Gold Market Analysis 2020 by BDO Institute

With the onset of the global pandemic, gold’s once placid place and price has been awakened. Demand for gold rose 36% in Q1 2020 due to safe-haven buying by Western retail investors, albeit the demand for jewelry fell to the lowest record in Q1 2020, led by a 65% decline in China — the largest jewelry consumer and first market to succumb to the outbreak. To learn more about gold and the drivers that are influencing its awakening, please download BDO’s market analysis.

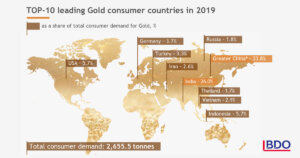

Gold has emotional, cultural, and financial value and different people across the globe buy gold for different reasons, often influenced by national socio-cultural factors, local market conditions and wider macro-economic drivers.

Did you know that?

Following are some interesting facts about gold:

- Gold has been discovered on every continent on Earth;

- There is enough gold in the Earth’s core to coat its entire surface;

- 78% of the world’s yearly supply of gold is used in jewelry;

- An estimated $771 trillion worth of gold lies hidden in the ocean

The role of Gold from a historical perspective

The Bretton Woods system broke down in 1971 with the end of the gold standard in the USA, and today gold is traded freely. From a historical point of view, there are some major events which influenced the history of gold:

- The first use of gold was to make decorative objects, jewelry and coins;

- Increased use of gold in the international monetary system;

- The century-old adoption of an International Gold Standard;

- The end of the classical gold standard after World War II;

- The introduction of the Bretton Woods system after World War II;

- The post-Bretton Woods gold-pegged exchange rate system

The current state of the gold market worldwide

Gold is the new future and safe-haven asset. In our gold Report, you can find out more about our view of the gold perspective. The role of gold can be a crucial leading indicator of world markets.

In general, the demand for gold is prevalent in domains such as Jewelry, Investment, Central Banks and other Institutions, as well as Technology. Our gold Report includes more precise information about each of these areas. So let’s have a look at a brief description of each of them:

- Jewelry has the biggest demand globally. As of 2019, the total amount of mined gold amounts to almost 200,000 tonnes, with nearly half of it used for jewelry.

- The next one according to demand is the Investment sector. Gold purchases from various investment vehicles represent approximately 25% of the total demand for gold.

- The third sector is Central Banks and other Financial Institutions. Demand for gold has been growing since 2010. Safety, liquidity, and returns on gold encourage Central Banks to use this precious metal as a reserve asset.

- The last sector is Technology. Demand for high-end electronic components used in IoT and electric vehicles will support gold’s position as a material of choice. However, gold’s role in technology continues to be very low compared to other elements.

The price of gold in the future

Let’s peek into the future as it relates to the price and supply of gold. If demand rises, and new supply is falling, the price of gold will grow in response to this basic supply/demand equation. The price of gold is expected to increase in 2020 due to Gold hedging qualities that perform across multiple scenarios. Moreover, the industry could run out of minable gold in the next 20 years. Therefore, recycling has to play a larger role in the gold industry. Currently recycling accounts for approximately 25% of gold’s yearly supply. The gold standard self-regulates to match the supply of money to the need for it. That is the real advantage of returning to the gold standard. At the same time, the gold standard makes the supply of money vulnerable to the ups and downs of gold production, which is a disadvantage.

A 1% decrease in gold demand in 2019 was due to the rise of investments in ETFs (Exchange-traded funds) In 2019, gold-backed ETF reached the highest inflows in history at 438.4% compared to 2018 and demand reached 401 tonnes due to the monetary easing and investors’ geopolitical concerns.

Is there a possibility for gold to become the investors’ protector during the crises?

$1 million of gold was donated to the Solidarity Response Fund, a government backed fund run by the WHO to fight against COVID-19. In the spotlight: Political statements and COVID-19 have led to intentions to return to the gold standard.

Although gold makes up less than 1% of the investment portfolio globally, it may be positioned to become a reliable store of value. The volume of gold bought by investors has decreased with a Compound Annual Growth Rate (CAGR) of 2.4% over the last decade.

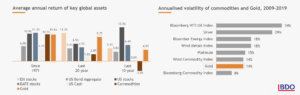

Gold has delivered positive returns over the long run, outperforming the key asset classes. Gold is one of the most effective commodity investments in terms of volatility, outperforming other metals, individual commodities and broad-based commodity indices. It is a beneficial asset during periods of uncertainty as it generates long-term positive returns. Over the last 50 years, average returns on gold reached 10.6%, outpacing the US CPI (Consumer Price Index).

During the past three decades, Gold has outperformed risk assets in nearly every single major market downturn. The gold price increased by almost 18% from December 2019 to May 2020. Some gold even saw the price of bullion breaking the record high set in 2011, when it briefly topped 1,900 USD, roughly 25% higher than current levels.

Future gold market perspectives

“The future of the gold market is shaped by technological advances, high production costs and its emotional value for people,” says Lidia Vakulenko, Principal Consultant of BDO Centers LLC.

“BDO Centers LLC is a hybrid shared service center and a boutique management consulting firm in Kyiv, a subsidiary of BDO AG in Germany, a consulting and auditing company. We develop and scale innovations across the largest and most diversified group of strategy, consulting, digital, audit, tax, and operations professionals in the world. Working as trusted advisors to our clients, we are focused on delivering value. We combine analytics with industry skills and technology in a way that is truly differentiated and delivers business outcomes. We provide a top-level service to our clients within the BDO network and worldwide to BDO customers.”

Antonovycha Street | Kyiv | Ukraine