The move is viewed as the most recent of many unsuccessful attempts to encourage Ukrainian citizens and companies to declare shadow income.

Ukraine’s government has approved the draft of a bill it will submit to parliament on providing private individuals and businesses one year to legalize their “shadow assets,” paying a mere 3 percent in taxes on the undeclared valuables to the state.

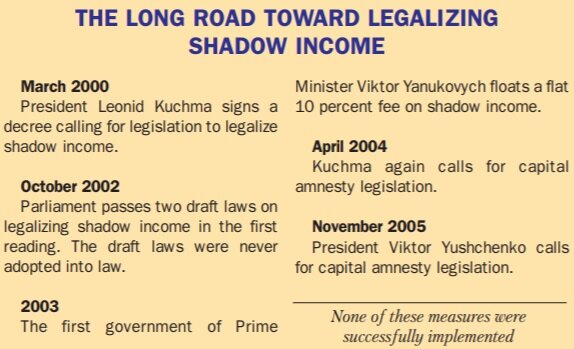

The move is viewed as the most recent of many unsuccessful attempts to encourage Ukrainian citizens and companies to declare shadow income. But many experts have questioned the dedication of Ukraine’s leaders toward reducing the shadowy economy, and the methods to tackle the problem. What’s more, experts question whether such legislation will be passed amid the current political crisis and imminent early parliamentary elections.

Close to half of Ukraine’s economy is estimated to be in the shadows. Different governments have tried to encourage the legalization of shadow capital in different ways, from friendly tax rates and exemptions to threats of criminal responsibility, but none have worked.

Experts say the problem can be solved if tax evasion becomes inefficient for business, perilous for individuals and morally unacceptable for high-ranking political figures.

In mid-April, First Deputy Prime Minister and Finance Minister, Mykola Azarov, unveiled the details of the newest measure intended to coax illegal incomes out of the shadows, saying that the declaration of incomes would be voluntary and not subject to further investigation.

He said that individuals and businesses would have one year to legalize any hidden income. According to Azarov’s plan, capital legalization should begin in January of 2009.

There have been attempts to legalize the shadow economy before.

Experts estimate that between 25 and 50 percent of Ukraine’s economy functions in the “shadows” because high income taxes, corruption, privatization fraud and poor tax supervision allow for the “hiding” of personal and business incomes.

In a recent report, the Economy Ministry estimated that around Hr 120 billion – almost $25 billion – circulate beyond the state budget.

According to the report, the most “shadowy” industries are coke production, oil processing, wood processing and transportation (particularly city shuttle buses). The report states that a large portion of salaries remains hidden.

Experts are skeptical about the government’s efforts, arguing that capital amnesty alone would not fix the situation.

“The logic of the shadow business is that it will prefer staying in the shadows as long as it is cheaper than being legal,” said Yevhenia Akhtyrko, a senior economist at the Kyiv-based International Center for Policy Studies.

“It also relates to security. It is cheaper for them to guarantee the safety of their assets than to pay taxes,” she added.

Akhtyrko also noted that the proposed income legalization does not provide for legalizing the way the incomes were made in the first place. Thus, the problem of illegal income generation would continue.

“The government has to provide good reasons for legalizing incomes together with deterrents and punishments for hiding assets or create a more business-friendly tax environment,” she added.

Akhtyrko estimates that 30 to 60 percent of country’s economy is beyond the budget, and refers to the construction industry as one the most shady in the country.

Volodymyr Kotenko, tax and legal services partner at the Kyiv offices of Ernst & Young, said to deal with tax evasion, it must first be recognized as a problem by the state and society.

“By evading taxes for many years, society is sending a strong signal that it is not happy with existing tax rules,” he said.

“By evading taxes for many years, society is sending a strong signal that it is not happy with existing tax rules,” he said.

“The first step therefore is to ‘repair’ the taxation system, in particular, through enacting modern, clear and fair tax legislation,” he added.

Kotenko said that any amnesty on illegal incomes should perform multiple tasks.

“It should help not only to take businesses out of the shadows, but to improve moral attitudes toward tax-paying.”

“A business that is encouraged to leave the shadows will contribute much more to the budget and society than a one-time payment that is made upon income legalization,” he noted.

Meanwhile, Vasyl Yurchyshyn, the director of economic programs at the Razumkov Center for Economic and Political Studies, a Kyiv-based think tank, said that income legalization is more than just an issue of the tax system.

He said income legalization would not occur until Ukrainian politicians and officials provide an example.

“Nobody believes the incomes declared by politicians, since everyone sees the actual standards of life they are living,” he said.

According to Yurchyshyn, tax rates on legalized incomes will not matter, be they zero or 20 percent. More important is for the political elite to be involved in the process.

Yurchyshyn estimates that half of Ukraine’s economy is still in the “shadows” due chiefly to the construction industry, medical care and the university education system.