Ukrainian state-owned banks are looking forward to creating a market-driven banking sector, despite a challenging year marked by the COVID-19 crisis.

That was the conclusion of a panel of financial experts and CEOs of the country’s top state-owned banks — Privatbank, Oschadbank and Ukreximbank — as well as Yurii Heletii, deputy governor of the National Bank of Ukraine (NBU), who gathered for an online discussion in the framework of the Annual Ukrainian Investment Roadshow on Dec. 8.

In Ukraine, four state-owned banks — PrivatBank, Oschadbank, Ukrgazbank and Ukreximbank — represent over 54% of the sector, which is an issue for competition on the market.

The CEOs of Privatbank, Oschadbank and Ukreximbank said they are preparing their banks for new investors, but the state has not given strong signs of decreasing its shares yet.

On behalf of the NBU, Heletii praised the government strategy adopted in September to decrease the state’s presence on the market and said the central bank would veto the initiative of state postal operator Ukrposhta to become a state-owned bank.

“We want less state banks,” he said. “The question is how soon the government will decrease its presence, but we do not see a strong implementation of this strategy yet.”

Decreasing state presence

Heletii said he believes state-owned banks have to operate in a market environment and the bank’s decisions should be made without political interference.

“I believe independence in corporate governance is crucial,” he said.

Sergii Naumov, the chairman of the board of Oschadbank, concurred with Heletii. He said the majority of banks should be privatized and the amount of shares owned by the state should decrease to attract investors to Ukraine’s banking sector.

Naumov said his bank will be ready to find investors by 2025.

However, decreasing state shares should go hand in hand with the development of commercial products for small and medium enterprises, retail businesses and private corporate clients.

“We should reduce the shares of the state and increase the parts of the private sector,” he said.

In order to attract investors, a bank should be efficient, ready to attract new capital, and also be self-sufficient, Naumov said. Heletii echoed that statement.

“Banks have to be self-sufficient and profitable enough,” he said.

Digitalization

In 2020, the most profitable bank was PrivatBank, with a total asset of Hr 22.2 billion ($791.1 million) as of October 2020 including Hr 1.78 billion ($63.4 million) in growth since last year.

According to Petr Krumphanzl, chairman of PrivatBank’s management board, the success is due to the bank’s strategy to focus on digitalization and quick services.

Krumphanzl said digitalization is the “bread and butter” of the bank, which is considered to be the leader of the digital banking market. In his view, going fully digital attracts investors. That is why Privatbank keeps developing such tools for the private sector and especially small and medium-sized enterprises, he said.

Krumphanzl said the bank’s clients use it as a platform for making and accepting payments and cited the successful example of cashless point of sales terminals, used to pay by card. The bank aims to develop mini-terminals for courier delivery.

“The most important (thing) is the speed,” he said.

Such a key sector requires constant upgrades and new products developed fast, Krumphanzl said, which is the reason he could not forecast the bank’s strategy for 2021 beyond following market trends.

Digital banking puts the Ukrainian banking system at the forefront of digital transformation, Heletii added, making Ukraine the 4th country in the world in terms of contactless payments.

In 2020, card-to-card payments accounted for 42% of transactions and 55% of payments were cashless in September, according to data from the NBU.

Such services also help with market analysis and allow for money to be lent faster to small and medium-sized businesses, Krumphanz said.

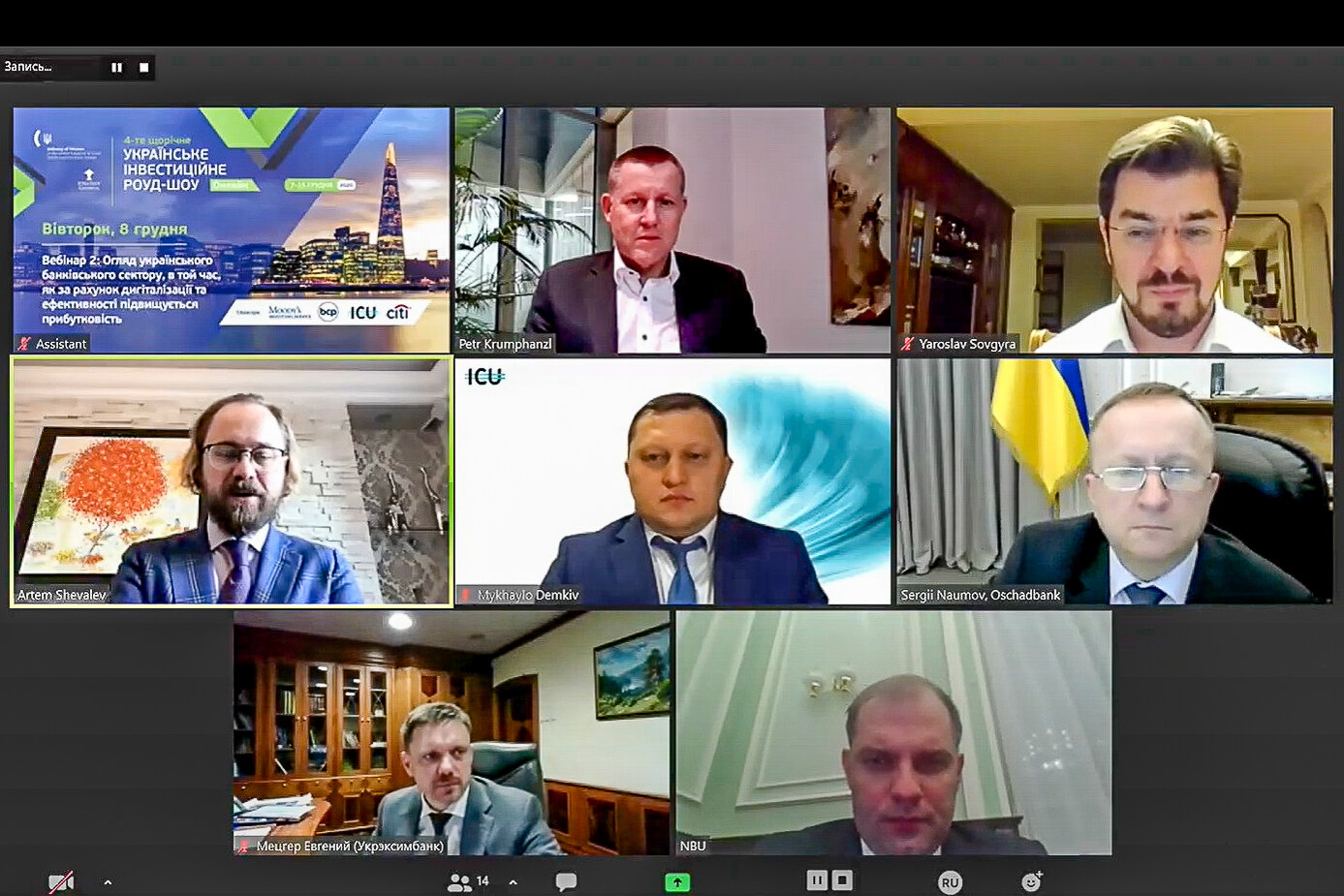

Petr Krumphanzl, chairman of the management board of PrivatBank (top C), Yaroslav Sovgyra, associate managing director at Moody’s (top R), Artem Shevalev, member of the board of directors of the European Bank for Reconstruction and Development (L), Mykhaylo Demkiv, financial analyst for ICU Ventures (C), Sergii Naumov, chairman of the board of Oschadbank (R), Ievgen Metsger, chairman of the management board of Ukreximbank (bottom L) and Yurii Heletii, deputy governor of the National Bank of Ukraine (bottom R) discussed the future of state-owned banks in the framework of the ‘4th annual Ukrainian Investment Roadshow’ on Dec. 8. (Courtesy)

Small and medium enterprises

Naumov agreed that speed is of the essence, insisting that increasing the share of small and medium-sized businesses in Oschadbank’s portfolio should happen fast, but it can only happen if the state’s shares decrease in parallel with a private-sector oriented policy.

“It should be balanced,” he said.

Small and medium-sized enterprises are worth Hr 5.8 billion ($206.7 million) of Naunov’s bank’s portfolio, but he admitted it is too small.

“For our country, it is not enough,” he said, adding that the bank had been working on creating a network of small and medium-sized enterprises for the past four years.

Ievgen Metsger, chairman of the management board at Ukreximbank, concurred that opening up to small business is a key factor to attract investors.

Ukreximbank participates in the so-called “affordable loans at 5-7-9%” program, which offers loans at interest rates of 5,7 and 9% to the tune of Hr 1.5 million ($53,500) to be repaid over five years. Oschadbank also takes part in the program.

Ukreximbank is eager to launch new projects for small and medium-sized businesses, but Metsger acknowledged the need for better communication with the government.

“We need better cooperation with the Cabinet of Ministers to reinforce (the) participation of the industry,” he said.

Non-performing loans and rule of law

Another issue Metsger is working out with the Cabinet of Ministers is the reduction of bad loans on the market. Government banks account for almost three-quarters of total non-performing loans (NPLs) in the country.

In 2020, state banks started to get rid of their massive volume of NPLs, thanks to new guidelines approved by the Cabinet of Ministers in April.

Reducing NPLs is also one of the International Monetary Fund’s major demands of Ukraine and an issue for the NBU too, Heletii said.

Naumov said that banks have the option of writing off large toxic debts, but they often face difficult adversaries, he said.

“It is often very difficult to fine bad borrowers in court,” he said. “And the judicial system should be improved.”

Metsger disagreed. He said Ukreximbank would continue to work with difficult borrowers if the government gives the state bank a good framework to sell debts before assets become toxic.

However, to resolve this issue, Ukraine needs to deal with its corrupt courts, in turmoil this year after the Constitutional Court undermined the country’s anti-corruption infrastructure, sparking an ongoing constitutional crisis.

According to Yaroslav Sovgyra, associate managing director at the rating agency Moody’s, one of the rating indicators is the rule of law, which he said was “disappointing” in Ukraine.

“We don’t see a functioning system yet and it is disappointing,” he said.

On this subject, Artem Shevalev, member of the board of directors at the European Bank for Reconstruction and Development, who moderated the discussion, concluded that the government paying off NPLs should not give the borrowers a feeling of impunity.

“If the rule of law is not fully applied, the resolution of NPLs will only be partially effective,” he said.