Users of Ukrainian ATMs are currently charged up to 1 percent for transactions.

Small and mid-sized Ukrainian banks unable to expand their own ATM networks now have an alternative way of keeping up with the country’s increasingly consumer-oriented society.

Rather than spending the tens of thousands of dollars needed to establish and operate a single new automated teller machine outlet in Ukraine, or using those of a competitor, banks can rent ATMs from a new US company entering Ukraine’s ATM market.

Euronet, which already manages almost 9,000 ATMs in Europe, the Middle East, Africa and Asia, says it will spend almost $3 million dollars to set up 200 ATMs in Ukraine by the end of 2008.

Ukrainian banks that sign on with the Kansas City-based company will be able to offer their customers use of the Euronet-branded ATMs with low or no service charges, Euronet said.

Users of Ukrainian ATMs are currently charged up to 1 percent for transactions.

Euronet’s Ukrainian subsidiary, Euronet Ukraine, announced plans on March 27 to launch an independent shared ATM network that will allow Ukrainian cardholders to make cash withdrawals, balance inquiries, and use of other services.

Ukrainian banks taking part in Euronet’s network will be offered a contract that promises cheaper costs than establishing and operating their own ATM networks.

“With the help of Euronet’s network, participating banks will be able to expand their own ATM network with much lower initial investments and ongoing costs,” Euronet Ukraine Managing Director Egor Musatov said.

“With the help of Euronet’s network, participating banks will be able to expand their own ATM network with much lower initial investments and ongoing costs,” Euronet Ukraine Managing Director Egor Musatov said.

“All our ATMs will be located outside of bank branches. Banks will pay a fee for the use of our network, but it will be cheaper than maintenance of their own off-branch ATMs,” he added.

According to Musatov, the challenge for his company is to explain the new concept for Ukraine to the banks .

“Foreign banks may be easier to convince, especially those which are our clients in other countries where we have similar networks,” Musatov said, adding, “But even local banks that understand very well the cost of running their own networks will be ready to join.”

Euronet currently works with many international banks in other countries, with Austrian Raiffeisen and Erste Bank, Hungarian OTP Bank, US Citibank and Italian UniCredit, which are represented in Ukraine, among them.

But only UniCredit has signed on board in Ukraine.

Euronet has had a presence in Russia since 2004.

The US company opened an office in Ukraine in April 2006, where it has offered financial software services.

Ukraine will be the first CIS country where Euronet will open up an ATM network.

“Ukraine’s banking market is more ready for innovations, more liberal and competitive than other [CIS countries],” Musatov said.

But the country’s 164 banks haven’t been able to build ATM networks fast enough to keep up with growing consumer demand, with large foreign banking groups awash with money continuing to buy into the market.

According to Musatov, despite the growing competition on Ukraine’s banking market, “not all banks can afford, and actually need, to invest money and time into their own ATM networks if there is a reasonable alternative.”

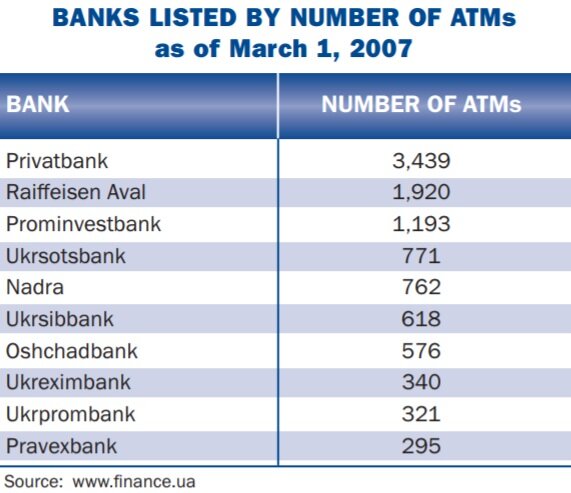

Currently, 90 percent of Ukraine’s more than 150 banks have their own ATMs, according to the Association of Ukrainian Banks. According to the Internet web portal FINANCE.UA, there are currently around 13,500 ATMs in Ukraine. But the lion’s share of ATMs are controlled by the country’s largest banks.

The biggest ATM network in Ukraine is boasted by the country’s largest bank in terms of assets and branch offices, Dnipropetrovsk-based Privatbank, which has almost 3,500 ATMs nationwide and over 12 million cardholders.

Austria’s Raiffeisen Bank Aval, a top five Ukrainian bank with foreign ownership, has nearly 2,000 for 5.3 million cardholders. And top 10 Prominvestbank operates 1,175 ATMs for over 2 million customers.

Euronet’s proposed ATM network can be very helpful for Ukraine’s banking market, according to Oleksiy Kushch, an advisor to the president of the Association of Ukrainian Banks, which includes 120 of Ukraine’s 164 banks, as the launch of one’s own ATM network is not profitable for a bank.

“It is expensive to set up an ATM and to support it, and the commission charged for the services does not cover these costs,” he said.

Kushch said that small and mid-sized banks will be more interested in piggybacking on a larger network.

“Often small and mid-sized banks merge their ATM networks with bigger banks to better compete, but not top 10 banks,” he added.

According to Euronet’s website, the US company operates an independent pan-European ATM network and the largest shared ATM network in India.

Euronet also calls itself the world’s leading provider of electronic distribution services, or top-up services, for prepaid mobile airtime, and a licensed money transmitter and bill-payment provider.

Euronet reported consolidated revenues of almost $700 million in 2006 and made almost 900 million electronic financial transactions in total.