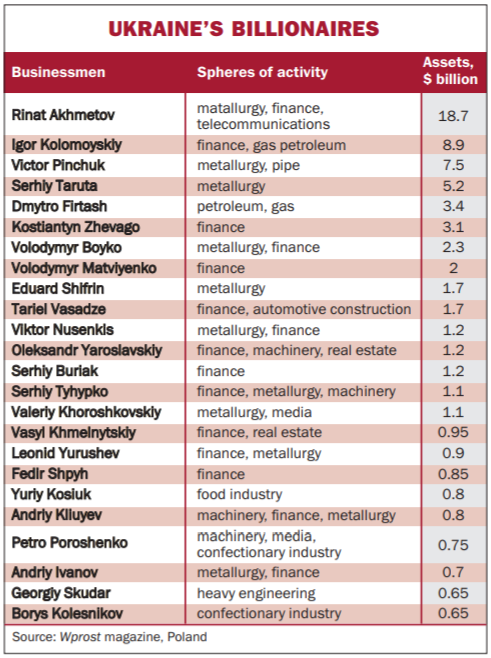

This year, 24 Ukrainian businessmen were among the Polish business magazine Wprost’s Top 100 wealthiest Eastern Europeans

The rich got shockingly richer in Ukraine during the last year. Ukraine’s richest businessman, Rinat Akhmetov, nearly doubled his wealth to $18.7 billion from $7.2 billion last year, according to Wprost, a Polish business magazine that annually ranks Eastern Europe’s wealthiest citizens.

Akhemtov is the fourth wealthiest Eastern European, Wprost reported, surpassed only by Russian businessmen Oleg Deripaska, Roman Abramovich and Gennadiy Timchenko.

This year, 24 Ukrainian businessmen were among the Wprost Top 100 list, with nine qualifying for the first time, the most debuting from any country and reflective of the nation’s extraordinary valuation boom.

“The arrival of Western investors, and the country’s growing attractiveness as a whole, increases the demand for domestic companies and their price accordingly,” said Vitaly Sych, chief editor of Korrespondent magazine, a sister publication of the Kyiv Post.

As a result, “these assets are growing quickly in value,” said Sych, whose Korrespondent magazine has ranked Ukraine’s wealthiest in the past two years using asset valuations calculated by Kyiv-based investment bank Dragon Capital.

Ukrainian mega-millionaires have mushroomed in the last three years. Only five made the Wprost Top 100 list in 2004.

The Russian Federation, on the other hand, had five fewer businessmen on the list, though its 43 mega-millionaires are the largest number, with Ukraine ranking second and Poland in third place with 15 billionaires.

Among the Ukrainian debutantes are high-ranking members of the Party of Regions – Deputy Prime Minister Andriy Kliuyev (estimated wealth $800 million), Akhmetov’s business partner Borys Kolesnikov ($650 million) and industrial magnate Georgiy Skudar ($650 million).

During the last year, five new Ukrainian billionaires emerged, Wprost reported.

They are auto-making magnate Tariel Vasadze ($1.7 billion), banker Serhiy Buriak ($1.2 billion), industrial magnate Viktor Nusenkis ($1.2 billion), metallurgy and media tycoon Valeriy Khoroshkovskiy ($1.1 billion) and banker Serhiy Tyhypko ($1.1 billion).

Ukraine’s top three wealthiest is rounded out by two Dnipropetrovsk industrial tycoons: Igor Kolomoyskiy, whose wealth increased 41 percent to $8.9 billion in the last year, and Viktor Pinchuk, whose wealth more than doubled to $7.5 billion.

The Wprost ratings are mere estimates and aren’t precise evaluations, said Dmytro Vydrin, a Ukrainian political expert.

“Not once, I myself asked local oligarchs to evaluate their assets and none of them managed to name any rough figure,” he said. “There are too many factors at influence.”

For example, Akhmetov’s fortune can fluctuate as much as 30 percent and 50 percent depending on metal and natural gas prices, as well as the domestic and international political situation, Vydrin said.

Billions the Ukrainian way

Skyrocketing asset valuations since the Orange Revolution have enabled businessmen to become mega-billionaires overnight, without taking the important steps of hard work and personal and intellectual development, Vydrin said.

They gained their wealth primarily through exporting natural resources, such as natural gas, oil and metals, observers said.

“Many rich Ukrainian men, unlike their European counterparts who founded businesses of their own, gained their initial wealth through muddy privatization of enterprises during the Soviet era,” Sych said.

After acquiring massive stakes in industry, Ukrainian businessmen began establishing banks, which enabled them to accelerate their profit, in distinction from their Russian counterparts.

The main assets of about 60 percent of Ukraine’s wealthiest businessmen are in banking, compared to 16 percent in the Russian Federation, according to research performed by Korrespondent magazine with Dragon Capital. Banking success is enhanced by strong demand by European banking groups to snap up banks in Ukraine’s promising market. This has, in part, increased the average worth of enterprises between 50 percent and 60 percent last year alone, Sych said.

The wide scope of tax evasion also contributes to the snowballing wealth of local businessmen, he said.

“Hence, the extremely low living standard in Ukraine, which is getting lower as the incomes of the super rich gets higher,” he said. “That’s why despite having the most multi-millionaires in Eastern Europe apart from the Russian Federation, Ukraine has the lowest average wage.”

Their prosperity isn’t limited to luck and graft, however. Increasingly, Ukrainian businessmen are assimilating Western standards and practices to make them attractive to Western investors.

More effective management and increasing business transparency have contributed to capital growth and foreign investment in Ukrainian markets, said Andriy Bespiatov, head of the research department at Dragon Capital.

In recent years, “many business owners hired foreign top managers, who created new standards in which more attention is paid to relations with investors, since many owners are trying to prepare their businesses for initial public offerings (IPOs),” he said.

Ukrainian businessmen have also imitated their Western counterparts in how they spend their wealth. Most spend a significant portion of their time abroad, engaging in business deals, as well as vacationing and shopping.

The lack of time and development in establishing their wealth has led many to feel like they have to “prove it” to others, Vydrin said.

“Hence, there is an over-consumption, complete with the ‘must-have’ lists of Ukrainian oligarchs, which often include football clubs, ostentatious castles, helicopters and jets,” he said.

The latest trend of investing in social and cultural projects is another attempt to attract attention, legally protect themselves, and even somehow morally justify their position.

“In other words, very rich people become increasingly public, creating the image of the so-called ‘benevolent billionaire,’” Vydrin said.

The prime example is Pinchuk, who has invested in the arts, improving medical care and education.

Political fever

Perhaps nothing more distinguishes Ukrainian mega-millionaires from their Eastern European counterparts than their passion for politics, analysts said.

Such a trend, which is not present in Western European countries, is a clear indicator of high levels of corruption in Ukraine, Sych said.

“It just as hard to earn big money outside of politics in Ukraine, as it is to become a politician without big money,” he said.

Ukrainian politics distinguishes itself because it offers the valves of power to create business opportunities, develop them further, and find shelter from competitors and corrupt officials, Vydrin said.

Those belonging to the Party of Regions have assets totaling about $18 billion, according to Korrespondent/Dragon Capital research.

A distant second is the Yulia Tymoshenko Bloc, whose sponsors are worth about $7 billion. It’s no coincidence these two political parties are the most popular.

Some businessmen form parties of their own, with minimal influence on political life.

Independent businessmen aren’t directly involved in politics, but sponsor politicians who lobby their interests.

Businessmen estimated they gain between 1,000 and 2,000 percent annual profit from investing in Kyiv politicians, compared to 100 to 200 percent profit from real estate.

For example, if Kyiv City Council members vote on land distribution decrees, shareholders can earn at least $200 million in half a day just from lobbying these decrees, Vydrin said.

“Most of the entrepreneurs are eager either to sponsor local officials or to become ones themselves,” Vydrin said.

Kolomoyskiy was widely believed by political observers to have sponsored the Our Ukraine-People’s Self-Defense Bloc without playing a direct role after providing similar support for the Yulia Tymoshenko Bloc in prior years.

He is also a shareholder in the influential 1+1 television network. Khoroshkovskiy recently expanded his television holdings to include the NTN network, in addition to his shares in Inter. Thus, with influence in the mass media, billionaires determine public opinion as well.

“Today, Ukrainian society acts as a service class to the society of billionaires and serves its needs, instead of the latter (billionaires) being the financial support of society,” Vydrin concluded.

As for the future, more Ukrainian mega-millionaires will likely emerge in the consumer products sector, Sych said, particularly banking, food production and food delivery.

Vydrin adds to the prospective list Internet media businessmen, information technology entrepreneurs and real estate developers. The main trend is the diversification of business spheres, Vydrin said.

“Ukrainian billionaires, who mostly gained their initial capital in metallurgy, are now entering mass media and telecommunication,” he said.

Ukrainian businessmen are also making gains on the foreign market by selling goods there, buying prized assets abroad and consolidating assets with foreign businessmen, Vydrin said.