Telenor files lawsuits challenging Vimpelcom's Ukraine acquisition

A conflict between Norwegian telecom giant Telenor and Moscow-based Alfa Group over a 2005 Ukrainian acquisition by leading Russian mobile company Vimpelcom, which both stakes in, is shifting into higher gear.

Telenor is pushing ahead with lawsuits against Vimpelcom’s acquisition of minor Ukrainian mobile operator Ukrainian Radiosystems, arguing that the acquisition be annulled.

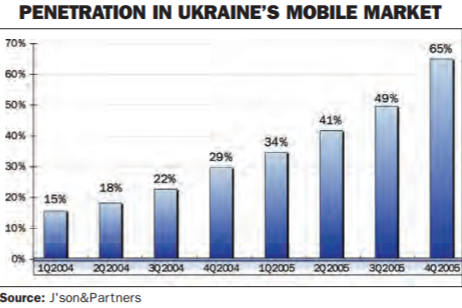

Meanwhile, analysts are warning that the longstanding conflict could hamper Vimpelcom’s plans to invest tens of millions of dollars into the expansion of its successful Beeline brand onto the Ukrainian market through URS, a fourth-tier mobile phone company that has operated under the Wellcom and Mobi brands.

In a Jan. 26 statement, Telenor announced that it had commenced three lawsuits in Moscow against Vimpelcom, in which it holds a 29.9 percent interest, on grounds that the other main shareholder, Alfa Group, together with Vimpelcom management, bypassed Vimpelcom’s board, circumvented minority shareholder protections in the company’s charter, and violated Russian law when they acquired URS last year.

Alfa, which spearheaded the URS acquisition, owns a 32.9 percent stake in Vimpelcom.

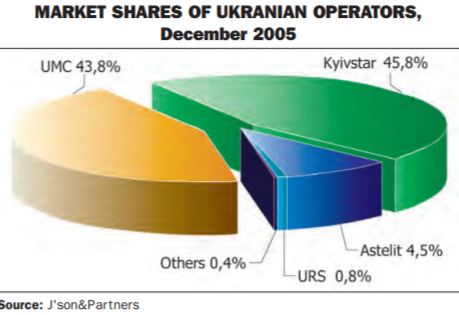

URS, which controls less than 1 percent of Ukraine’s booming mobile phone market, was previously controlled by companies affiliated with the Dnipropetrovsk-based business group Privat.

“Until recently, Telenor had a good relationship with Vimpelcom’s management and Alfa Group,” said Jan Edvard Thygesen, executive vice president and head of Telenor in Eastern and Central Europe.

“However, we cannot accept that Vimpelcom and Alfa Group are now operating with a complete lack of respect for law, transparency, corporate governance and financial controls.”

“We encourage the Alfa Group and Vimpelcom management to recommit themselves to operating within the ethical norms and corporate governance standards appropriate for an NYSE-listed company, and to cooperate in building the value of Vimpelcom,” Thygesen added.

Both Telenor and Vimpelcom are publicly traded companies.

Russia’s number two mobile operator, Vimpelcom, purchased URS for $231 million last November. Telenor officials claim the acquisition was conducted without the approval of 80 percent of Vimpelcom’s board. Telenor has opposed the acquisition, claiming that the sale price was inflated, while adding that the business plan for the acquisition was not in the interests of Vimpelcom shareholders.

“The proposed business plan overestimates the income and underestimates the immense capital required to establish URS as a viable national mobile operator in Ukraine,” said Thygesen.

The conflict has spoiled a once successful tandem between Telenor and Alfa in the region’s mobile phone industry. In addition to being co-shareholders in Vimpelcom, both Alfa and Telenor jointly control Kyivstar GSM, one of Ukraine’s top two mobile operators. Telenor owns a majority share in Kyivstar; Alfa has a blocking stake. The conflict has also left URS, a well-developed but small operator, hanging in limbo.

Soon after their acquisition of URS, Vimpelcom officials boasted of their vast investment plans, revealing their intention to re-brand the small Ukrainian operator as Beeline, after the group’s leading Russian mobile product. Company officials spoke of $50 million in financing for URS as part of a plan to boost its market presence to about 15 percent, or 4 million subscribers, within several years. But on Dec. 14 of last year, Vimpelcom’s board of directors failed to reach agreement on the company’s budget for 2006.

With the ongoing conflict between Telenor and Alfa only expected to continue, approval of the bold investment plans are a long ways off. Meanwhile, the decision on the budget was postponed until early 2006, but still hasn’t been made.

Company officials said that the company’s management will work in line with the 2006 consolidated budget earlier proposed to the board until a new budget is adopted.

Boris Ovchinnikov, director of the Moscow-based telecoms consultancy J’son and Partners, said the conflict will slow Vimpelcom’s expansion into Ukraine only in the short term. But if the conflict drags on, he said, Telenor is likely to back out, as an extended conflict could hamper Vimpelcom’s growth and development.