Two major players on the global life insurance market together currently hold a nearly 50 percent share of the Ukrainian life insurance market.

While Ukraine’s life insurance niche has recorded steady growth recently, it still represents a fraction of the country’s slowly developing insurance business, reflecting a lack of confidence in the benefits of having life insurance, as well as the still relatively low income levels, among the population.

Industry insiders say, however, that despite the small returns that life insurance currently brings insurers in Ukraine, the life insurance segment remains attractive to foreign insurers. Insiders say that foreign insurers are banking on the long-term development prospects of the Ukrainian life insurance market, expecting it to undergo a boom in the next five to 10 years.

Natalia Guduma, the general director of the League of Insurance Organizations of Ukraine (LIOU), said that the past year has been characterized by the Ukrainian insurance sector’s stable growth, with the arrival on the market of large Western insurance groups, including such industry giants as Italy’s Generaly and Austria’s Vienna Insurance Group, both of which launched their insurance businesses in Ukraine as life insurers.

She said, however, that unlike the more predictable growth of the Ukrainian life insurance sector in the past year, it was more difficult to forecast developments in the sector for 2007.

“Unlike last year, when it was easy to predict the development of the events, and the entry of certain players [onto the Ukrainian market] was anticipated for sure, now it’s pretty difficult to make forecasts for 2007,” Guduma said.

“Although we can still expect the entry of some new Western and Russian companies, it [the entry of foreign insurers] will be less intense,” she added.

According to LIOU statistics, the share of life insurance on the Ukrainian insurance market has been slowly but steadily on the rise.

While four years ago life insurance comprised some 0.8 percent of the entire Ukrainian insurance market, that share grew to 2 percent in 2005, and to 3 percent by the end of the third quarter of last year.

The number of companies providing life insurance has also been increasing in the country.

Whereas in 2004, only 45 of 383 insurers provided life insurance in Ukraine, in 2005, their number grew to 50 out of 398 insurers on the market. By the end of the third quarter last year, 55 insurance companies were operating in the life insurance segment out of a total of 407 risk insurers.

According to the LIOU, the index of total premiums for the first nine months of 2006 in Ukraine’s life insurance segment totaled Hr 290 million ($58 million), while that figure totaled Hr 226 million ($45.2 million) for the same period in 2005.

In 2006, the main players on the Ukrainian life insurance market remained largely unchanged compared with the year before.

Two major players on the global life insurance market together currently hold a nearly 50 percent share of the Ukrainian life insurance market, according to the LIOU. They are US-based Alico Aig Life, which has been operating in Ukraine since 2002, and currently holds a 25.6 percent share of the country’s life insurance market, and Austrian-owned Grawe Ukraine, with a 22.9 percent share of that market.

According to the LIOU, at present, 28 percent of all foreign investments in Ukraine’s life insurance market are US-based, with 19 percent coming from Austria, and 9 percent from Poland, largely as a result of PZU’s presence in Ukraine. Russian and British-based investments into the Ukrainian life insurance market currently account for 7 percent and 6 percent of the total, respectively.

Andriy S. Pikula, First Deputy Chairman and Chief Operating Officer of ALICO AIG Life, a leading Ukrainian life insurance company, said he expects the arrival of more foreign insurers on the Ukrainian life insurance market. He said that large international companies will invest into Ukraine’s life insurance sector, while Russian insurance groups will enter Ukraine with risk insurance services, looking for the quicker profits that other types of insurance can yield compared with life insurance.

Pikula said that one of the reasons for the slow development of Ukraine’s life insurance market was a lack of understanding and confidence among the population regarding the benefits of owning life insurance as savings, and insurance protection products for long-term financial planning. He added that while incomes in the country continue to rise, Ukrainians still prefer placing their investments into real estate or interest-bearing savings accounts with the banks.

“With respect to the middle class, it places more trust in real estate investments, as this market appears to be on the rise for a long time and continues rising. Regarding the lower income population, it has a lack of information or education as to where to place its available resources (inadequate for the expensive real estate market) and put them aside to satisfy their medium- or long-term financial needs,” he said.

According to LIOU’s Guduma, demand for life insurance in the country remains small because the income level of most Ukrainians is still low.

“A more or less interesting [life] insurance package costs around $500 a year, and for many Ukrainians, this is unaffordable,” she said.

However, Maria Boroday, a spokesperson for PZU Ukraine Insurance Group, said that Ukrainians earning average incomes tend to show more interest in life insurance packages, with that interest being especially keen among those seeking bank loans.

PZU Ukraine Insurance Group, which has been operating in Ukraine for more than 13 years (previously under the Skide West brand), is the Ukrainian subsidiary of Polish insurance giant PZU Insurance Group.

“By insuring life risks, a person secures himself and his family, and the bank, in its turn, secures itself as well,” she said, adding that some Ukrainian banks require that private borrowers have life insurance as a condition for giving them a loan.

Boroday said that in addition to private individuals, more companies – particularly those with foreign investments – have been turning to Ukrainian insurers to beef up their corporate benefits packages with life insurance, in addition to medical insurance and other benefits, in their bid to attract, hold on to, and motivate their employees. Boroday said that the “golden age” of corporate life insurance for companies’ employees was expected to begin in Ukraine in the next several years.

According to deputy board chairman of Fortis Life Insurance Ukraine, Marina Naumova, while the Ukrainian life insurance market has been undergoing growth, most life insurance companies operating in Ukraine continue to suffer financial losses.

Fortis is an international banking and insurance services provider with a presence in more than 50 countries and head offices in Belgium and the Netherlands. In August 2006, Fortis announced the signing of a preliminary agreement to acquire Etalon Of Life, a top 10 Ukrainian life insurance company in terms of premiums. In February of this year, the company began operating in Ukraine as Fortis Life Insurance Ukraine.

Naumova said, however, that life insurers typically undergo a financial loss phase of five to seven years on new markets, such as Ukraine’s, before turning a profit, since their business is aimed at more long-term returns compared with other types of risk insurance.

She added that Ukraine’s life insurance market has not been in existence long enough for life insurers to have begun recouping their losses and turning a profit.

According to Naumova, life insurance companies that set up shop in Ukraine will suffer losses for around 10 years – the amount of time they need to upload their reserves to ensure that they can pay out their obligations at the end of insurance contracts’ terms.

According to Naumova, life insurance companies that set up shop in Ukraine will suffer losses for around 10 years – the amount of time they need to upload their reserves to ensure that they can pay out their obligations at the end of insurance contracts’ terms.

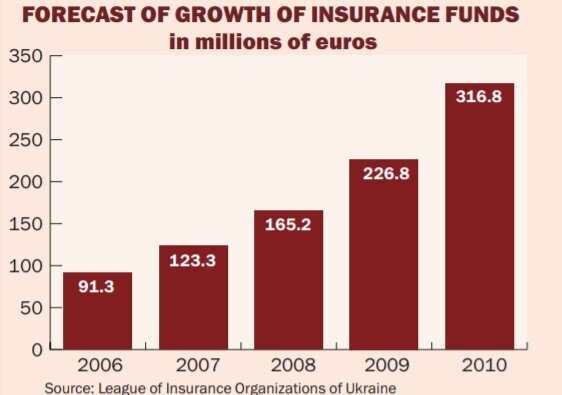

According to LIOU’s forecast, Ukrainian life insurers’ reserves will total 316 million euros by 2010, up from 91 million euros today.

Naumova said that following life insurers’ loss-making period, the life insurance market in Ukraine will begin to see strong growth.

“The boom in the life insurance market in Ukraine, with the constant increase in the economy’s growth rate, is slated to begin in three to four years,” she said.

According to Naumova, the major players on the Ukrainian life insurance market are Western investors, and their entry onto the Ukrainian market is expected to continue, given that life insurance comprises 60-70 percent of the insurance business in the West compared with its fractional share of the business in Ukraine.

“The number of market players will continue to increase, though less actively, and by the end of the next five years, most of the long-term investments [made by financial corporations offering life insurance in Ukraine] will start to work,” she said.

That same five-year period, she said, will see the mass payout of obligations as well.