Ukraine’s legal services market, driven mostly by a younger generation of companies, is seen as highly fragmented by experts, with firms focusing on their area of proficiency. Opportunities for growth come with tough competition that places domestic and international law firms in an obstacle course for professional excellence.

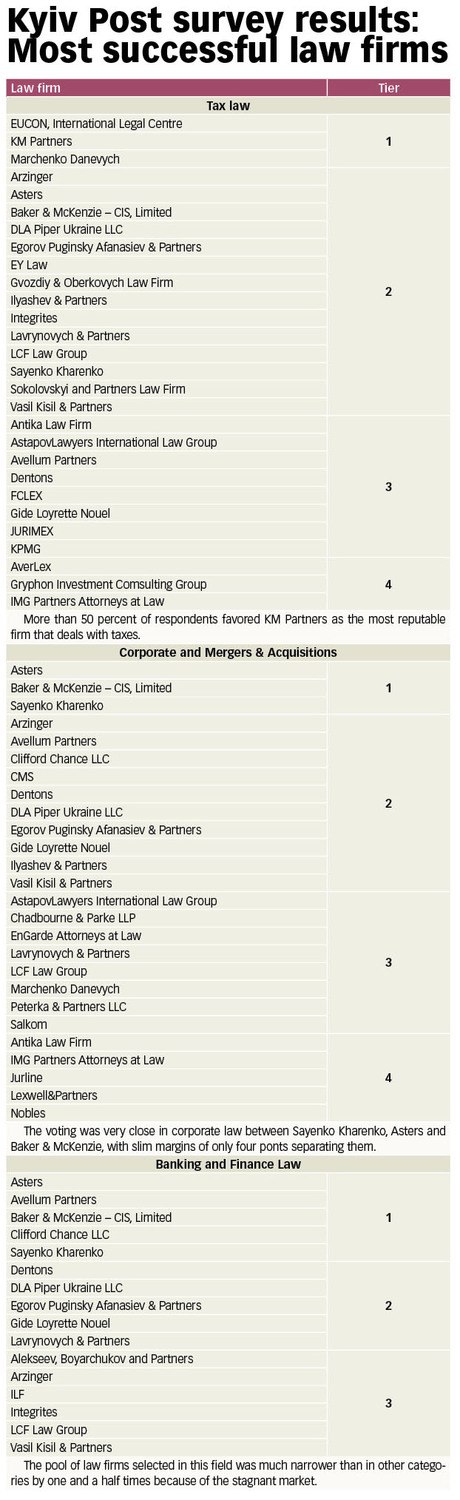

According to a Kyiv Post peer survey conducted this month, more than half of the 90 law firms polled appeared on the local market in the 2000s. As the nation’s business environment evolved over the last 15 years, law practices and their clientele grew in tandem.

Even the 2008-2009 financial crisis – from which the Ukrainian economy hasn’t quite recovered – didn’t prevent new firms from entering the market. Times of crisis, says Olga Usenko, chief editor of the Ukrainian Journal of Business Law, also offers opportunities for skillful lawyers, such as in mergers and acquisitions and bankruptcy.

Yet small law firms with no more than 15 employees manage to draw big corporate clients, and with it, decent earnings. They usually avoid the more competitive sectors of M&A, corporate, and tax law.

Instead, they occupy niches where they excel and to stay afloat. Concentrating on intellectual property, customs law, or oil and gas deals for example, are successful business models, Kyiv Post research found.

Local service providers have moreover adopted Western management structures that usually have several managing partners at the top, followed by junior lawyers, and interns who may still be in law school working as assistants.

There is usually a strong correlation with a firm’s image being tied to its senior partners, the Kyiv Post found. When they join advocacy or civic campaigns, this usually elevates their visibility.

“Ukrainian and foreign business people have different mentalities,” says Oleksandr Onufriyenko, the chief lawyer for Kinto, an asset management company. Ukrainian businessmen tend to deal with firms, whose senior partners they know personally.

In the nation’s cut throat legal environment, the market is known for having a group of lawyers who regularly change their employers. However, those holding partner-level positions should not be too presumptuous and see themselves as the only driving force in the business, notes Iryna Serova, an expert on public relations with a doctorate degree in law. But still, she admits, clients recognize the last name of a senior partner more than a firm’s brand.

When a prominent lawyer quits their job to accept another one at a different company, their clients are likely to follow suit, says Oleksiy Komlichenko, partner at Talent Advisors, an executive head hunting firm.

Kyiv Post research in addition indicates that a law firm’s image depends on the quality of its senior partners’ portfolio of accomplishments.

“We look at the company’s area of expertise and then look for a specific partner or advisor (when choosing the legal service provider),” explains Ellada Yakunina, human resources manager for DMS, a Donetsk-based conglomerate that runs businesses in finance, energy and steel production. Therefore, when a partner with an impressive reputation leaves the company that doesn’t have a strong brand, it may bring the firm’s revenues down very significantly.

International law firms in Ukraine have a different client approach in terms of ethics which matters when making the customer centered more on the brand rather than personality. Often times, they have several recognized international experts sitting on their board because Western legal experience is valued on the Ukrainian market.

And because legal practice involves team work, big businesses check even who the junior lawyers are, the ones who gather information and conduct research. “This is very important, because choosing a law firm for the client is similar to choosing a doctor,” said Serova, the public relations expert.

Servicing the most profitable industries of the nation’s economy remain the most efficient revenue source for lawyers. By contrast, lawyers are losing interest in areas like banking, industry experts say. Standard & Poor’s global debt quality evaluator does not expect the banking sector to make a profit this year.

Meanwhile, tax law remains quite profitable since the country’s legislation in this field is not the simplest one, said Kinto’s Onufriyenko. Mergers & acquisitions is promising too, especially where so-called “raider” activity flourishes since property rights violations are still widespread in Ukraine.

Kyiv Post staff writer Iana Koretska can be reached at [email protected].