Gloria Jean’s Coffees opened its first cafe in Kyiv, making the Australian-owned chain the first international franchise to enter Ukraine

Gloria Jean’s Coffees opened its first cafe in Kyiv, making the Australian owned chain the first international fran chise to enter the Ukrainian market.

The company stated it plans active expansion in the capital and the country’s regions in the next several years.

The chain’s arrival coincides with intense development of the Ukrainian coffee-shop segment, with more Western investors expected, experts said.

One chain that might be interested in Ukraine is Starbucks, which expanded into Russia this autumn. The company has not made any official announcements in this regard and told the Post that reports in Ukrainian media regarding its plans to open 50 cafes in Ukraine next year were just rumors.

“The coffee-shop market in Ukraine is developing very rapidly, particularly in Kyiv,” said Gleb Marchenko, director of the Your Restaurant consulting company. “But it is far from saturated, so I can see great potential.”

The first Gloria Jean’s opened on Velyka Vasylkivska Street on Nov. 4 in downtown Kyiv.

The retail chain announced it is aiming to open at least five franchises in 2008, and up to 50 within the next 10 years in cities with more than a half-million residents.

Between 700 and 800 new jobs will be created as a result, said Yunus Shirin, general director of Gloria Jean’s Ukraine.

Total investment may reach $12.5 million, said Akhmed Shenodzhak, president of Gloria Jean’s Coffees Ukraine.

Originally founded in Chicago, USA in 1979, two Australian businessmen acquired the Gloria Jean’s Coffees (GJC) international franchise brand and roasting rights for all countries (except the US and Puerto Rico) three years ago.

Currently, the chain operates 784 stores in 29 countries. It is second only to its main world competitor, Starbucks, which boasts 13,000 outlets around the globe.

The rights to the franchise cost between $350,000 to $450,000, and GJC Ukraine will pay 6 percent of its annual profit to the Australian owners, said Olga Nasonova, the general director of Restaurant Consulting.

Buying a franchise is likely to be very expensive and Ukrainian companies will probably resort to sub-franchising to recoup expenses, Nasonova said.

“Starbucks may be eyeing the Ukrainian market, though it may be complicated to find franchisers willing to buy a very expensive franchise,” Nasonova said. The Ukrainian coffee market is extremely interesting for foreign investors, with only 30 percent of the market tapped, she said.

However, many fear local operators will steal their technologies and market them under a different brand.

“That is why they prefer to work on a franchise basis. In addition, all the good spots are already occupied by the local and Russian chains,” she added.

Caffeine invasion

The strongest franchise players on the Ukrainian coffee-shop market are currently Russian chains that entered Ukraine in the last five years.

They assumed leading positions because they had a better understanding of the Ukrainian market through experience compared with Western companies, Marchenko said.

Most importantly, they had better investment possibilities, he said.

“They simply could afford the rent in city centers and occupy the best locations, and thus, the leading positions,” Marchenko said.

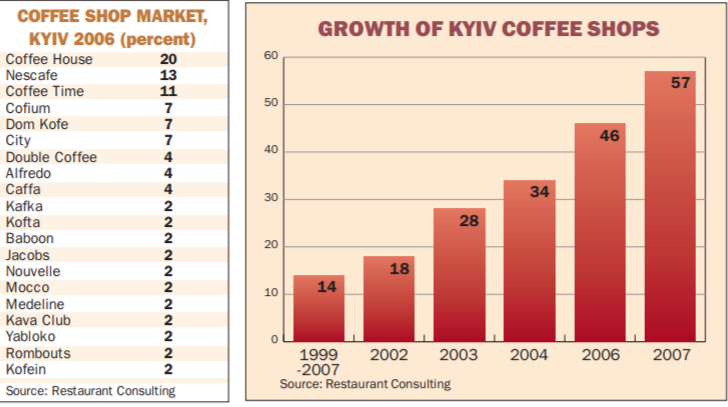

Among the key players is Coffee House (130 coffee shops throughout Russia), with 20 coffee shops in Kyiv and 20 more cafes scheduled to open throughout Ukraine by the end of next year, Coffee House Ukraine Director Roman Karpushkin said.

Shokoladnitsa entered the fray as well, opening three cafes in Kyiv, while Coffee Time operates seven shops in Kyiv.

Another large chain is Latvia’s Double Coffee, which has 34 stores in Baltic countries and eight in Kyiv.

Locally owned brands include Cofium with three shops in Kyiv and Kafka with five.

More to pour in

Ukraine’s coffee-shop market has grown annually by 20 percent and is the fastest-growing segment in the public catering market, which has seen 8 percent average annual growth, Nasonova said of Restaurant Consulting.

She said coffee-shop revenues last year topped $22.7 million in Kyiv and $70 million throughout Ukraine.

The number of coffee shops in Ukraine doubled compared to 2004, Nasonova said, and there are 58 coffee shops currently in Kyiv.

But “there are no serious international coffee-shop brands broadly presented in Ukraine so far, so the appearance of Western investors in this segment is quite welcome,” Marchenko said.

The Ukrainian coffee-shop market is attractive for foreign and domestic investors due to the business’ relatively inexpensive start-up costs ($60,000 to open a coffee shop on average) and a rather quick return on investment (about 1.5 years), according to Marchenko.

“There is a lack of coffee shops on the left bank of Kyiv and in the bedroom communities, as most cafes are concentrated in the city center,” Marchenko said.

“This provides great opportunities for local entrepreneurs, as the rent in the outlying areas is more affordable and competition is lower.”

Foreign investors will find it easy to assume leading positions in Ukraine because they will offer higher-quality standards and fill niches currently unfilled in the country, namely coffee-to-go and corner coffee, Marchenko said.

Only big chains will be interested in Ukraine because opening up just several spots will not be profitable, he said.

Other international chains will definitely come to Ukraine within the next few years, Shirin said.

They will introduce competition that is essentially missing at the moment and increase considerably the quality of products and services, he said.

New coffee culture

GJC will serve Ukrainians “coffee to go” – a format new to customers accustomed to a more relaxed cafe culture.

Ukraine is a strategic market for the company, Shirin said.

“Ukrainians’ demand for high-quality products and service has increased, but there are still few places that supply them,” he said.

Gloria Jean’s coffee shops are intended to provide customers with quick service (one-two minutes), which will also increase client flow.

Customers are not expected to stay long, but the cozy atmosphere is intended to draw them back two or three times a day.

“In addition, we already have experience with other Eastern European countries, like Bulgaria, Romania, Poland and Hungary, which are similar to Ukraine in culture, so we know the technology and conceptual approach required for Ukraine,” Shirin said.

“We will also introduce new standards in coffee drinking and corporate culture. Every employee, regardless of position, should be able to make a high-quality espresso. I myself can make coffee for customers, for example, when needed.”

Such an approach will make customers feel at home while the right atmosphere within the company will help expand the network much quicker, Shirin said.

Your Restaurant’s Marchenko predicted success for the chain in food courts and “corners” – essentially, small bars with a premium quality coffee machine and a couple of tables in a commercial center.

“This format is almost absent in Ukraine, while the number of commercial and entertainment centers is growing,” he noted.