For the past decade, the mobile phone has become one of the most integral parts of everyone’s daily life and hence – the pivotal source of delivering and gathering information. “Data is a new oil” – is a common expression for describing the modern business development paradigm. However, an immense amount of data generated by subscribers of mobile operators brings little value without the correct use of analytic techniques. For several years lifecell Ukrainian mobile operator has been accelerating data to value for its business enhancement and the digital transformation of other companies. lifecell Big Data solutions provide businesses with the right insights at the right time and contribute to improving their customer experience, operation efficiency, and fraud prevention system. The operator’s most in-demand products in Ukraine are credit and marketing scoring and numerous fraud prevention services.

Letting the numbers speak for themselves

The number of companies using Big Data-based products has grown significantly lately. In August 2021, the total amount of lifecell customers who use Big Data services increased by 82% (vs August 2020). lifecell data analytics solutions are popular among financial companies the most. The number of such customers has risen by 220% since last year. They generate more than 50% of the total lifecell revenue from data analytics.

Transforming Data into Value

lifecell has extensive expertise in building credit and marketing scoring models for businesses.

Credit scoring from a mobile operator is a considerable tool for banks and credit organizations for creditworthiness evaluation and making well-informed credit decisions. Parameters analyzed by lifecell credit scoring models:

Age of a mobile number – helps predict a potential borrower’s availability for contact and detect a fraudster. lifecell system checks how long the phone number is in use. It also spots SIM cards activated immediately before the loan request – then, there is a high probability that the borrower will not stay in touch in the future.

Telco services usage – evaluates the stability of service usage by identifying the frequency of telecom services consumption. In particular, lifecell checks the following criteria: swings in the usage pattern (e.g., this month a subscriber used mobile services – next month he did not); types of services used the most (e.g., only incoming calls or only outgoing calls or SMS, frequency of Internet usage, etc.).

Payment pattern – identifies the reliability of potential borrowers by analyzing the regularity of payments for mobile operator service packages. lifecell system checks the mobile number for payment delays and high-cost services consumption, etc.

Social circle – helps to understand whether there are connections with “preferred” or “unwanted” borrowers.

Analysis of movement – helps to predict occupation type by identifying home-work-home pattern or working in taxi or courier service as well as being imprisoned.

Other features – define model and cost of a subscriber’s mobile phone; how often a subscriber changes it; how many unique phone numbers pass through his device.

Marketing scoring helps to ensure that every interaction is relevant to a particular customer enabling businesses to provide personalized customer treatment, prevent churn and improve marketing performance. lifecell marketing scoring models focus on analyzing subscriber income and behavioral characteristics: stability of payment for telecom services, cost of services used, geolocation (e.g., how often a subscriber uses roaming, occupation type), mobile device model, the intensity of Internet traffic consumption, preferred communication channels (voice calls, messenger types), etc.

lifecell scoring models use API. The client sends the operator a mobile number – then lifecell system returns a scoring rate automatically. It is worth paying attention that there are no universal solutions: each client has its own set of parameters for scoring and different algorithms for ranking these parameters. An effective scoring model will differ even for each bank, not to mention companies from various industries.

Fighting fraud the digital way

According to the Ukrainian Interbank Payment Systems Member Association “EMA”, the average amount of losses per one unauthorized transaction after SIM card hijacking amounted to UAH 12,500 in 2020. Most often, cybercriminals manage to carry out several operations like this. In such a case, the amount of the loss exceeds hundreds of thousands of hryvnias. And these are just direct financial losses but let’s not put aside reputational consequences. These figures convince more and more Ukrainian companies to use fraud prevention services.

The portfolio of fraud prevention services lifecell provides to its customers is quite extensive:

Age of a mobile number – is very actively used by banks and financial organizations both as a part of credit scoring and as a separate antifraud service (see description above).

SIM-Counter – checks the number of SIM cards per mobile phone. The more numbers were activated with the same mobile device – the higher the possibility of fraud is. Scammers use “disposable” mobile numbers to receive loans and other financial services.

IMSI Сheck – detects SIM card replacement by checking its unique IMSI number (International mobile subscriber identity). If a SIM was replaced – then there is a high probability that a SIM hijack was carried out (i.e., SIM was reissued under a scammer’s name). It is a typical scheme among scammers who intend to access the bank accounts of another person or apply for a loan in someone else’s name. SIM hijack is widely spread in Ukraine since the majority of mobile operator subscribers remain anonymous (see the scheme details at www.lifecell.ua).

Call forwarding check – checks the number for call forwarding since a fraudster can activate it on his victims’ device so that all incoming calls forward to the fraudster’s phone number. Then the victim becomes unaware when the bank calls or sends SMS with a one-time code to confirm a transaction, and the bank does not know that it contacts a fraudster. After the fraudster’s confirmation of the bank transaction – the money goes away. This service of lifecell helps to avoid such situations.

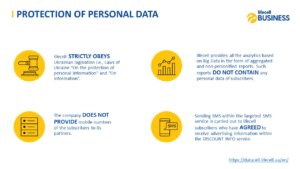

Protecting personal information

Providing data analytics services, lifecell strictly obeys Ukrainian legislation i.e., Laws of Ukraine “On the protection of personal information” and “On information”. The company provides only aggregated and non-personified data and performs any scoring by mobile number only after the prior consent of a subscriber.