Ukrainian officials risk losing $3.65 billion in Chinese loans targeted for Ukraine’s energy sector, with Economy Minister Stepan Kubiv arranging last-ditch meetings to save the deal while on a trip to Beijing.

The credit line — initially agreed in 2012 under President Viktor Yanukovych for coal gasification projects — is being offered by the state-owned China Development Bank. But the agreement has languished since the EuroMaidan Revolution that drove Yanukovych from power on Feb. 22, 2014.

While the state-owned energy giant Naftogaz has proposed projects for the money, government ministries have failed to approve them, one of the loan conditions. Kubiv will meet with officials from the Chinese state bank at a conference in Beijing next week in a bid to make a June proposal deadline for the cash.

The meeting follows warnings from the Ukrainian Embassy in Beijing. One letter from Ukrainian Ambassador to China Oleh Dyomin to Kubiv warned that losing the loan would “negatively impact the entire spectrum of Ukraine-China cooperation on investment.”

Naftogaz blames various government ministries for the debacle.

“Naftogaz has done as much as it could,” said Andriy Suprun, head of Naftogaz subsidiary Vuglesintezgaz, which is overseeing the projects. “It’s not only an economic issue — it’s an issue of building a long-term relationship.”

The money would allow Ukraine to update its gas and coal energy infrastructure, potentially saving hundreds of millions of cubic meters of gas annually worth billions of dollars.

China would gain rights to sell construction materials for the new energy plants and possibly strike profit-sharing agreements for exporting gas to Europe.

Dzerkalo Tyzhnya first reported on the delay in January 2016. After the deadline was extended in December, Reuters wrote about the issue in April.

Loan agreement

In 2012, Ukraine signed the loan agreement with the China Development Bank on coal gasification projects in Yanukovych’s Donbas political base.

“Coal gasification is a Chinese technology,” said Gennadiy Kobal, director of energy consultancy ExPro. “They wanted to sell equipment for the project and export the technology.”

The agreement created a Naftogaz subsidiary called Vuglesintezgaz to oversee how Ukraine would use the cash.

The agreement was discarded in part due to Kyiv’s loss of control over parts of the Donbas because of the war Russia launched in 2014.

The Chinese government kept the loan available, but on four conditions: that the money be used for energy-related projects, that it be guaranteed by the Ukrainian government, that Naftogaz be the borrower, and that Chinese companies supply 60 percent of the project’s needs.

“It took quite a lot for the government, for the ministries, for Naftogaz, for myself, to realize what this loan agreement is, how can we use it,” Suprun said.

Four projects have been submitted. They include two new coal power plants in Kyiv, one new coal plant in Lviv, the modernization of state-owned gas extractor Ukrgazvydobuvannya’s drill fleet, and the outfitting of Ukrainian apartment complexes with new boilers.

The Kyiv projects would substitute 600 million cubic meters of natural gas annually with coal, Suprun said, while the Ukrgazvydobuvannya refitting would increase the company’s drilling capacity by 45 billion cubic meters over the equipment’s 15-year life cycle, according to a rough estimate from Naftogaz.

Internal pressure

Suprun said that Naftogaz submitted proposals for the projects to the ministries of economy and finance for approval in 2016, but that none have signed off on them.

Chinese officials extended the December 2016 deadline by one year, Suprun said, adding that the applications for projects under the loan need to be submitted by June 2017.

Suprun said that he hoped Kubiv’s visit to Beijing next week would accelerate approving the proposals.

Internal pressure may also be playing a motivating role.

Dyomin, the Ukrainian ambassador to China, warned Kyiv through a series of letters in 2016 that the country may lose the credit.

“A lot of time and effort has been spent on supporting these projects from the Chinese Ministries of Commerce and Foreign affairs,” Dyomin wrote in a May 2016 missive to Kubiv. “Politically, dismantling the energy project cooperation that we have begun would negatively impact the entire spectrum of Ukraine-China cooperation on investment.”

Spokespeople for the ministries of economy, energy, and foreign affairs did not reply to requests for comment.

Who profits?

It’s not clear whether the proposals have been delayed due to pressure from vested interests or administrative incompetence.

In March, the General Prosecutor’s Office opened a criminal investigation into Suprun for “criminal negligence” over the delays. The Vuglesintezgaz director denies wrongdoing.

DTEK, the energy firm owned by billionaire oligarch Rinat Akhmetov’s System Capital Management, has a lease through Kyivenergo on one the Kyiv power plants that would be replaced under the loan — TETs‑6.

One document reviewed by the Kyiv Post showed that Kyivenergo has recently refused to grant Naftogaz surveyors access to the TETs‑6 site.

Kyivenergo did not reply to a reqeuest for comment.

At the same time, replacing a gas power plant with coal could be a serious boon for DTEK’s coal supply business.

“Coal is a tradeable commodity, if the situation were not good, the project could burn coal from Poland no problem. Poland’s coal — we’ve examined it, and it’s perfectly suitable,” said Suprun.

“For the government and local producers, which is DTEK, it should be in their interests to be the supplier. They could bid for that,” he added.

A DTEK spokesman said the company was unaware of the project.

Yulia Ulasik, director of the Center for Contemporary China, argued that other failed China-funded projects — like the proposed express train between Boryspil Airport and Kyiv and a grain loan program — had become sore spots.

“At the level of the government, it’s not ready to take on something else again that it’s not prepared to fulfill,” Ulasik said.

Kobal, the energy consultant, said that Naftogaz’s proposals are “very distant from the kind of work that Naftogaz usually does. It seems like they’re already far from synthetic natural gas and are just trying to find some replacement.”

Hedging bets

The case may cause Chinese investors to shy even more away from Ukraine. “For them, it’s an issue of losing face,” said Andrey Goncharuk, a board member of the Ukrainian Association of Sinologists.

In spite of the delays, however, the Chinese government appears to be positioning itself for a longer stay both in Ukraine’s energy market and for Ukrainian investment more broadly.

The state-owned China National Building Material’s Ukraine office has announced several plans, including a project that would turn part of the Chornobyl exclusion zone into a large solar farm.

The Chinese investment consortium Bohai Commodity Exchange also bought a former state bank in a November privatization auction from the State Property Fund for 3 million euros.

Goncharuk, the China expert, said that the bank’s name — “Ukrainian Bank for Reconstruction and Development” — is no accident.

‘“They now have their own bank in Ukraine with which to finance projects that interest them,” he said. “They bought a signboard.”

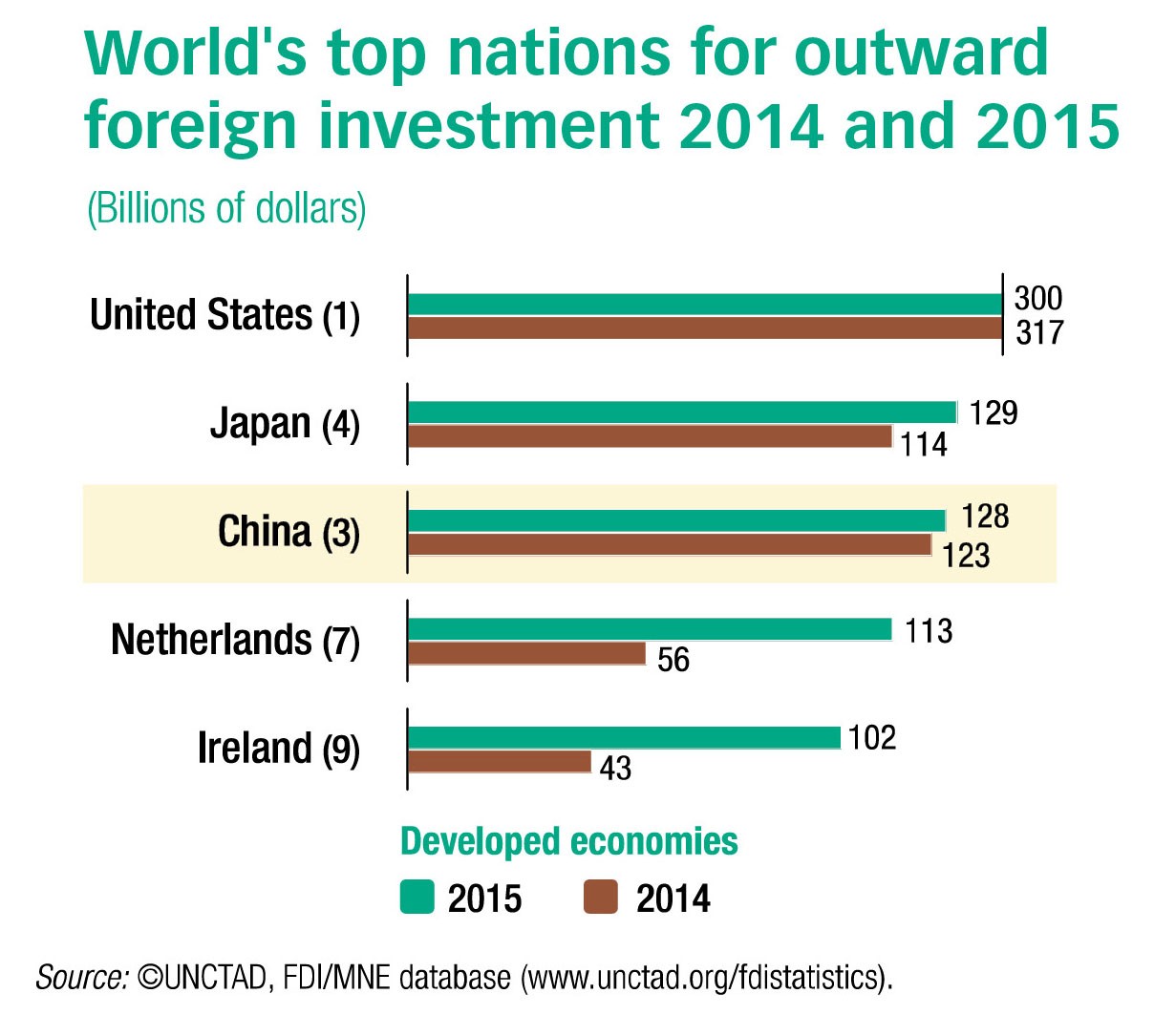

China kept its place as the world’s third biggest international investor from 2014 to 2015, trailing only Japan and the United States. China could become the top outward investor in coming years as Beijing puts up tens of billions of dollars in financing for infrastructure projects in connection with its “One Belt, One Road” initiative to increase its global presence. Among other aims of the political project is expansion of trade routes to help Chinese goods get to Europe.