Out of 20 airports in Ukraine, 12 are falling apart. That’s how aviation experts put it.

The awful state of the local airports, along with high taxes on aviation fuel, is the reason why few people travel by air domestically in Ukraine.

In contrast with the widespread railway network that connects 80–90% of cities in Ukraine, domestic air routes are nowhere near as developed, while the tickets are more expensive.

Olga Tovkes, general director of Master-Avia that manages Ihor Sikorsky Kyiv International Airport (Zhuliany), said it’s a vicious circle: ticket prices will go down when there is greater demand, while the demand will go up if the tickets are cheaper.

Tovkes believes that a bigger passenger flow can be achieved when “the quality of life improves” throughout the country and the locals start to earn more. In 2019, less than 3% of the population used air transport to get to another Ukrainian city, according to the Ukrainian Institute for the Future.

Yevgen Treskunov, founding partner of Aviaplan, an independent aviation consultancy, has built a formula for cheaper domestic airfares in Ukraine, and the key steps are reconstruction, making aviation fuel cheaper for airlines and abolishing the value-added tax on domestic air tickets like the European Union countries did.

Rail vs. air

In a country with a population of 40 million, airlines served 390,200 domestic air travelers during the first eight months of 2020, according to the State Aviation Administration of Ukraine.

Meanwhile, Ukraine’s railroad monopoly Ukrzaliznytsia transported 11.8 million passengers within the country during a similar time frame, the Ministry of Infrastructure reported.

Domestic flights can’t compete with the well-developed railway system in the country unless they become more affordable by overcoming the obstacles to cheaper airfare throughout the country, aviation expert Kyryl Novikov said.

Yevhen Khainatsky, CEO of new low-cost carrier Bees Airline, admitted in April that domestic flights are currently unprofitable for all airlines. He estimated the average domestic airfare to be between $55 to $66, while Novikov calculated train tickets to be about three times cheaper.

Many regional airports need to repair their runways to serve more aircraft types and contribute to the development of the local airline industry. However, regional airports struggle to find investors who would be willing to finance their reconstruction projects. (Kostyantyn Chernichkin)

Outdated infrastructure

Most runways in Ukraine were built more than 30 years ago, specifically for Soviet aircraft, which put a lot less pressure on the ground when they land in comparison to the common types of aircraft used by low-cost carriers — Airbus and Boeing.

Treskunov said that the pavement needs to be either replaced or strengthened to meet today’s standards, but runways are “the most complicated part of the airport” and finding investors for reconstruction is very difficult, especially for airports with less than 1–2 million passengers a year.

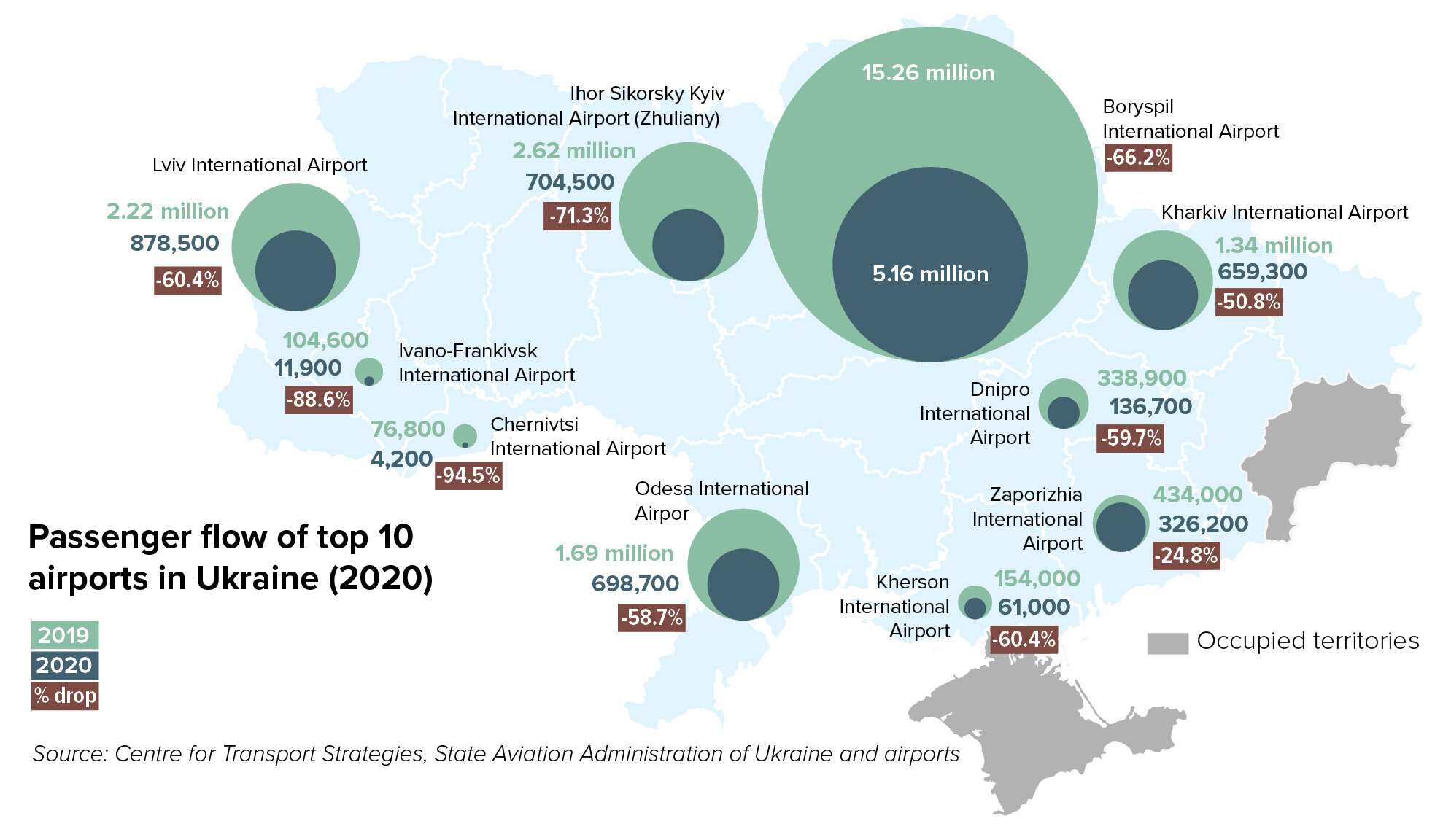

Ukraine’s aviation market is heavily focused on the two airports in Kyiv — Zhuliany and Kyiv Boryspil International Airport, while the development of regional airports lags behind, according to Treskunov. In 2020, the two Kyiv’s airports served 68% of the total air traffic in the country, the Center for Transport Strategies reported.

Ukraine’s aviation market is heavily focused on two airports in Kyiv — Zhuliany and Boryspil. In 2020, the two airports served 68% of the total air traffic in the country.

The reconstruction of runways at regional airports needs to be completed first because the airport would otherwise “become invisible for airlines,” which would discourage investors from pouring their money into other infrastructure such as passenger terminals, the expert said.

While investors can usually get a return on airport terminals within 10–15 years, runways are expensive with a longer repayment period and don’t generate as much revenue, according to Treskunov.

The aviation consultant explained that even banks are less willing to credit the development of runways because terminals are just “more commercially attractive,” so the government needs to step up and help regional airports.

Former Infrastructure Minister Vladislav Krikliy stated last year that the ministry will continue working to modernize regional airports — about $90 million has been allocated from the state budget.

Treskunov said that Airbus A320 and Boeing 737 next generation families, both of which are widely used today, have some of the lowest costs per seat. But in most regional airports, they are restricted by frequency or total loaded weight or cannot be serviced at all since the pavement is not strong enough to bear their weight of the aircraft.

Though runways are “not attractive for investment,” they are the key to air connectivity, he said.

“Low-cost carriers are very important to attract because they are the best developers of traffic,” Treskunov told the Kyiv Post.

Only five airports in Ukraine have the infrastructure to accommodate the world’s most popular commercial jet airliners — Airbus 320 family and Boeing 737 Max and Next Generation — without any restrictions. They are: Kyiv Boryspil International Airport, Lviv Danylo Halytskyi International Airport, Kharkiv International Airport, International Airport Zaporizhia and Odesa

International Airport, according to Treskunov.

Monopoly oil market

Ukraine has had the most expensive aviation fuel price in Europe for many years. Fuel eats up 35% of airlines’ total expenditure, according to Novikov.

Treskunov blames the “monopoly of local jet fuel producers combined with high import taxes” for the overpriced aviation oil. He explained that a majority of the airports in Ukraine get fuel from the Kremenchuk oil refinery plant, one of the largest producers of oil products in the country.

“Monopoly always restrains the development of the market and keeps prices high,” Treskunov said.

The tax to import aviation fuel or even crude oil for production is high, and it is more profitable for retailers to sell petroleum for cars than for aircraft, according to Treskunov. He elaborated that the cost of transporting oil products via railway is also expensive, and Kremenchuk, located in central Ukraine, is too far from most airports.

In order to weaken the monopoly, Treskunov advises creating incentives to attract big international players selling ready-made fuel or oil, or developing a second jet fuel plant in the country.

“Competition drives the economy and reduces prices,” he said.

Eliminating VAT

While Treskunov estimates lowering aviation fuel prices at least to the level of the European market will make tickets for domestic flights 15–20% cheaper, getting rid of the value-added tax (VAT) will reduce prices by another 20%.

“Only these two factors can decrease the cost of the tickets by 30–40%,” he said.

Despite years of promises to abolish VAT on domestic air transportation, the government began moving in that direction just recently. Meanwhile, international transportation of goods, passengers and their luggage is tax-exempt.

Prime Minister Denys Shmyhal said during a meeting in April that the Cabinet of Ministers will develop a bill for a zero-VAT rate on domestic flights by summer to reduce ticket costs and revive tourism in the country.

The press service of Ukraine International Airlines told the Kyiv Post that the abolition of VAT for flight operations within the country would help the company attract customers who always travel by train.

But the airline will only consider lowering domestic airfares if the zero VAT rate applies to all goods and services such as fuel, handling and catering.

If airlines are able to make domestic flights cheaper, it would improve the mobility of the population and increase business productivity. When domestic airfares become more affordable, railway operators will realize that they now have a new competitor and improve their service, according to Novikov.

“It will force everybody to keep developing and offer better services,” he said.