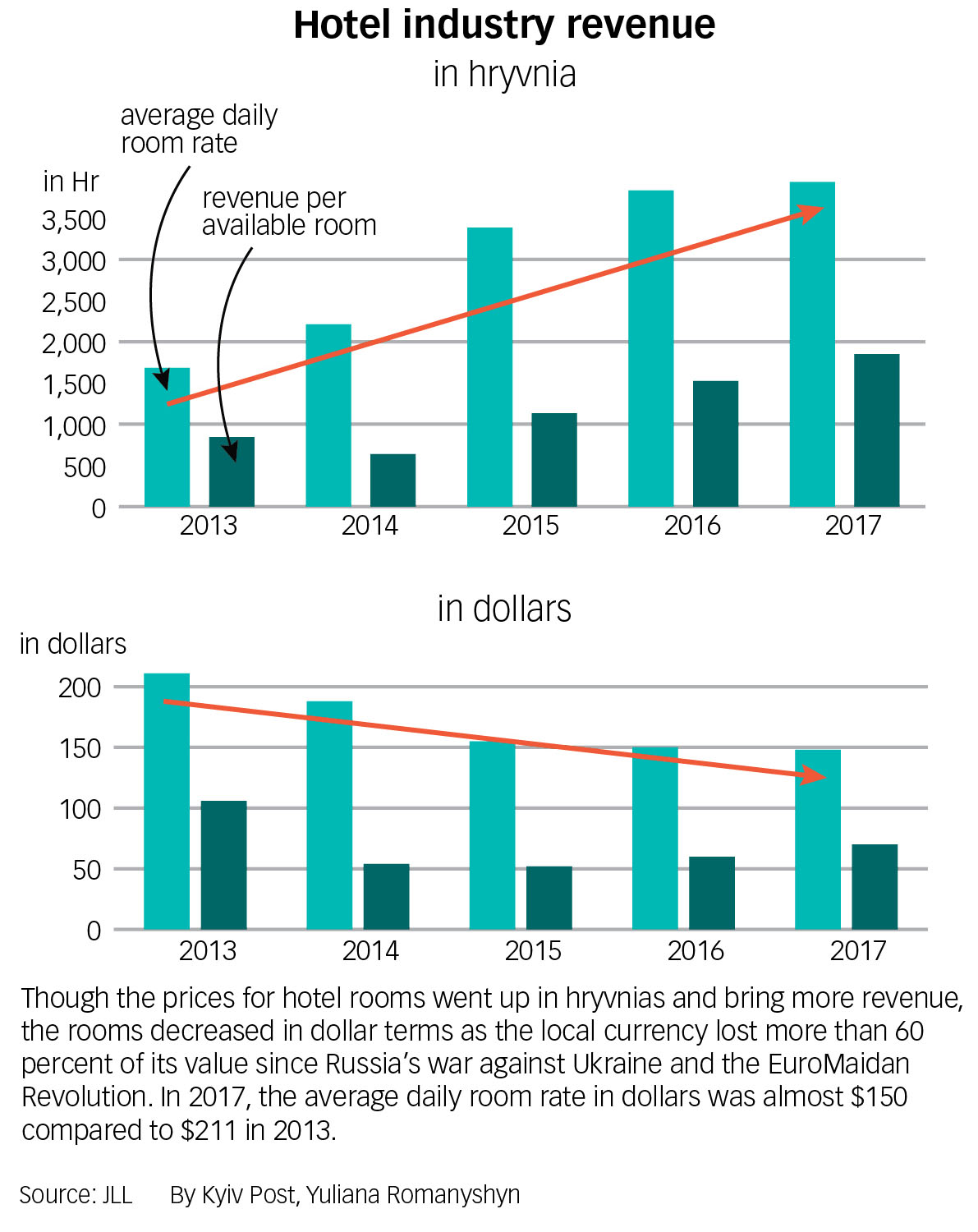

Kyiv is no Rome or Paris when it comes to attracting tourists, but it could be someday. One reason is its cheap local currency, numerous conferences, exhibitions, sport events and concerts. Another sign of health is the rebounding of Ukraine’s hotel industry, from the recession, revolution and war-marred dar days of 2013 and 2014.

Tatiana Veller, head of JLL commercial real estate services, says that the hotel occupancy rate in Ukraine went to 47.3 percent in 2017, an increase of 7.4 percentage points. “This is the highest positive dynamic in the past five years. And Boryspil International Airport reported an increase in passenger flow by 17 percent, which is over 10 million arrivals,” Veller told the Kyiv Post.

“In 2017, the total number of tourists visiting Kyiv amounted to about 2.3 million people and has increased by 29 percent compared to the previous year.

Local aspects

Vytautas Budreika from Lithuania comes to Ukraine for work up to three times a year since 2014. He recalls staying in a hotel for less than $2 a night, although the accommodation wasn’t very good. He says that, in general, everything is cheaper in Ukraine.

“For example, Ibis Hotel in Kyiv is more on the budget side,” Budreika says. “Still, it is cheaper than in Poland and offers the same good quality.”

Budreika traveled to many cities all over Ukraine. Some of the hotels he stayed in were not so good, whereas others were pretty cheap and with good services.

And although Kyiv remains as the most popular tourist destination in Ukraine, the hotel industry is improving in regional cities, driven by the desire of travelers to see new places.

Tourist breakdown

Approximately 52.6 percent of foreign tourists come from Europe, 32.5 percent from Asia and 8.2 percent from the United States.

More than 70 percent of tourists are men.

“The two outposts that are notable right now and that attract a lot of attention and investment are Lviv and Odesa,” Veller says.

Western Ukraine’s Lviv has a robust market as it is closely located to the Polish border and perceived as a safe destination in Ukraine.

“The city has highly attractive well-preserved historical quarters, friendly locals, a great restaurant scene, and a multitude of festivals and events,” Veller says.

Lviv hotels are running very high occupancies, up to 70 percent year round, and generally have lower prices. For example, the average price for its luxury hotels is $150 per day.

By contrast, Ukraine’s southern Black Sea port city of Odesa runs on extremely high prices during its May-October high season. “Since this is the sea destination of choice in Ukraine right now, the attention is quite focused here,” Veller says.

Yet Rostislav Levinzon, head of Quinn Properties Ukraine, a real estate firm, says that room occupancy is not the only measure of a hotel’s financial health.

Luxury hotels, in particular, profit by social events, such as business and information technology conferences. But it’s possible only in cities with a dynamic business environment.

“No matter what, there are many conferences going on in Kyiv throughout the year,” Levinzon says.

“So as in Lviv and Kharkiv where the IT community is very strong.”

Ukraine’s Synevyrska Polyana village in Zakarpattia Oblast attracts tourists because of its picturesque mountains and lake. Western Ukraine is a popular destination for locals. (UNIAN) (Courtesy)

Ukraine also needs to do more to become a weekend destination like Budapest or Prague. Businesspeople on work trips still dominate in Kyiv, Odesa or Lviv.

Dennis Spitra, head of business development at STR Global Europe, says that during the weekends, the occupancy in Kyiv hotels is 10–20 percent lower than weekdays. N

ew hotels in big cities The market is also growing as internationally branded hotels expand their presence in Ukraine.

Three examples: the 196-room four-star Park Inn by Radisson Kyiv Troyitska, next to Olympic Stadium; the four-star Mercure Kyiv Congress, with 160 rooms, with a $75–170 price range; and the three-star Ibis Kyiv Railway Station, for 212 rooms, with a $64 — $85 price range.

Odesa has been showing notable results as well: it opened its Marlin four-star business hotel as well as the De Versal three-star hotel with a $40-$115 price range. It is also planning to open a Radisson Blu.

Lviv’s Dolynskiy three-star hotel opened in 2017 with a $25-$35 price range. Another Ukrainian city is starting to attract new hotels as well.

Kharkiv, the second largest city in Ukraine, opened a four-star Miraks hotel with a $35-$100 price range. The city isn’t popular among tourists but it has a strong IT component and a growing business community.

According to Kyiv City Administration’s development strategy, the total number of tourists should amount 2.6 million people annually until 2025.

Even Russia’s war in Ukraine, contained mainly to the eastern Donbas, is not keeping people away. “In 2014 when I told my Lithuanian friends I am going to Ukraine, they were worried for me, but now most of them have been to Ukraine too and it is pretty common now to go to Ukraine for a vacation,” Budreika says. “The country is very big, and only a very small part of it may be dangerous.”

Foreigners ride a tour bus in front of the Aloft hotel in Kyiv in April 2017. The four-star hotel has 312 rooms and is expected to launch in May, according to Colliers International’s Ukraine branch.(Volodymyr Petrov)