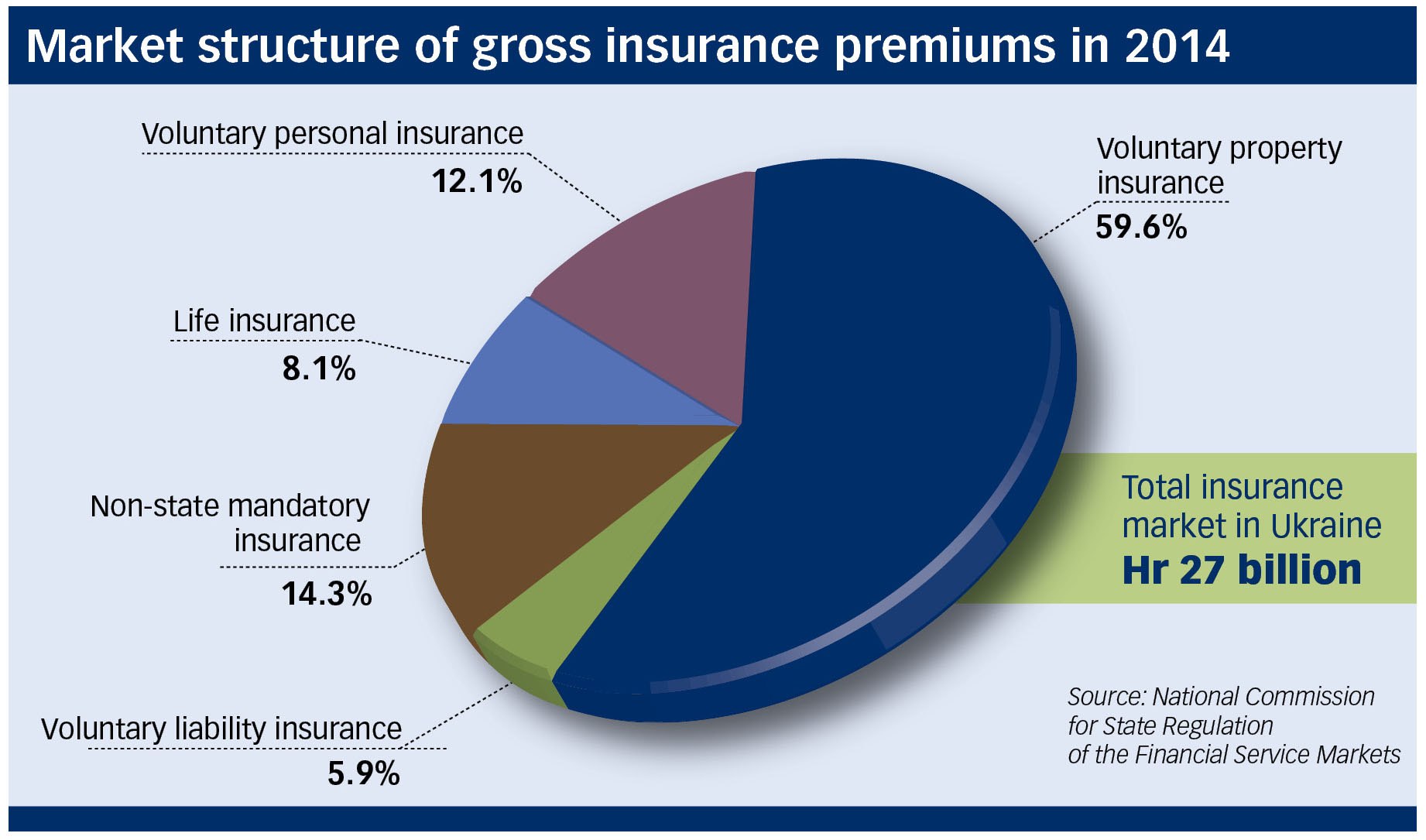

Eighty percent of Ukraine's € 1 billion insurance market is dominated by property insurance plans for real estate, cars and personal belongings.

This is a major segment for some companies like Alfa Strakhuvannya, especially for household appliances and technological gadgets like laptops, cell phones and refrigerators.

“We discovered this market a few years ago and we have the dominant position in this market,” Jacek Mejzner, head of the board of Alfa Strakhuvannya, said. In 2014, the insurance company had issued 2.3 million policies, including up to 40 percent of the tech gadget insurance market.

The remaining 20 percent of the industry covers personal risk, including accidental, health, and life, said Halyna Tretyakova, the general director of the Ukrainian Federation of Insurance, a non-profit industry advisory group.

Ukraine’s Hr 27 billion ($1.1 billion) insurance market in 2014 was dominated by property insurance, whereas life insurance was less than 10 percent of the market. The average Ukrainian spends approximately €75 annually on insurance, which is 15 times lower than what the average European pays.

This means that only one-seventh of companies provide life insurance, or 8 percent of all premiums, the government regulator reports.

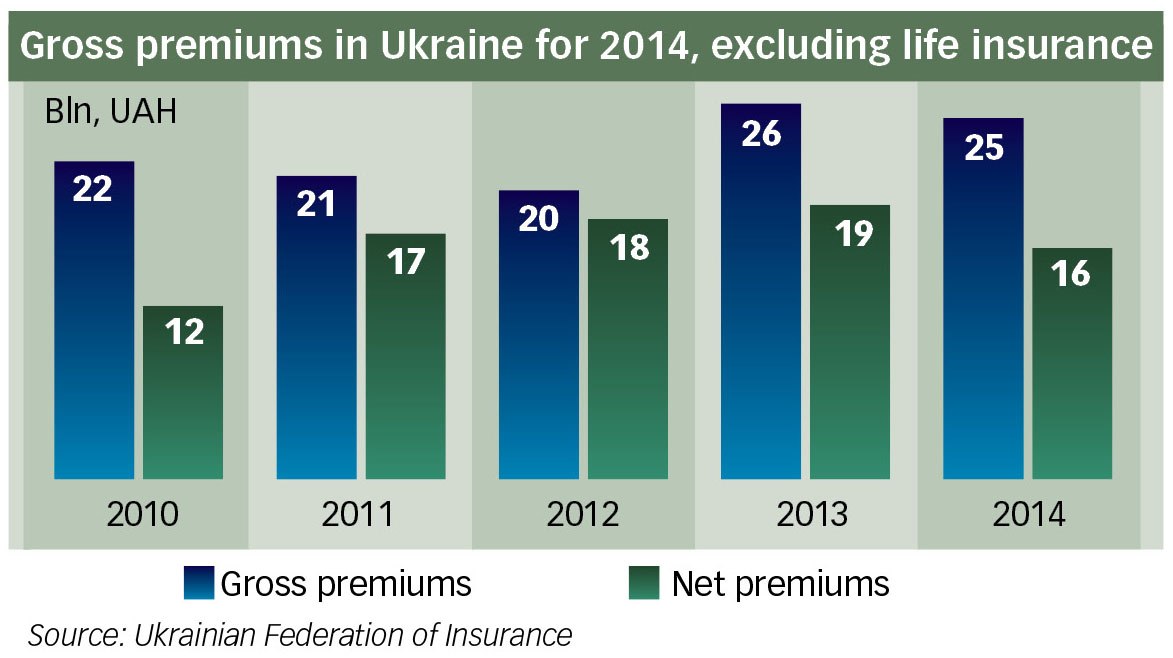

Last year the industry witnessed a 6.6 percent decline over the previous year and had 382 insurance companies servicing 167 million contracts, according to the government regulator of the industry.

The average Ukrainian spent around €75 per year on insurance, whereas in Poland and Switzerland it was closer to €300 and €2,000, respectively.

When comparing insurance spending as a percentage of gross domestic product, Tretyakova said, there is room for growth. On average, a country’s insurance market is 7 percent of GDP. In Ukraine, it is less than 1 percent.

For that to happen, the number of untrustworthy companies should be punished, and the public should be educated on the value of mitigating risk and long-term planning, industry groups and players said.

Ukraine’s modest non-life insurance market decreased by 4 percent in 2014 compared to the previous year. Overall, the market showed little growth during the past five years.

There are too many insurance companies in Ukraine, according to Tretyakova. Only about 120-150 are actually functional. The rest create risk by accepting premiums and not honoring insurance claims. That number (382) should be trimmed like getting rid of a cancerous tumor, Tretyakova said. “It’s impossible to oversee 400 companies.”

Many companies sprung into existence because initially it was easy to obtain licenses and some hoped they would be resold to foreign insurers looking to enter the market.

Others formed for tax evasion purposes because insurance companies only had to pay a 3 percent income tax whereas the standard corporate tax was 18 percent. This provoked a huge amount of “dead souls,” says Tretyakova.

Stricter supervision of insurers is required and insolvent and dishonest companies should be eliminated, Tretyakova said.

“There is a history of premiums being received by insurance companies and claims not being paid or being paid very late, so the people do not trust insurance companies,” says Belgium-born Cedric Hermann, the managing partner of Europ Insurance Brokers, which services mostly corporate clients.

Raising the bar on professionalism and service could help weed out the unreliable companies, said Philippe Wautelet of France-based AXA Insurance.

Administering 800-900 staff members in Ukraine, Wautelet said: “We manage claim processing the same way they do in France, Belgium or Germany. We are really part of Europe on this side.”

The only foreigner in his company, Wautelet has noticed the Ukrainian government to be friendlier toward the insurance market making it easier to promote European standards.

But Ukraine’s inherited monopolized insurance structure from its Soviet past makes the process more difficult. “After we changed the economic platform in Ukraine we did not modernize the social security system,” Tretyakova said. To do this, insurance companies must be integrated into the social security system of Ukraine. This should be a priority for the Ministry of Economic Trade and Development, she said.

However, ordinary Ukrainians don’t see the value that insurance plans offer in mitigating risk and creating a safety net when health problems or accidents occur. And government officials, according to experts, underestimate the negative effects on the economy when people aren’t insured because businesses spend years on recovery during times of asset damage instead of insurance companies quickly taking care of it, for example.

“There’s still a lot of education that has to be done with regards to the insurance market,” Hermann said.

Many have a short-term view of insurance because they live in an environment where so many struggle to buy food, and pay rent, he says.

“Insurance companies often say that human life is second after possessions (in Ukraine). That is also one of the mentality problems,” said Tretyakova.

Thus, it’s still “a very small market compared to the financial market in general,” Wautelet said.

Kyiv Post staff writer Ilya Timtchenko can be reached at timtchenko@kyivpost.