A new index of stocks owned or controlled by the country’s most powerful tycoons’ six business groups control half of Ukraine’s PFTS listed companies

A new index tracking stocks owned or controlled by the country’s most powerful tycoons shows that companies representing half of the PFTS’ total market capitalization are in the hands of six business groups.

The “Oligarch Indices” launched earlier this month by Kyiv-based investment bank Concorde Capital track the performance of assets owned or controlled by six financial-industrial groups: Privat (Ihor Kolomoisky, Gennady Bogolyubov, Oleksiy Martynov), System Capital Management (Rinat Akhmetov), Interpipe, EastOne (Viktor Pinchuk), Bank Finance and Credit (Konstantin Zhevago), Industrial Union of Donbas (Serhiy Taruta, Vitaliy Hayduk, Oleh Mkrtchan) and Svarog Asset Management (Konstantin Grigorishyn).

Combined, these six groups own or control companies that account for half of the total market capitalization of the PFTS, Ukraine’s leading stock trading platform. The entire market was estimated to be worth $110 billion at the beginning of this month.

Stocks traded in companies controlled by these business groups account for more than 55 percent of PFTS free-float trading, representing a combined $2.9 billion, according to Concorde.

Nearly every portfolio investor in Ukraine has exposure to stocks belonging to one of these groups, Concorde added.

The report also points out that the groups in focus have, over the course of the last several years, reshuffled their assets to strengthen core businesses. They got rid of incidental assets grabbed in the chaotic privatizations of the mid-1990s. Additionally, Concorde’s analysts believe there is an obvious trend to boost shareholder value through restructuring of assets and improved corporate governance, and audits conducted by the Big Four auditing firms.

“Each of these six groups passed a difficult test in the Orange Revolution. The transformation of the political system put oligarchs under stress, but all six, each in its own way, proved its resilience and adapted to new realities,” the report reads.

“Now that they have cleaned up and are carrying out clear-cut strategies, we can expect value creation to become visible and substantial,” Concorde’s analysts explained.

Daily website updates

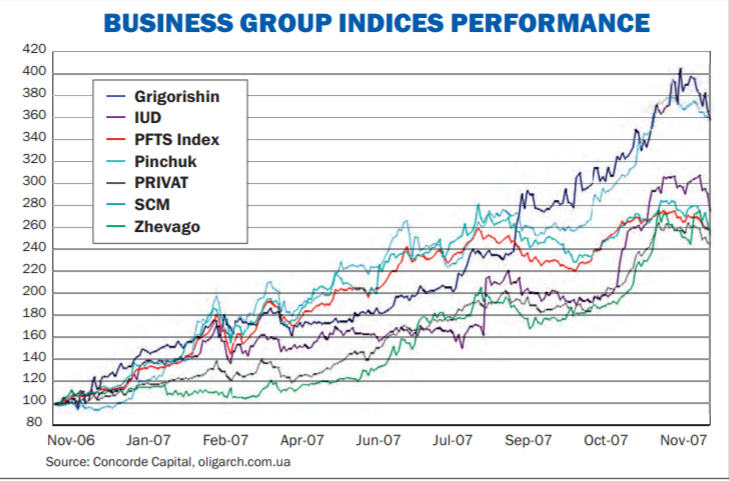

The indices measure stock performance relative to the overall performance of the PFTS beginning with a base score of 100 in January 2006. The indices are updated daily and are available on Concorde’s “oligarch” website devoted solely to the index.

Four of the six ‘oligarch’ groups outperformed the PFTS index year-to-date.

In October, the Grigorishyn index led the pack, followed by Pinchuk and the Industrial Union of Donbas. SCM and Privat were close to PFTS levels, while Zhevago lagged furthest behind.

“Our business group family of indices is designed to track how successful Ukrainian oligarchs are on their way to capitalizing their business. Over time, one after another, each will make their holdings public at major international stock exchanges. A string of placements are expected as early as 2008: SCM, Pinchuk and Zhevago have the market waiting,” the investment bank said.

Concorde’s analysts expect Pinchuk to IPO Interpipe in the first six months of next year, while further public offerings for Zhevago, who successfully floated an iron-ore producer on the London Stock Exchange’s main market earlier this year, include the AvtoKraz truck manufacturer and the Stakhaniv Wagon railcar maker.

Estimating values

Earlier this month, Forbes magazine published its rating of the 15 wealthiest Eastern Europeans. Concorde’s tallies for the value of Ukraine’s oligarchs do not correspond to those published in Forbes.

One example of this discrepancy is Forbes’ valuation of Zhevago. The publicly traded assets of the 32-year-old billionaire’s Bank Finance and Credit group alone have a market value of $3.4 billion, while Forbes pegged him at only $1 billion.

The Forbes’ list included seven Ukrainians: Akhmetov’s wealth was pegged at $4 billion, Pinchuk’s at $2.8 billion. Hayduk and Taruta’s wealth was estimated $2 billion each, while Bogolyubov and Kolomoisky were each estimated at $1.2 billion. Zhevago placed last in Forbes’ list of the 15 wealthiest Eastern Europeans, which was based on last March’s estimates.

“In their first attempt Forbes was incredibly conservative. I wouldn’t be surprised if they even upset some people with their low valuations,” quipped Concorde analyst Nick Piazza.

The bank’s index is purely an informational tool and the basket of oligarchs is not tradable.