After the political crisis began, some analysts warned that the market was entering a bearish period.

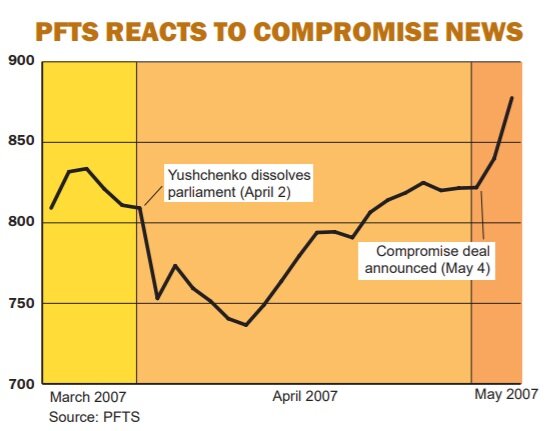

Ukraine’s small but burgeoning stock market on May 4 responded favorably to news that the country’s feuding president and premier struck a compromise deal agreeing to early elections.

What’s more, the month-long political crisis did not have as negative an impact on the First Securities Trading System (known by its Ukrainian acronym as the PFTS) as analysts had initially forecast.

When rumors first surfaced that President Viktor Yushchenko was leaning toward dissolving a hostile parliament backing the governing coalition of Prime Minister Viktor Yanukovych, the market reacted negatively.

On the last Friday in March, rumors that parliament would be dissolved triggered a flurry of sell-offs that, in turn, caused the PFTS electronic trading system to crash for two hours. Then, a day after Yushchenko dissolved parliament, the PFTS recorded a loss of nearly 7 percent. It was the largest drop the market experienced in a single day since early in 2006.

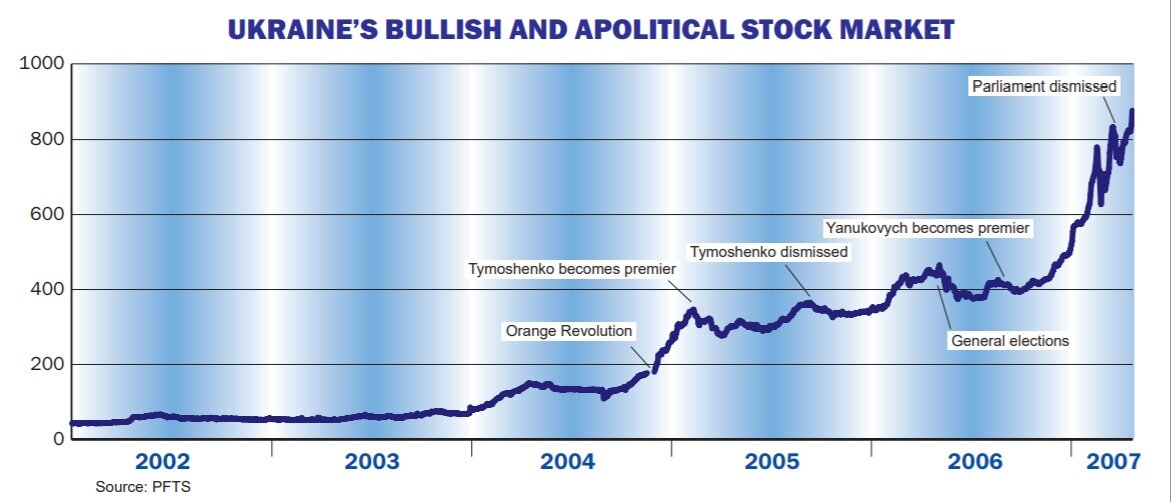

But despite such knee-jerk reactions to escalating political volatility, prices of top Ukrainian stocks have grown sharply this year. In fact, the market has steadily surged ever since the Orange Revolution slapped the country onto the radar screens of investors.

But despite such knee-jerk reactions to escalating political volatility, prices of top Ukrainian stocks have grown sharply this year. In fact, the market has steadily surged ever since the Orange Revolution slapped the country onto the radar screens of investors.

“The market did not react negatively to Yushchenko’s decree dismissing parliament. Rather, investors understood that parliament and the cabinet would disagree with the decree and a period of confrontation would follow,” said Denis Matsuyev, deputy director of trading at Dragon Capital, a Kyiv-based investment bank.

After the political crisis began, some analysts warned that the market was entering a bearish period. Others went as far as to suggest that the PFTS’ record breaking year-to-date gains would be wiped out. The PFTS index first crossed the 500-point barrier in January of this year and has grown by more than 350 points in the first four months of 2007.

Although trade volumes remained low throughout April, the PFTS actually experienced growth, albeit slight.

Dragon Capital’s KP-Dragon Index, which measures the prices of the top 20 Ukrainian stocks, surged by 4.6 percent to a new all-time high on May 7, continuing its latest rally triggered by encouraging political news.

On May 8, the market slid a bit upon news that Ukraine’s political leaders had taken longer than expected to decide on whether elections would be held in July or in the fall.

Traders said that although foreign investors continued to focus on profit-taking and assumed a wait-and-see stance, local investors picked up that slack and began buying stocks more actively.

“Initially we thought it would be worse,” Matsuyev said. “It is a good sign that local investors have become more active players [compensating for a downturn in activity by foreign investors]. This was not the case even one year ago.”

The news of the political compromise broke late afternoon Friday, May 4. The PFTS surged in the last half-hour of trading on that day.

The news of the political compromise broke late afternoon Friday, May 4. The PFTS surged in the last half-hour of trading on that day.

After trading was complete, the PFTS index, which measures the activity of the most liquid Ukrainian stocks, had grown by more than 2 percent May 4 and reached a record high of 839 points, marking a 68 percent increase year-to-date.

On May 7, the PFTS jumped another 37 points to finish with over 877 for the day.

In the compromise deal, Ukraine’s leaders agreed to hold early elections, but they are now at loggerheads over when to hold them. Sources said Yanukovych wants elections held late in the year, allowing time for 40 percent hikes on pensions and state salaries to kick in, winning some votes for his party. Yushchenko-allied parties want the vote held sooner.

“In the best-case scenario, the final election date may be known already this week. But even if the talks drag on, we do not expect any negative surprises and think the political rivals will remain committed to early elections as the way out of the current impasse,” Matsuyev added.

Concorde Capital, a leading investment bank based in Kyiv, was also upbeat.

“There is likely to be some more horse trading before a date for new elections are called, but [the elections] will happen, as the Finance Ministry has already announced plans to allocate money for the new polls,” reads a report issued by the investment bank.

Ukraine’s $50 million stock market is on par with that of Hungary but lags far behind Russia, whose market capitalization stands at over $1 trillion.