Credit rating agency S&P hoisted Ukraine’s sovereign long- and short-term credit ratings to six levels below investment grade from selective default on Oct. 19 after Kyiv last month successfully restructured $18 billion of its foreign debt.

Handing Ukraine a credit rating of B-, the credit rating agency said that the country’s risk of default in the next two to three years has “diminished” due to its commitment to reforms as set out in the International Monetary Fund’s $17.5 billion four-year lending program.

Kyiv’s 12-month outlook also is “stable,” S&P said in an e-mailed statement on Oct. 19, if the Ukrainian government maintains “access to its official creditor support by pursuing needed reforms on the fiscal, financial and economic fronts.”

Uncertainty over a $3 billion Eurobond issued by Ukraine that was bought by Russia’s National Welfare Fund – a rainy day reserve – and maturing on Dec. 20 didn’t prevent the rating upgrade. However, S&P maintained its D, or default, rating for that particular security.

Ukraine’s Finance Ministry welcomed the decision.

“This is a direct and positive effect of the approval of Ukraine’s (debt) restructuring…” the Finance Ministry said on its website. “This represents the first step in the return of Ukraine to the international capital markets, and will facilitate financing by international financial institutions and export credit agencies. It will also facilitate international financing of Ukrainian companies and banks.”

Two other assumptions of the rating agency relate to how Ukraine will treat its Russian credit obligation: “The Ukrainian government will pay the obligation out of its international reserves… or the Ukrainian government will not pay the obligation, and will let it remain in default until another solution is found or the debt is repudiated.”

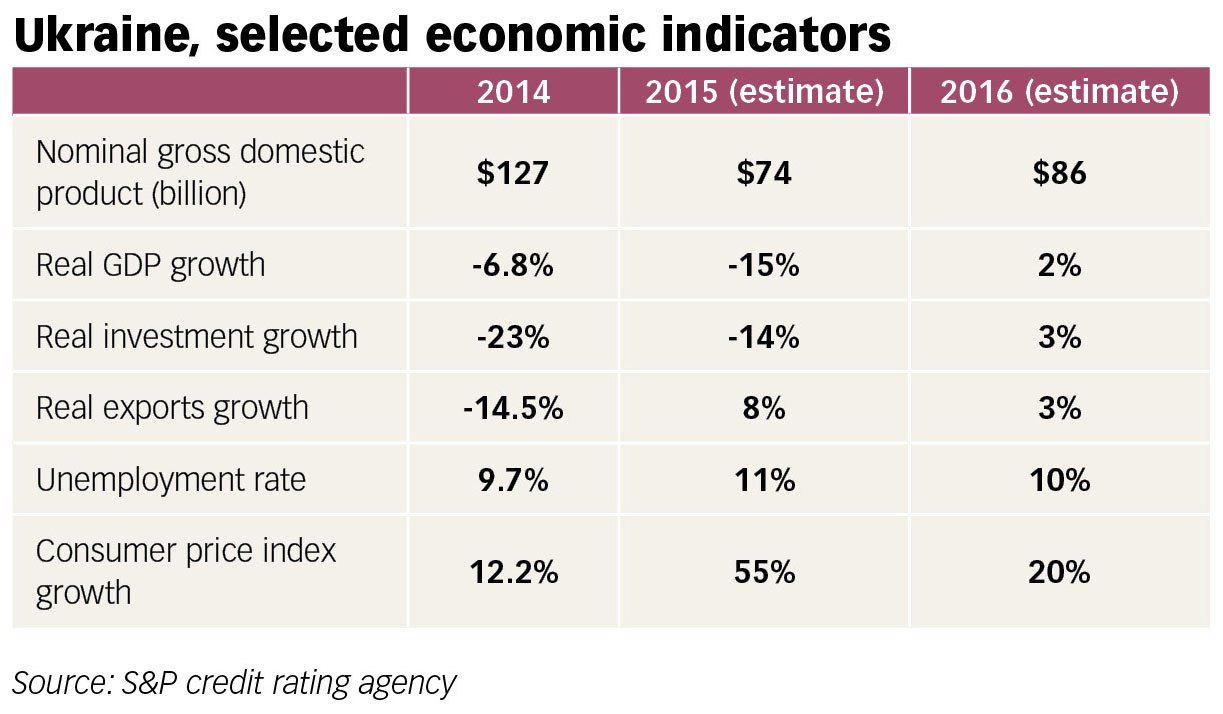

If Russia’s war in eastern Ukraine subsides and international financial institutions, such as the International Monetary Fund, continue to lend, the nation’s economy should start to recover in 2016.

If the second outcome occurs, S&P thinks the IMF will enact its “lending into arrears” policy and continue disbursing the $11 billion in installments under its lending program ending in 2018.

Ukraine’s economy will “likely shrink by about 15 percent this year,” according to S&P, or to about $74 billion, with an “upside potential” for 2 percent GDP growth the next year.

Positive signs for the economy are already beginning to emerge. Ukraine’s statistics agency reported that the decline in industrial production slowed in September on a yearly basis to -5.1 percent. Metals were a key driver, demonstrating growth for the first time since July 2013, rising by 3 percent in August versus -1.8 percent over the same period last year.

Reflecting the notable reduction of conflict in the Donbas, coal extraction and coke production surged by 15 and 51 percent, respectively, on a yearly basis.

Kyiv-based investment house Empire State Capital said it expects the “positive political and security development in the country… together with the institutional, regulatory, and policy changes ahead of the forthcoming implementation of the free-trade agreement with the EU from Jan. 1 to generate robust support for the country’s rating right from early 2016.”

The last time S&P rated Ukraine this high was in late 2013, before the EuroMaidan Revolution erupted, ending in the massacre of some 100 protesters and the fleeing of disgraced President Viktor Yanukovych. In 2009, in the midst of the world financial meltdown, S&P rated Ukraine CCC+, or “currently vulnerable.”

The next scheduled rating publication on the sovereign rating on Ukraine is Dec. 11, according to S&P.

Kyiv Post editor Mark Rachkevych can be reached at [email protected].