Polish-born Kamil Gorecki, the Chief Executive Officer of PZU Ukraine Life Insurance, talks to the Post in this exclusive interview.

Polish financial giant PZU has been operating on the Ukrainian insurance market for the last two years, having been the first Western insurer to enter Ukraine in 1993. PZU began offering its insurance services as PZU Ukraine in February 2005 after buying Ukrainian insurance group Skide-West and Skide-West-Life. Today, PZU Ukraine Insurance Group unites PZU Ukraine, PZU Ukraine Life Insurance, SOS Service Ukraine, and Inter-Risk Ukraine. Polish-born Kamil Gorecki became the Chief Executive Officer of PZU Ukraine Life Insurance in December 2006. Gorecki told the Post in this interview that as in other more developed Western markets, Ukraine is finally beginning to see a middle class form the main clientele base for the country’s steadily growing life insurance market.

KP: How did you come into your present position with PZU in Ukraine?

KG: In Poland, I worked in different spheres, having obtained extensive experience within banking structures, the gaming business, a textile factory and a trading company operating in the Far East (China and India), which gave me a great deal of managing and marketing practice. So, the offer to work within PZU Group in Ukraine seemed suitable to me from the point of view of using my international experience, as the Ukrainian market becomes increasingly more important for Western investors regarding its potential.

KP: How does the situation in the life insurance sector in Poland in the 90s compare with the current development of the segment in Ukraine?

KG: Your country currently faces the processes that Poland went through in the 90s. In other words, Ukraine is now repeating the Central European way of development, and with our experience, we can help avoid major mistakes here.

In Poland, the share of life insurance comprises 50 percent of the entire insurance market. The main difference is that Ukraine is going down this road much quicker than we did due to richer resources and higher incomes. What I admitted at the very beginning of my appointment [as PZU Ukraine Life Insurance CEO] is the readiness to learn and develop on the part of our Ukrainian colleagues, which greatly simplified the introduction of Western standards. At the same time, we are learning from you in terms of some specifics of the local market and processes.

KP: Can you describe the growth dynamic of PZU Ukraine Life Insurance in 2005-2006?

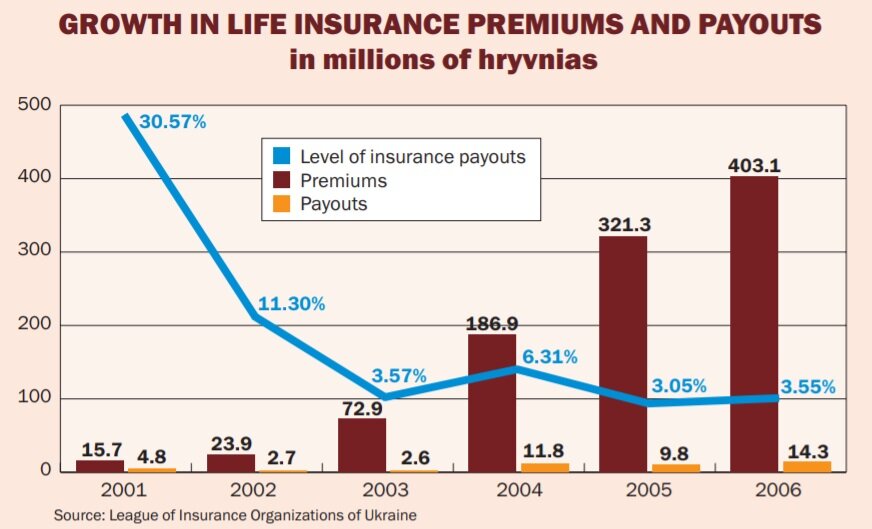

KG: We can say considerable growth in premiums started in 2005, and premiums grew 72.1 percent [in a year]. Thus, with Hr 11.15 million ($2.23 million) in premiums in 2006, we occupy seventh place in the top-15 list of life insurance leaders [in Ukraine].

KP: Although, as with most life insurance leaders in Ukraine, you continue to suffer losses?

KG: In our case it is connected with the reserves formation process and development of the company, as well as considerable growth in payouts, which indicates the high rate of development of the company, as mass payouts on the market are supposed to start in three to five years. It also indicates the increasing confidence of the clients. The growth in payouts in PZU Ukraine Life Insurance for 2005-2006 [year-on-year] totaled 162 percent and Hr 1 million ($200,000). For example, at the end of 2006, for an insured accident, we paid one of the largest payouts in Ukraine – Hr 400,000 ($80,000), which is one of the core factors of the activity of the insurance company (PZU).

KP: Who are your main clients and how did this change over the last several years?

KG: First of all, our clientele is changing in some sense. If several years ago we mostly dealt with people with high incomes, now we can say that in Ukraine the so-called middle class has been established and it is taking an increasingly greater interest in it [life insurance]. Apart from this, with the percentage of people taking loans – and especially with respect to the intense growth in mortgage lending – many of them turn to life insurance to secure themselves and their families.

KG: First of all, our clientele is changing in some sense. If several years ago we mostly dealt with people with high incomes, now we can say that in Ukraine the so-called middle class has been established and it is taking an increasingly greater interest in it [life insurance]. Apart from this, with the percentage of people taking loans – and especially with respect to the intense growth in mortgage lending – many of them turn to life insurance to secure themselves and their families.

KP: Is there demand for corporate life insurance from PZU, and if there is a trend, where is it going?

KG: If we are talking about the number of insurance policies, of course, the majority of them are concluded with private individuals. However, this tendency is changing, and companies are more inclined to approach us as they have started to realize it [corporate life insurance] to be a strong means of personnel motivation. This can be demonstrated by the correlation between premiums taken from companies and private individuals, which currently is approximately 50-50.

KP: What products does PZU offer, and of these, which are the most promising?

KG: Ninety percent of our sales are savings programs, which are defined by the possibility of tax benefits for private individuals and legal entities [businesses], as well as by guarantees of payouts during a definite term in every case.

However, I predict two interesting products will be more actively offered by PZU in the future.

One of them is the unit-linked insurance package, which allows the insured to invest money and receive income. I believe this to be rather promising, as people in Ukraine have started to earn more money and are showing a greater willingness to risk and invest it.

The second product that we are intending to promote is pension insurance. In fact, we already offer this kind of insurance, and though it currently totals a small part of our sales, the tendency is that it is growing as a result of young people who are already thinking about their future, not having the best example from their grandparents. On the European market, savings programs normally total 60-70 percent of the premiums, while the rest belongs to pension and unit-linked insurance.

KP: What is your forecast for the Ukrainian insurance market for the next year?

KG: I still expect a considerable number of new investors from the West, as well as from Russia. Though I think that the market will stabilize and growth will become more evened out.

KP: The PZU network embraces almost all of Ukraine. How many offices do you have and are you planning to expand?

KG: By the end of 2006, we had 71 offices throughout Ukraine. In 2006, we opened 29 more offices and additional service centers for our clients. Our nearest plans include the further development of our regional network and increasing the number of our exclusive agents.