In a bid to unlock Ukraine’s $17.5 billion loan program from the International Monetary Fund, the government has started selling its stakes in electricity distribution companies.

The stakes, however, are likely to be bought by the country’s oligarchs, leaving the energy utility sector entirely under their control.

In mid-August, the State Property Fund sold 25 percent stakes in five regional companies — Donetskoblenergo, Dniproenergo, Dniprooblenergo, Zahidenergo, and Kyivenergo — which supply electric power and heating to citizens of Kyiv, Lviv and eastern Ukraine. Stakes in three more companies failed to sell.

All five lots were bought out for Hr 3.5 billion ($132 million) by the Cyprus-registered Ornex Limited, which belongs to Rinat Akhmetov’s System Capital Management holding. The oligarch’s DTEK Holding had already held the majority stakes in those companies.

Yuriy Nikitin, deputy head of the State Property Fund, called the minority stakes “donut holes” that neither brought any dividends to the state nor gave it decision-making power in corporate affairs. By selling off the stakes, the government was happy to get rid of illiquid assets, earn some cash and please the IMF.

The World Bank, however, expressed concern with the lack of transparency in the sales.

“The August sales (…) didn’t provide confidence to the market players and international investors that the privatization is going to proceed the way they expected,” Satu Kahkonen, the World Bank’s country director for Ukraine, Belarus and Moldova, told the Kyiv Post on Oct. 3.

Public organizations, such as the Federation of Trade Unions of Ukraine, protested against the complete acquisition of regional energy distribution companies, or oblenergos, by private companies, fearing increases in electricity tariffs.

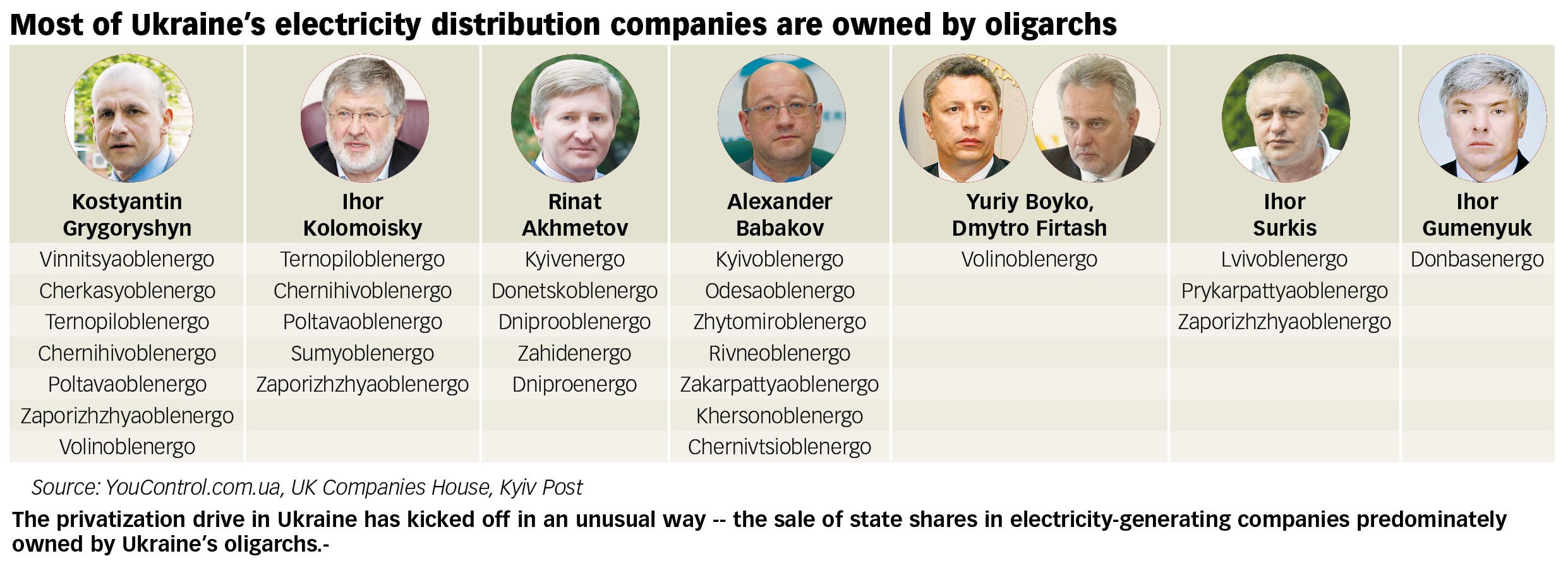

At the moment, the market of 26 electricity distribution companies is divided between the government and companies affiliated with the oligarchs Ihor Kolomoisky, Yuriy Boyko, Rinat Akhmetov, Ihor Surkis, Kostyantin Grygoryshyn and Alexander Babakov.

Nikitin doesn’t see there being a problem. “The government finally began to sell illiquid — from the corporate governance point of view — assets. The goal wasn’t to attract new investors, and we understood that the minority stakes would be mainly interesting to the majority stakeholders,” he said on Oct. 4.

Nikitin admitted that the privatizations happened quickly because of budget and IMF considerations. Privatization of state-owned enterprises is one of the key requirements of the international lender.

“Except for those five minority packages, we didn’t have any other items that could have been put up for sale immediately,” Nikitin said.

In mid-November, the fund will try again to sell 25 percent stakes in the three oblenergos that didn’t attract any bidders at the August auction. It’s not clear who the potential buyers might be.

The government has banned Russian firms and citizens from taking part in privatizations. The majority stakeholder of Odesaoblenergo is VS Energy, which belongs to Russian oligarch Evgeniy Giner and member of the Russian parliament Alexander Babakov. The majority stakeholders of Sumyoblenergo are two Cyprus companies owned by oligarchs Grygoryshyn, a citizen of Russia, and Kolomoisky.

The value of Donbasenergo, majority owned by Netherlands-registered Energoinvest Holding B. V., has dropped since it lost control over its main asset, Starobeshivska thermal power plant, situated in the Russian-occupied Donetsk Oblast. Energoinvest is owned by Whitebridge Resources Limited, which is owned by Igor Gumenyuk, a business ally of oligarch Rinat Akhmetov.

There are hopes that the introduction of RAB (regulatory asset based) tariffs from April 2018 will encourage investment in the electrical power sector. According to the initiator, the National Commission for State Regulation of Energy and Public Utilities, the consumer tariffs for oblenergos will include operational costs for modernization. Effectively, the more a company invests into its assets, the more profits it will make. The Cabinet of Ministers called the scheme “unfair” and “non-transparent.”

For 2018, the State Property Fund designated for priority privatization a 78 percent stake at Centerenergo and state-owned majority stakes in six regional electricity distribution companies.

The fund hired an independent adviser, the consortium of EY, Baker McKenzie and SARS consulting firms, to help with the sale of the stake in Centerenergo. The auction is expected to take place in May. The same procedure will be used for the six oblenergos.