the globe, including Russia and the Baltics. Its turnover in 2006 was 1.8 billion euros ($2.4 billion).

“Shostka is respected by consumers in Ukraine and has experienced dynamic growth in recent years. That made the purchase an attractive option for us,” Boivin said. According to statistics by Danone, the average annual growth of the Ukrainian dairy products market exceeded 15 percent between 2004 and 2006.

Rising consumption of dairy products that were not available on the market one or two years ago, such as soft cheeses, has been particularly noticeable in big cities.

Boivin said Ukraine’s cheese sector promises substantial growth potential.

Shostka plant director Larysa Rudakova said that her company was attracted by Boivin’s more than 100 years of expertise in marketing and modern technologies.

Based in Sumy Region, Shostka City Milk Plant is a top five Ukrainian cheese producer in terms of market share. It posted a $44 million in turnover in 2006.

Oxana Kozachok, an analyst at Kyiv-based investment firm Dragon Capital, estimates the Shostka deal at approximately $50-60 million.

She believes Shostka greatly owes its leading position and investment attractiveness to its previous owner, Kyiv-based Horizon Capital, which purchased the milk plant in 2005.

Prior to that acquisition, more than 50 percent of Shostka’s products were destined for export. Horizon Capital re-oriented Shostka more toward the domestic market, allowing it to reduce losses from Russia’s 2006 import ban on Ukrainian meat and dairy products.

Prior to that acquisition, more than 50 percent of Shostka’s products were destined for export. Horizon Capital re-oriented Shostka more toward the domestic market, allowing it to reduce losses from Russia’s 2006 import ban on Ukrainian meat and dairy products.

In addition, Kozachok said, Shostka launched a massive advertising company and created a recognizable trademark.

According to Kozachok, Ukraine’s market for cheese, as well as other dairy products, is highly decentralized. About 40 percent is controlled by five large companies, including Shostka, which boasts a 5 percent share. The other 60 percent is distributed among a multitude of small companies, working mostly for export to Russia.

Kozachok said that during last year’s Russian ban, larger Ukrainian dairy companies incurred losses, forcing them to improve corporate governance and transparency. That resulted in the companies becoming more attractive to foreign investors.

Industry analysts have pointed out that big international players entering Ukraine’s dairy market will have to establish a particular niche, for example in cheese, as higher consumption has led to more sophisticated consumer spending in general.

Kozachok said the purchase of Shostka indicates the growing interest of foreign companies in Ukraine’s cheese production sector.

“We will see the trend continue. Local cheese producers will review their business policies to attract foreign investors,” she said.

In September, the Paris-based Groupe Danone announced that it had bought local market player Rodych Dairy Plant, based in the southern Ukrainian city of Kherson.

The deal was reported in Ukrainian media to be worth around $10 million.

With around $16.5 billion in total sales in 2005, Groupe Danone says it is the world leader in fresh dairy products, posting sales of $1.5 billion during the same period in Russia, Poland, the Czech Republic, Hungary, Romania and Bulgaria.

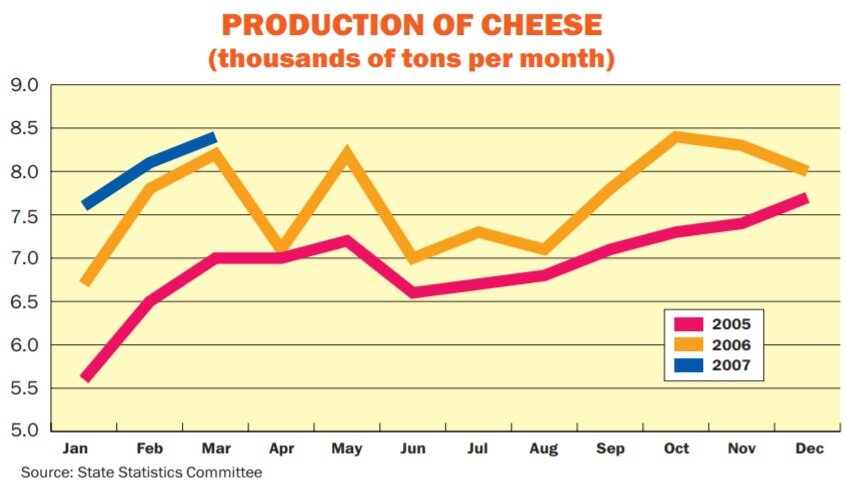

According to Ukraine’s State Statistics Committee, Ukraine currently produces an average of around 1 million tons of dairy products a month, or about 33,000 tons a day.