Inflation re-emerges as prime concern for Ukrainian economy because of domestic regulation, price controls and global economic factors

Inflation reemerged as a prime concern for the Ukrainian economy in recent weeks, as the protectionist policies of Prime Minister Viktor Yanukovych’s governing coalition have exacerbated world commodity price rises and stiff price hikes on natural gas imports.

Domestically, rising incomes, a retail lending boom, monetary policy and political instability have also contributed to rising inflationary pressures that exceeded the National Bank of Ukraine’s (NBU) expectations, analysts said.

Poor global harvests also had a big effect, coupled with grain export restrictions that spooked farmers, leading them to plant less wheat.

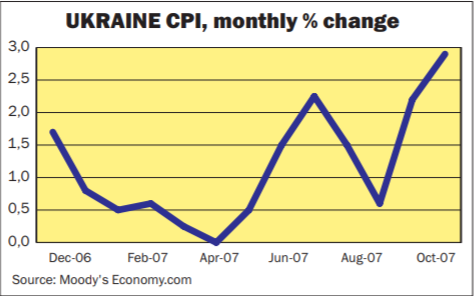

Consumers prices surged 14.8 percent in October from the same year-ago month, according to a report by credit rating agency Moody’s, while increasing 12.2 percent year-to-date.

“The situation raises certain risks for the country’s economy, including middle and large-sized businesses,” said Oleksandr Zholud, an analyst at the Kyiv-based International Center for Policy Studies.

“However, it is not disastrous, and certainly we cannot speak about an economic crisis.

The single-month inflation jump of 2.2 percent in September sounded alarm bells within the government.

For the first time, President Viktor Yushchenko attended a Cabinet of Ministers meeting led by Yanukovych on Nov. 2 to propose adjustments to customs policy, budgetary policy, monetary policy and balancing economic sectors.

“The tempo of inflation growth this year evokes concern,” Yushchenko said.

October consumer prices rose 2.9 percent the government reported on Nov. 6.

Inflation factors

Agricultural and food prices are the most significant factor this year, analysts said, while utility prices were the most influential drivers the prior year.

Still-higher natural gas prices are driving up utility bills, while the summer drought has increased food prices, Moody’s reported.

The Ukrainian economy was particularly vulnerable to poor global and domestic harvests because they led to deficits in food products, said Vitaliy Vavryshchuk, an analyst at Dragon Capital, a Kyiv-based investment bank.

“The above factor wouldn’t have been so hurtful for Ukraine if the country was more integrated into the international economy and the local agriculture market was less monopolized,” he said.

“In other countries, the effect is far less noticeable due to higher integration and competition on the market.”

Restricted food supplies significantly boosted overall inflation since they comprise between 40 and 60 percent of the total consumer basket of goods in Ukraine, analysts say.

Specifically, year-to-date prices surged in October by 73 percent for sunflower oils, 43 percent for eggs, 38 percent for fruit, 31 percent for food oils, 30 percent for wheat, 28 percent for milk and 14 percent for grain and bread, the State Statistics Committee reported Nov. 7.

Poor global harvests affected Ukraine’s neighbors too.

September consumer prices in Bulgaria increased 11 percent from the same year-ago month, Latvian prices rose 11.5 percent, Polish prices increased 2.7 percent and German consumer prices rose 2.7 percent, according to Zholud.

In the Russian Federation, consumer prices accelerated by 9.4 percent in September from the same year-ago month.

Another factor driving inflation is the lack of economic competition in Ukraine, according to analysts.

Suspected collusion among sunflower oil producers has done little to ease food price pressures, Moody’s reported.

“Many firms tend to merge de facto, but remain separate de jure for a number of reasons that include tax evasion, which intensifies the monopolistic hold and consequently the tendency to keep prices high,” Zholud said.

The demand for goods and services in Ukraine continuously exceeds supply, particularly in agriculture, which exacerbates inflationary trends already in place, said Balazs Horvath, the International Monetary Fund (IMF) representative in Ukraine.

Analysts differ on the inflationary effect on income growth, the rate of which is slowing but still significant.

The retail lending boom contributed 1.5 percent to consumer price growth, with $25.6 billion in outstanding retail loans, enabling households to remain solvent with decelerating wages, according to Alfa Capital.

Another inflationary factor was the 15.8 percent rise in producer prices from the same year-ago month, a large part of which were energy prices, Alfa Capital reported. Domestic oil refineries increased their prices by 15.5 percent in response to the increase in the price of imported oil.

Indirectly, Ukraine’s recent political instability has influenced inflation, with “the opposition continually repeating to the public that prices are growing,” Zholud said.

“Producers began raising prices and consumers tended to spend more than save.”

The effects

Inflation will have its most significant effect on the macroeconomic level, analysts say.

“Business players are going to hesitate where and whether to invest, since it will be difficult to plan price increases, and thus expenses and business as a whole,” Vavryshchuk said.

Zholud also mentioned the possibility of a so-called spiral effect, in which the high inflation rate will cause workers to demand salary raises, which will coincide with increased prices for resources.

The banking sector will be immediately affected, as it becomes confronted with higher interest rates and declining savings, Alfa Capital reported.

As a result of low incentives for households to save, banks will be forced to raise deposit rates, which will decrease their net income margins, Alfa Capital said.

Importers may benefit because they buy their products abroad at stable prices, while selling them domestically amidst rising prices. The opposite is true for exporters, Vavryshchuk said.

Dealing with it

In addressing the Cabinet of Ministers, Yushchenko called on the government to deal with the problem of inflation collectively. He proposed examining electronic-based customs and customs appraisal to enhance Ukraine’s borders and trade control.

Ukraine’s economic sectors need to be balanced to ensure supply and demand are in check, he said, and budget spending needs to fall under stringent control.

Grain will be sold from official reserves at 75 to 80 percent of current market price to ease prices in that market, but Yushchenko criticized the state of current reserves, which amount to 200,000 tons of grain. National grain reserves should contain no less than 1.5 million tons of grain, he said.

“If we don’t have clearly formulated grain reserves next year, then we won’t have an elementary mechanism to influence price speculation somehow,” Yushchenko said.

He also urged a tight monetary policy.

“Empty money doesn’t cure anything,” he said. “Only strong money motivates everyone to work, and money is only strong when it’s stable.”

The national Hryvnia currency’s strength will curb consumer price growth, said NBU chair Volodymyr Stelmakh.

The NBU should switch to a monetary-targeting policy that involves freeing the Hryvnia from the US Dollar to allow for a broader floating range, which proved to be effective in many transition countries and is also highly recommended by the IMF, Dragon Capital’s Vavryshchuk said.

The IMF recommends containing demand and scaling back money-supply growth, since policymakers can’t influence energy import prices, Horvath said.

Productivity needs to outpace wage growth, social payments need to be targeted and limited to avoid large budget deficits, he said.

Monthly inflation will decelerate through the year’s end, according to analysts.

The IMF increased its inflation forecast for Ukraine to 12.5 percent in 2007 from 11.3 percent, well above the government’s official target of 7.5 percent.

It projects 11.3 percent inflation next year, depending on what macroeconomic policies the new government will implement.

“Our projection is in line with the Ministry of Economy’s latest consensus forecast, foreseeing double-digit inflation both in 2007 and 2008,” Horvath said.