The Ukrainian Internet services provider market is not only becoming more competitive, but as its infrastructure expands and diversifies, the price of Internet access continues to fall, although the Ukrainian government’s recent decision to raise phone tariffs for intra-city calls could shake up the market a bit

The Ukrainian Internet service providers (ISP) market is not only becoming more competitive, but as the network and infrastructure expands and becomes increasingly diversified, the price of Internet access continues to fall. What’s more, the Ukrainian government’s recent decision to raise phone tariffs for intra-city calls could shake up the market a bit. By raising the price of intra-city telephone calls, the government could encourage a growing number of Internet surfers using dialup access, which is dependent on telephone lines for a connection, to switch to higher-speed connections.

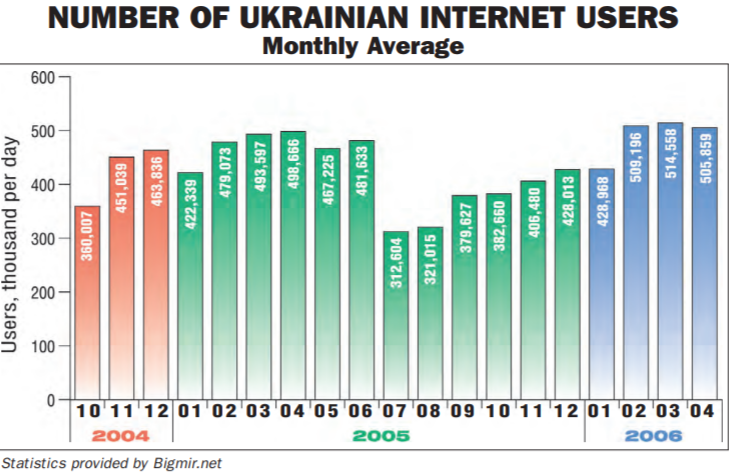

As it stands, Ukraine has just over 2 million unique Internet users, or those who have visited a website at least once regularly in a fixed period of time, according to statistics gathered by Internet portal Bigmir.net, founded in 1999 by the publisher of the Post.

Sites often calculate unique visitors based on the IP address information found in log files and sometimes through cookies, although many factors can skew the results.

Industry experts and ISP providers are in agreement that the number of Internet users in Ukraine is growing fast, at a minimum of 20 percent annually over the last few years, according to Tetyana Popova, the Chairman of the Board of the Ukrainian Internet Association, a group founded to consolidate efforts to develop the Internet in Ukraine.

But it is difficult to accurately assess how many Internet users there are, Popova added.

“According to Bigmir’s figures, the number of unique Internet users in 2005 was on average around 2 million a month,” Popova said.

“The State Statistics Committee puts the figure at around 600,000, while Spylog [an Internet statistics service] estimates that Ukraine’s number of [active] Internet users could be around 2.3-2.8 million. Bigmir reported 2.4 million [users] for December 2005 and approximately 2.8 million for the month of April 2006, although the core was around 600,000,” she added.

The number of ISPs is also challenging to determine. In its annual report for 2005, Ukraine’s National Communications Regulation Committee (UCRC) cited two figures, suggesting that there could be as many as 4,500 ISP providers, but only 544 that are registered, said Popova, adding that it all depends “on who we are counting.”

“Theoretically,” Popova said, “one network means one provider. However, that provider might be the size of Utel [a large subsidiary of state-owned fixed-line telephone company Ukrtelecom], or a smaller one that provides services for a single bloc of flats.”

Previous impediments to Internet growth in Ukraine, such as high prices for Internet service, an insufficiently developed infrastructure, and Ukrtelecom’s monopoly on telecommunications, are not as prevalent in 2006.

Volia Cable, one of Ukraine’s largest cable Internet providers, noted growth of about 20-25 percent year-on-year in 2006, said Andriy Pastuhov, Volia’s leading marketing expert.

Volia Cable is part of a portfolio managed by American investment firm SigmaBleyzer. Volia’s 1,200 employees serve over 50,000 customers in Kyiv, Lviv, Alchemsk and Chernivtsi with broadband cable lines that operate independently. Most of Volia’s clients, however, are in Kyiv, where the company holds a majority share of the cable market.

Telecommunications giant Ukrtelecom continues to provide the backbone for a large percentage of Ukraine’s ISP providers, as it controls roughly 60 percent of Ukraine’s telecommunications network by its own estimates. This includes a significant percentage of the fixed broadband market, still largely dominated by cable and DSL connections, but also the analogue phone lines used by most dialup ISPs. Ukrtelecom also has plans to expand its broadband clientele.

At an April 27 press conference, Ukrtelecom Board Chairman Heorhiy Dzekon said that he expected the number of broadband ADSL customers to grow by a factor of 4 from roughly 25,000 to 100,000 by the end of 2006. To facilitate this growth, Ukrtelecom and Intel, the world’s largest chipmaker and a leading manufacturer of computer, networking and communications products, announced plans to introduce a program earmarked for the third quarter of 2006. It envisions the sale of three-four kinds of personal computers to private individuals – on credit if necessary – which will be equipped with multi-media packages for Ukrtelecom’s ADSL-broadband Internet service “OHO,” increasing the number of home computers and widening their network at a range of prices.

Ukrtelecom, together with its subsidiaries, controls 60 percent of the Ukrainian telecommunications market.

However, a number of privately held telecommunications companies are catching up by expanding their own network backbone within Ukraine, Popova said, pointing to companies such as Evrotranstelecom, Datacom, UMC and Kyivstar.

Volia Cable also operates its own cable lines, which are independent of Ukrtelecom’s network.

The number of ISPs offering high-speed Internet options has increased over the last few years, including the United Networks of Kharkiv (founded in 2004), which offers high speed Internet access by leased lines; Superweb and SurfMax (2004), which offer ADSL in addition to dial-up services; and Stella and skyDSL, founded in 2005 and 2006, respectively, which offer satellite Internet.

In addition, there has also been a consolidation over the last three years on the dial-up ISP market, beginning with Optima Telecom’s purchase of a 50 percent stake in IP telecom in 2003, a company founded in 1998 that now also offers leased line options. The company System Capital Management (SCM), 90 percent owned by Donetsk tycoon Rinat Akhmetov, recently bought a controlling stake in Optima Telecom and Farlep-Invest, a fixed communications provider.

Ukrtelecom’s own statistics illustrate how much of the market is still controlled by dialup providers. Svitlana Katkova, director of the telecommunications service department at Ukrtelecom, noted that in addition to its 25,000 ADSL users under its trademark “OHO”, Ukrtelecom also has 5,000 xDSL clients and over 300,000 password free and regular dialup users through its ISP provider Svitonline and other brands.

Overall, dialup Internet continues to dominate the industry, especially outside Ukraine’s major cities. SputnikMedia.net reported that in February, 48.76 percent of all Internet activity took place in the Kyiv region, where broadband controls about 20 percent of the market, according to Volia’s Pastuhov. After Kyiv, seven regions account for approximately 39.76 percent of Internet usage: Dnipropetrovsk, Odessa, Donetsk, Kharkiv, Lviv, Crimea and Zaporizhya.

This geographic breakdown has changed little in the last year, and the trend is likely to continue for at least the next two years, “until newly arrived large ISP providers begin establishing a developed infrastructure not only in large cities, but also in the regions,” Popova said, adding that in the last two years, dialup ISPs’ share of the market has shrunk because of decreasing prices for leased-line Internet, the spread of DSL-access and the appearance of cable Internet.

Furthermore, the National Electricity Regulation Commission’s decision to increase the price for local, or intra-city calls by 30-35 percent will likely affect at least some dialup Internet users, even though others will continue to find dialup Internet more affordable, because broadband Internet providers often charge subscribers relatively high fees for traffic in excess of a base amount.

For most Internet users, “these changes will simply accelerate their ongoing search for higher-quality Internet access,” Pastuhov said.

“This price increase will likely stimulate them to more actively search for other alternatives for accessing the Internet,” he added.

Because dialup customers effectively pay for both their use of the Internet and also of the telephone line, “the planned increase in phone rates for intra-city calls will lead to a general increase in the cost of dialup Internet access,” Katkova said.

But, said Popova, telecommunications services become more affordable with each year, adding that “five years ago, for a 64KB line you’d pay $1,000, but today for that money an end user can buy 20 such lines.”

On the other hand, for providers of telecommunications services (including Internet) the most important thing is the so-called “last mile” issue.“It doesn’t matter what exactly it is – telephone line, TV cable or radio connection. The one who provides affordable services with the best quality will be the winner,” according to Popova.