The sale of the Odesa oil refinery by the Russian oil producer Lukoil in early March caused a stir for a variety of reasons. One of the largest Ukrainian oil refineries that stood idle for several years was bought by the mysterious 27-year-old Kharkiv businessman Sergei Kurchenko.

Until the end of 2012, he was virtually unknown in the business community at large. His Gaz Ukraina group of companies, recently renamed the East European Fuel and Energy Company (VETEK), claims an annual turnover of $10 billion and specializes in the sale of fuel, liquefied and natural gas. VETEK controls a network of 150 gas stations and plans to expand to 250 by 2014.

Kurchenko officially came to light in late 2012 when he emerged as the new owner of Metalist Kharkiv, a leading Ukrainian football club. His predecessor, Kharkiv tycoon Oleksandr Yaroslavskiy, later said he was pressured to find a new investor for the club. Also, respected weekly Dzerkalo Tyzhnya wrote that Gaz Ukraina was involved in oil smuggling, depriving state coffers of Hr 3 billion in uncollected tax revenue. Forbes Ukraine also linked Kurchenko to Artem Pshonka, a young lawmaker and the son of Prosecutor General Viktor Pshonka.

VETEK has vehemently denied these allegations in press releases. Kurchenko’s company also declined to be interviewed for this article.

Artem Pshonka denied the allegation of association with Kurchenko in a January press conference.

Even before the expected purchase of the Odesa refinery, Gaz Ukraina said that it’s in the market for a large oil asset. According to Forbes, TNK-BP had plans to sell the Lysychansk refinery in autumn 2012 to Kurchenko’s group for about $300 million. Negotiations collapsed, however, after Russian state-owned oil company Rosneft officially announced it had bought TNK-BP. In March Rosneft President Igor Sechin wavered on whether he would re-sell the company.

Gaz Ukraina then decided to buy the Odessa refinery. It has an annual capacity of 2.8 million tons but has been closed since October 2010 because of oil delivery problems. At the beginning of March Kuchenko’s re-branded VETEK acquired a 99.6 percent stake in the refinery in a deal estimated at $250 million by Ernst & Young. According to Lukoil’s press service, the deal will close by June 1.

“Lukoil decided to sell the Odessa (oil) refinery under an approved restructuring plan of foreign oil assets,” its press service wrote.

“There is certain logic behind the refinery’s purchase. Perhaps they (VETEK) need an asset that will refine crude oil and provide petroleum products to their fuel filling stations,” said Dmytro Marunych, director of the Institute of Energy Strategies, a think tank.

But according to Dzerkalo Tyzhnya’s sources, Kurchenko has helped Lukoil obtain long overdue VAT refunds worth nearly Hr 200 million ($25 million), thus “paving the way for a deal.”

Ukraine’s officials appear to have also blessed the deal. Minister of Energy and Coal Industry Eduard Stavytsky attended the refinery’s work start-up ceremony and spoke of state support. “The government is now working on a program of protectionism. Specifically – the provision of benefits to improve the refinery in the country. In a week or two the ministry will offer its suggestions to the government that will give more stability to the oil industry… In the near future you will see these government regulations, and then at the legislative level,” said Stavytsky.

Furthermore, the head of Ukraine’s anti-trust body Vasyl Tsushko recently said that the state will enact import duties on petroleum products.

“A year or two is needed for Ukrainian refineries to reconstruct and begin producing Euro-3 and Euro-4 petrol. The government should think what mechanisms (are needed) to contribute. It might be dues and grant schemes,” Tsushko told Liga news agency.

Yet if the government wants to support the refinery, it should be done with investments, not with import duties on petroleum products, said Gennadiy Ryabcev, deputy director of the scientific-technical center Psychea, which specializes in energy sector analytics. The best way to promote local refineries is to recognize the refining industry as a priority sector of the economy, and modernizing the Odesa refinery as an investment project qualifies as a priority sector, added Ryabcev.

Marunych of the Institute of Energy Strategies thinks the most reasonable support could be an exemption from import duties on equipment needed for upgrading refineries. There could be two other preferences – canceling VAT on crude oil imports and import duties on petroleum products.

But both might cause negative effects for the industry as a whole, experts noted.

“(There) definitely should be no preferences for particular business groups,” Marunych emphasized.

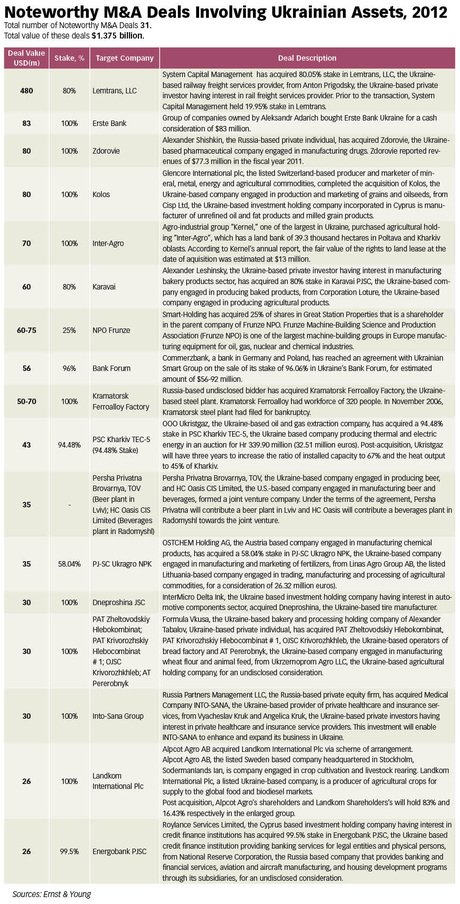

Noteworthy M&A Deals Involving Ukrainian Assets, 2012

Total number of Noteworthy M&A Deals 31.

Total value of these deals $1.375 billion.

Kyiv Post staff writer Kateryna Kapliuk can be reached at [email protected].