The deal worth at least $5 billion signals that neither side is willing to find common ground

Norwegian state-controlled telecom giant Telenor revealed a proposal on March 20 that could settle its long-standing dispute with Russia’s Alfa Group, presenting a deal worth at least $5 billion that would separate their interests in the promising and lucrative Ukrainian and Russian mobile telecom services markets.

The deal serves as a signal that neither side is willing to find common ground needed to preserve their long-standing partnership and joint shareholding in two of the region’s largest mobile telecom firms: Kyivstar in Ukraine, and Vimpelcom in Russia.

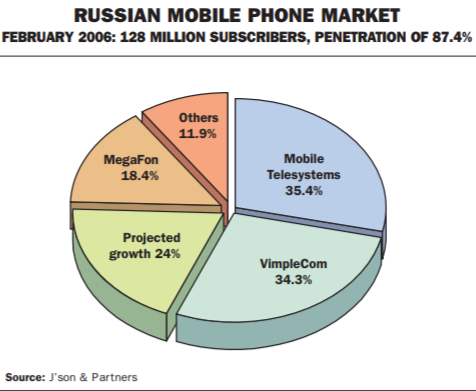

Alfa controls 32.9 percent of Vimpelcom and has a 43.5 percent stake in Kyivstar. In addition to its majority 56.6 percent shareholding in Kyivstar, Telenor owns 26.6 percent in Vimpelcom. About 44.4 percent of Vimpelcom’s shares are floated on the New York Stock Exchange as American Depository Receipts.

The once lucrative relationship between Telenor and Alfa began to sour in 2004 over control of Kyivstar and Vimpelcom’s expansion plans into Ukraine.

Both sides have faced off in courts numerous times since. The conflict escalated last fall after Alfa succeeded in convincing minority shareholders in Vimpelcom to acquire a small Ukrainian mobile operator (Ukrainian Radiosystems) for $231 million. Telenor sharply opposed this acquisition by Vimpelcom, alleging the price was inflated. The dispute has affected management of Kyivstar and Vimpelcom, with board meetings being stalled and challenged through court rulings.

The deal

Telenor’s proposal envisions the Norwegian company selling its majority stake in Kyivstar to Vimpelcom, in which Telenor has a share, for at least $5 billion in cash. Alfa had proposed weeks earlier that the jointly owned Vimpelcom buy out Telenor’s stake in Kyivstar in return for a larger, but not controlling shareholding in the Russian mobile telecom firm.

Telenor’s proposal goes further, envisioning a de facto tender, in which both sides would bid for each other’s stakes in Vimpelcom after the Norwegian company had sold its stake in Kyivstar. Whichever side offered more, would win, yielding them a majority stake in Vimpelcom, which would also equate to a majority stake in Kyivstar.

In a statement, Telenor described the offer as a “market-based separation mechanism.”

Telenor said it was willing to sell its Kyivstar stake to Vimpelcom, establishing a larger cross-country operator, but expressed fears that Alfa’s alleged unfair pressure tactics in management would not cease.

“We are not prepared to sell Kyivstar to Vimpelcom unless there is a structure that will ensure that Alfa’s attacks will end,” said Jan Edvard Thygesen, Telenor’s executive vice president.

Alfa is controlled by Ukrainian-born Mikhail Fridman, ranked as one of Russia’s richest tycoons, with assets in the $10 billion range.

“Our proposal is designed to ensure these requirements are met and, if implemented as proposed, would establish a basis for ending Alfa’s attack on Telenor’s ownership interests in Vimpelcom and Kyivstar,” Telenor’s Thygesen added.

Telenor set a deadline of March 31 for an official response.

Later, on March 20, Alfa responded, expressing its willingness to go along with such a settlement, as long as it would “not harm Vimpelcom and its shareholders.”

If the sale goes through, it would mark the single largest price every paid for a Ukrainian asset. It would surpass the $4.8 billion that Mittal Steel paid for Ukraine’s Kryvorizhstal steel mill last fall.

It would also put both of Ukraine’s largest mobile telecoms in the hands of Russian-based companies.

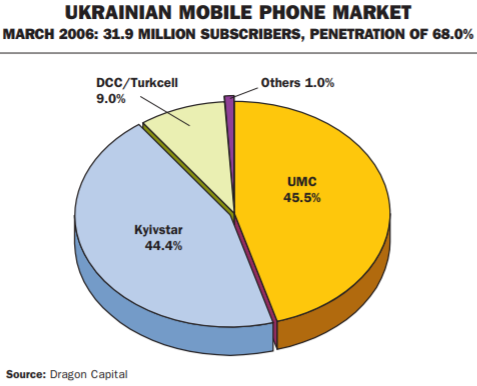

Russia’s Mobile TeleSystems acquired Ukrainian Mobile Communications for just under $200 million through a series of acquisitions in 2003-2004. Kyivstar and UMC control about 90 percent of Ukraine’s fast-growing mobile phone services market, which grew by some 62 percent last year. Analysts predict that penetration levels in Ukraine, which currently has about 32 million subscribers, could rise to more than 90 percent within the next two years.