Interviewer – Mikhailo Kruglov

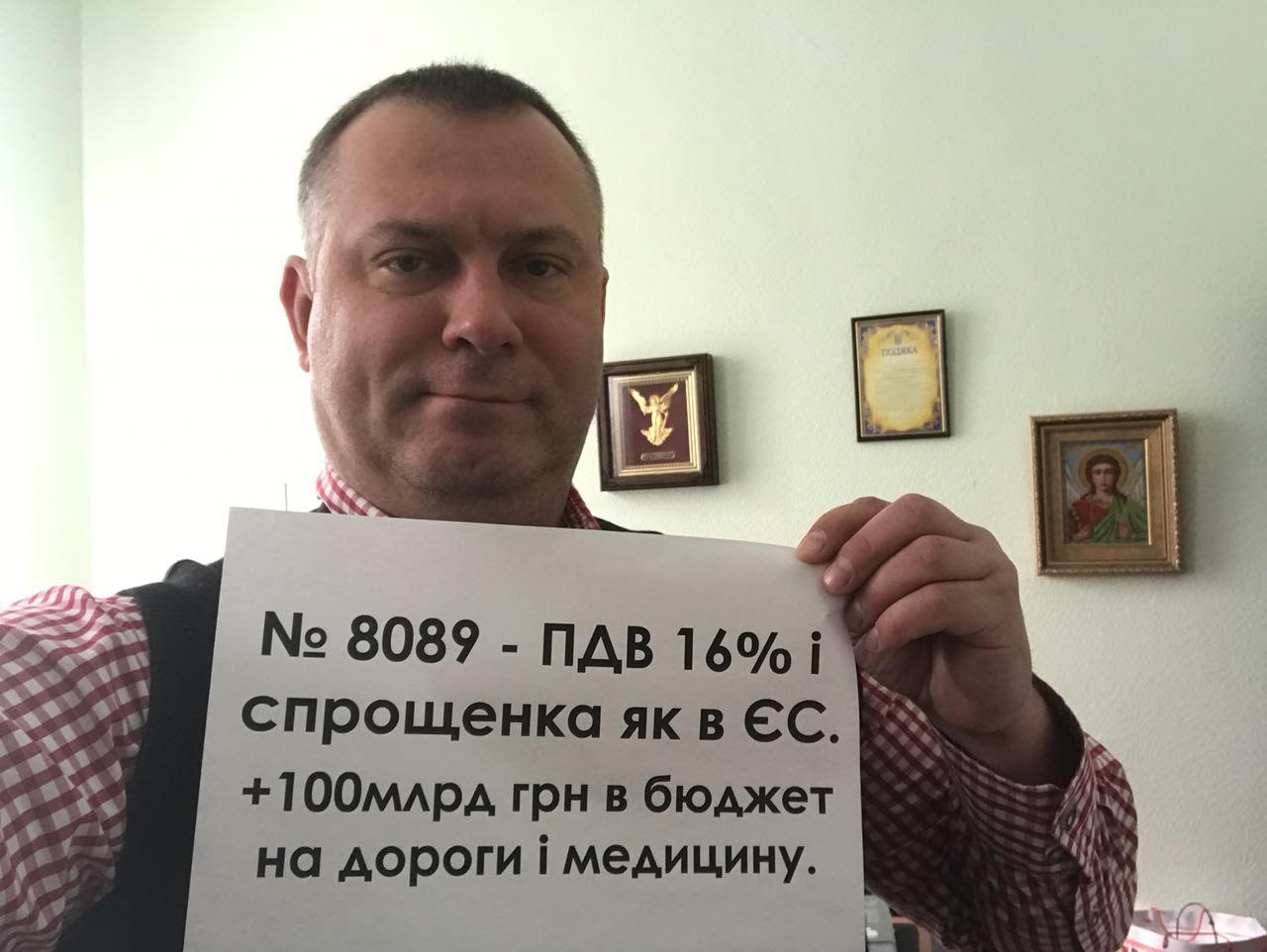

According to the International Monetary Fund, 44.8% of Ukraine’s economy is in the shadow. How to reduce this figure three times said the people’s deputy, the author of the bill number 8089 Andriy Shinkovich at a meeting with representatives of the coalition “For the de-shadowing”. A brief answer to this question, according to Shinkovich, can be seen in the photo. In his view, reducing the basic VAT rate to 16% along with the reform of the State Fiscal Service (SFS) and eliminating abuses by a simplified tax system will reduce the country’s shadow economy to 15%.

– VAT abuse is spoken quite often, but why, in your opinion, lowering the rate to 16% will improve the situation?

– Despite the active work of the Ministry of Finance and the SFS in bringing order in this issue and blocking risky tax invoices in CEA VAT, the current high rate of 20% promotes the search for optimization schemes. There are new sophisticated schemes that allow to minimize VAT payments in the form of so-called “branch twists”, whose services are still cheaper (10-12%) than the full payment of this tax to the budget. Effective struggle against this phenomenon is possible only by moving towards business and lowering the VAT rate to 16% and simultaneously improving administration.

To this end, in draft law 8089, we provided for a basic VAT rate of 16% and, according to many experts, this will lead to de-shadowing and increase real revenues from the value added tax, as the risks will exceed the economic feasibility of applying optimization schemes. At the same time, the proposed reduction of the VAT rate to 16% does not contradict the Council of Europe Directive “On the common system of value added tax”, which provides for a minimum standard rate of VAT of 15%.

– Do you position the bill number 8089 as being in line with EU practice, but such a low VAT (16%) is not in any country in the European Union?

– Look at the general tax burden of business in EU countries, especially in the Baltic countries, Bulgaria or neighboring Russia, Kazakhstan and Georgia, because it is lower than in Ukraine. If we talk specifically about VAT, then, for example, in Switzerland, the basic VAT rate is only 8%. In Kazakhstan, the unified rate of VAT is 12% and there has long been forgotten about all the optimization schemes that are still operating in Ukraine.

– Even in the case of de-shadowing, this main tax will probably be a loss of budget from a reduction of the rate of VAT to 16%. What compensators do you offer?

If to count simply, then budget losses from the reduction of VAT will amount to about 80 billion UAH. Of more than a trillion hryvnia in the shadow, about 200 billion hryvnia do not come in the budget from non-payment of shadow VAT. According to experts, even with the current work of the SFS, the reduction of the basic VAT rate from 20% to 16% will lead to a sharp reduction of abuses in this area and budget losses will be minimal. If the SFS will hold contests, and new honest workers with high wages will come to the top positions of the territorial bodies, then budget revenues, including the new reduced VAT, will increase.

A recent study by RPR experts showed that urgent reform of the SFS and the revision of the simplified taxation system were urgently needed. This is what the study of the German Advisory Group says.

Therefore, the main compensator envisaged in draft law 8089 is the elimination of large-scale abuses of the simplified system. Bringing this issue to European standards will increase budget revenues to 100 billion USD per year, which can be directed to the development of a quality network of roads and medicine. A 4% reduction in VAT will also lower prices for most goods, which will gladly satisfy consumers and reduce inflation.

– Expansion of fiscal and cash registers is very unpopular among entrepreneurs. How are you going to overcome the resistance of small business?

– Do you want to draw attention to the European choice of our country? The draft law 8089 does not say at all about the total expansion of fiscal policy. It is about bringing the simplified taxation system in line with European standards. I believe that after 8089 it is necessary to adopt a holistic document in the form of “Liberal Tax Code”.

Small business with a real turnover of up to 1 million USD per year is not a bill 8089 and will not have to put the cash register in the first group. Also, no accounting or commodity accounting for all self-employed individuals is foreseen. But show me a store that exceeds 20 square meters with a turnover of up to 1 million USD per year.

– How will the draft 8089 affect the activities of private entrepreneurs?

– At the beginning of the formation of the economy of independent Ukraine in order to create a simplified system of taxation, it was first of all to give work to people who were massively subjected to reductions from inefficient state-owned enterprises, as well as promoting the development of a real small business with a small annual revenue in retail segments in the markets and providing small services to the population. At that time, few of the deputies could have guessed what mine they had put in the development of the shadow economy.

Imperfectly written activities for simplified entities and the lack of a real opportunity to check the true turnovers (for this world-wide cash register serves, from which the authorities freed all “small” businesses) have led to large-scale misuse by large companies.

The simplified system began to be used by owners of large business for the purpose of tax optimization, as well as to legalize the sale of goods imported into the territory of Ukraine by smuggling. Do not go far for examples, just visit a shopping mall, even in the center of the capital, and buy a coat, leather or jewelry to discover that a non-fiscal check is issued from a single tax payer entrepreneur (at best).

– Does anyone really believe that the turnover of such an entrepreneur is about 80 thousand UAH a month? (by law, the annual turnover should not exceed 1 million USD per year in order not to set up a cash register)

– Judging by the queues at the cash desk, some such entrepreneurs make a turnover of 80 thousand UAH per hour, but there are also such stores that use a simplified system to sell at several million UAH per hour. We are all accustomed to receiving in the restaurant two checks, fiscal on alcohol (excise goods cannot be sold by simplified) and non-fiscal from a self-employed individual. Is this normal for the country, which has marked its European choice? When really the same businessman works, but legally executed business is on different self-employed individual, then the goal is purely tax optimization and nothing else.

– What specifically envisages draft law 8089 on the reform of the simplified taxation system?

– Repeated studies on the possible misuse of the simplified tax system have shown that self-employed individuals on a single tax, which carry out activities in trade facilities of more than 20 square meters, due to the lack of control of the real turnover of cash receipts exceed the maximum allowable amounts of annual income in 1.5 million hryvnia for the second group of single tax payers and only in very rare cases, entrepreneurs move to the general system of taxation.

Studies also show the widespread use of individual entrepreneurs in the third group of single tax payers in order to optimize taxation while paying wages, as well as for cash withdrawals for various “gray” business needs, including bribes. In order to save on taxes, companies conclude service contracts with their employees, as with private entrepreneurs (self-employed individuals).

It should be noted that the bill number 8089 does not increase the tax burden in the form of raising the rates of the single tax and this is an important point for a real small business. The second important point – it remains the same amount of income of entrepreneurs of the first and second group.

I also want to emphasize that nobody is trying to interfere in business or restrict it, it is only about the application of a taxation system. However, in order to stop the optimization schemes with the use of simplification and withdrawal from the shadow of a real big business that abuses the use of single tax payers, the following positions are offered:

1) The first group of self-employed individuals remains unchanged;

2) Simplified system of taxation of the 2nd group to save only if the area of the commercial object does not exceed 20 square meters;

3) Taking into account the experience of Lithuania, a specific list of goods and services, which gives the right to be a single tax payer of the 2nd group, must be approved by the Cabinet of Ministers.

4) Prohibition on staying on a simplified taxation system for all entities engaged in trade in excisable goods, medicines, jewelry, complex household appliances, leather goods and fur;

5) Also, payers of the first and second groups are prohibited from engaging in wholesale trade and mediation in wholesale trade;

6) Eliminate the third group of single tax payers, since the list of services approved by the Cabinet of Ministers may be carried out both by the group 2, including for enterprises;

7) Prohibition to be a single tax payer for the second group for self-employed individuals who carry out activities with the possibility of transition to a second group for individual entrepreneurs that meet the requirements for such a group;

8) The prohibition to be a single tax payer for the second group for self-employed persons carries out retail sales of goods or in the restaurant industry or in the provision of services in more than two trading objects, and the first group – for self-employed persons who sell goods more than three retail outlets in the markets, since the activity of one entrepreneur in a greater number of trading facilities has signs of network business;

9) It is envisaged that there should be added to the register of single tax payers additional information about all places of business activity a self-employed individual – a single tax payer;

10) Clarification of the provisions on the possibility of transition from the first group to the second group of simplified taxation system and issues of transition from the second group to the general system of taxation;

11) Obligation of the Cabinet of Ministers to develop a single type of fiscal check with a QR code, whereby any consumer will be able to check the presence of a check at the SFS data base, thereby helping to reduce the shadow economy and further protecting itself from the purchase of counterfeit alcohol, drugs and other goods.

At the same time, the seller’s responsibility for failing to receive a fiscal check increases, from the first time a fine of 200% of the purchase price (today a fine of 1 USD does not frighten anyone). It is especially important to resolve this issue in the light of the bill on so-called ” cashbacks” (6757 and 6759), at the realization of which every buyer is interested in checking received checks;

Will it not happen that some entrepreneurs will divide their 100-meter store into 5 different self-employed individuals with 20 meters?

– The draft law 8089 clearly states that a trade item of 20 meters should have a separate entrance and should be divided with neighbors by a high partition.

– In the transition of entrepreneurs to the general system of taxation, how much will their expenses grow?

– Today, it is quick and inexpensive to register a legal entity or individual entrepreneur on a general taxation system, and judging by the advertisements, keeping bookkeeping at home for LLC is only 500 UAH per month more expensive than for a self-employed individual. A cash register costs from 4500 UAH, and the monthly expenses on it do not exceed 400 UAH.

Even for the most honest entrepreneurs who operate through trading facilities of more than 20 square meters, these costs do not exceed 1-3% of their total investment in their business. After all, in order to open such a pavilion or shop, it is necessary to hang a sign, make repairs, buy trade equipment, obtain all permits for trade, pay for rent, and finally buy goods from a supplier…. A good help for a small business may become, in fact, the free purchase of a cash register (Draft Law 7281) by reducing the amount of a single tax to be paid.

Recently, at the German Embassy, a meeting was held between the members of our Coalition “For De-shadowing” and George Milbradt, an authorized representative of the German Government on reform issues in Ukraine, on which, besides important issues of decentralization, he supported the idea of the so-called “cashback”, at which the consumer will be interested in checking issued checks. George also told about the introduction of a large fine in Italy for a buyer who does not require a fiscal check.

You mentioned about “cashback”. When do you think will it be accepted?

I am very pleased that such reputable politicians as George Milbradt advise and help develop the Ukrainian economy. Of course, you will not find in Germany any store that does not issue fiscal checks. Italian experience is difficult to apply in Ukraine, because consumer fines are a very radical way to solve this problem.

The popular idea of “cashback” was supported by the Ministry of Finance and, to my knowledge, a whole group at the Finance Ministry is actively working on this issue. We will be glad if the Ministry of Finance introduces such an effective mechanism that will quickly force all stores to issue fiscal checks.

– What can you tell about other bills 7142, as well as 6755 and 6756 (so-called “Jackets” and “Parcels”)?

– The draft law 7142 is struggled to be pulled out by the first author and colleague Mykola Frolov. The ideas in it are very correct, but they relate only to certain categories of risky goods – electronics, jewelry and medicines. None of the experts has any doubt that these industries should first be removed from the shadows, and despite the fact that the 7142 only obliges converters sellers of these goods to use cash registers and have documents about the origin of the purchased goods, some “pseudo-advocates” of small business make information attacks on Frolov.

The ideas laid down in 6755 and 6756 with minor changes have already been adopted by the parliament and signed by the president. The suspension of “Jackets” has grown into pseudo-protests at the borders organized by experienced smugglers. The scheme for contraband, in which hundreds of goods vehicles on the front lines cross the border every day, unfortunately, is still working. You can find these products in well-known online stores and shop windows. Moreover, as a result of the “Jackets” suspension, the pilot circuit swiftly gained momentum.

The adopted bill of 150 euros for three consignments per month, at the moment does not work for a temporary technological reason, the complexity of administration, and is postponed for a year… Also, unfortunately, the volume of internal smuggling has sharply increased, in which the declaration with other code for under-invoicing has become a widespread phenomenon. In this matter, no laws will help. It is necessary, as I have already told, to recruit new leaders of territorial SFS.

I want to note that the adoption and implementation of the proposed draft law 8089 is extremely necessary for Ukraine. The withdrawal of the economy from the shadow is possible only through the movement of counter courses, on the one hand to reform the SFS and the simplified taxation system, on the other – lower tax rates.

This will help to expand the tax base and legalize shadow cash turnover, destroy tax evasion schemes, equalize the conditions of economic competition, and create a supportive business environment. The confidence in the SFS and in general, on the part of the business, will increase dramatically, and then a voluntary declaration and an amnesty of capital should be made by analogy with the successful Italian experience in 2001, and you will read about it in our new bill, which we will talk about another time.

Original Source: RBC-Ukraine