Most people have a hard time getting excited about taxes and government budgets. I love these discussions, but not because I am a policy wonk.

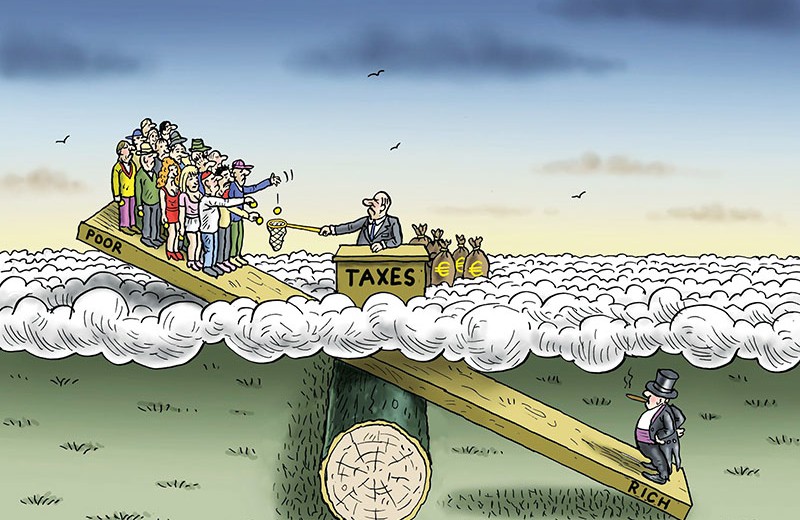

Show me a nation’s tax code and I will show you its priorities – whether it favors the rich, the poor, promotes equal opportunities, whether it aims to increase economic opportunities for everyone or just the select few. In short, taxes and budgets reveal much about whether a society is fair, compassionate and just.

Taxes redistribute income – either up or down or just all around. They are the money we throw into the collective pot for public services. Elected politicians (if one is lucky enough to live in a democracy) decide where the money goes.

If a tax code favors the rich, they will become richer, income inequality will grow and the economy will become distorted in a way that works against the vast majority of people in every nation – the working classes who are poor or swimming hard to stay in the middle class.

Too often in nations, privileges for the rich are hidden in the tax code, through exemptions for certain types of economic activity, lower rates for type of income (investment versus payroll) and many other tailor-made favors.

It’s often done on the tax side of the ledger, because it would be political suicide (one would hope) to support budgeting billions of dollars for billionaires or multinational corporations.

My country, America, never had an income tax until 1913 – allowing for great fortunes to amass for centuries without much going for the public good. Some people think this was a great era. I think it was horrific. I am a Franklin Delano Roosevelt Democrat and believe, as America’s greatest president did, that the best way to tax is on the ability to pay – a progressive income tax in which those who benefit the most from the economy also pay the most in taxes.

Ukraine’s economy has relied on exports of steel and agricultural commodities. Moving to diversify and modernize the economy has been difficult, considering vested interests that favor the status quo and keep obstacles in place to discourage foreign direct investment.

There is a limit, however. Maybe there are studies that back me, but any time the tax burden is higher than 33 percent, people start looking for ways to evade taxes – perhaps even 20 or 25 percent is the trigger for this behavior in some people. Despite the liberal in me, income tax rates above 33 percent strike me as confiscatory and detrimental to the economy.

America in 1913, while on its way to becoming one of the world’s great economic engines, would have been better with a progressive income tax in place much earlier. Public education didn’t take hold until the 19th century – which, combined with the lack of income tax, allowed wealth and knowledge to accumulate for generations among the elite few. The pre-income tax era of America was also one of labor exploitation, legalized racial inequality and such extremes in wealth that growing old was frequently a sentence of poverty or dependence.

Those are not the good old days – yet many in Congress, which fronts for wealthy donors in my view, want to drag America back to those barbaric times. Not a chance, if my vote counts for anything. I support strong public education, so university students don’t go into debt; equal opportunities and labor unions, so working people can get ahead; and a retirement in which the elderly’s net worth increases, because of pensions, social security and private savings, so they can live out their golden years in dignity. I also believe in modest inheritance taxes for anyone with more than $1 million in assets.

So what do the tax-and-budget policies of Ukraine, my second homeland, say about its society?

It’s not good. The portrait presented is one of an unfair, cruel nation.

First of all, most of the wealthiest businesses and people dodge taxes through offshore tax havens and accounting schemes – through abuse of transfer pricing and other ways – that minimize the taxes payable in Ukraine. This is a continuation of behavior that started when the oligarchs made their first fortunes in post-Soviet Ukraine on the cheap, through scandalous insider deals in the first wave of rigged privatizations.

Secondly, the way Ukraine treats many classes of people is simply awful. The elderly, government workers from school teachers to garbage collectors, and students – all are treated shabbily by public policy. It is hard to see a society advancing under such conditions.

Thirdly, the byzantine and corrupt tax collection system put in place by people like ex-President Leonid Kuchma and ex-Prime Minister Mykola Azarov encouraged capital flight, tax evasion and the explosion of a shadow economy, which hovers around 40 percent of gross domestic product. Those who pay their taxes look like fools who put themselves at a competitive disadvantage. Not enough has been done to erase the damage.

So Ukraine is left with the ability next year to levy taxes on $94 billion in official economic activity – the forecasted amount of gross domestic product, even though the real size of the economy might be twice that high but goes hidden in the shadows.

Ukraine’s state budget comes to $38 billion, less than half of New York City’s municipal budget, but 40 percent of its entire GDP. The big four sectors of the budget are almost untouchable: defense & security spending (given Russia’s war), pensions, debt service and education. So public officials such as Finance Minister Natalie Jaresko are left with trying to weed out the fraud and privileges, simplifying matters and hoping for the best.

Ukraine has much to do to get out of this downward spiral – more fairness, more growth and more effectiveness in government spending are three keys. Only if these elements fall into place will more people and employers be willing to come out of the shadows and pay their taxes.

America has a high rate of voluntary tax compliance for two key reasons.

Firstly, people see how their tax dollars improve society.

Secondly, people are afraid of the Internal Revenue Service. I had a run-in with our tax collection agency 30 years ago and never forgot the lesson: Declare income and pay taxes or else, sooner or later, the IRS will find you and you will end up paying more. In most cases, tax evasion is not an option – the government deducts the taxes from the average employee’s paycheck.

Compliance not only applies to income taxes.

Few people love paying them, but taxes are essential to funding government services, including education, infrastructure, defense and pensions.

The genius of the American tax system is that people cannot avoid taxes. They are broad-based and everywhere. We have income taxes – national, state and even local. We have sales taxes on all levels. We have real property taxes, not the nominal ones that Ukraine is only starting to introduce. We have excise taxes, so every gallon of gas purchased is already taxed. The list goes on and on. In the end, however, tax rates in America are low compared to many European countries. One reason is that everyone pays. It can be argued whether everyone pays their fair share or not, but everyone at least pays.

My hope for Ukraine is that its tax and spending policies in 2016 reflect the best of its values, not the worst of them.