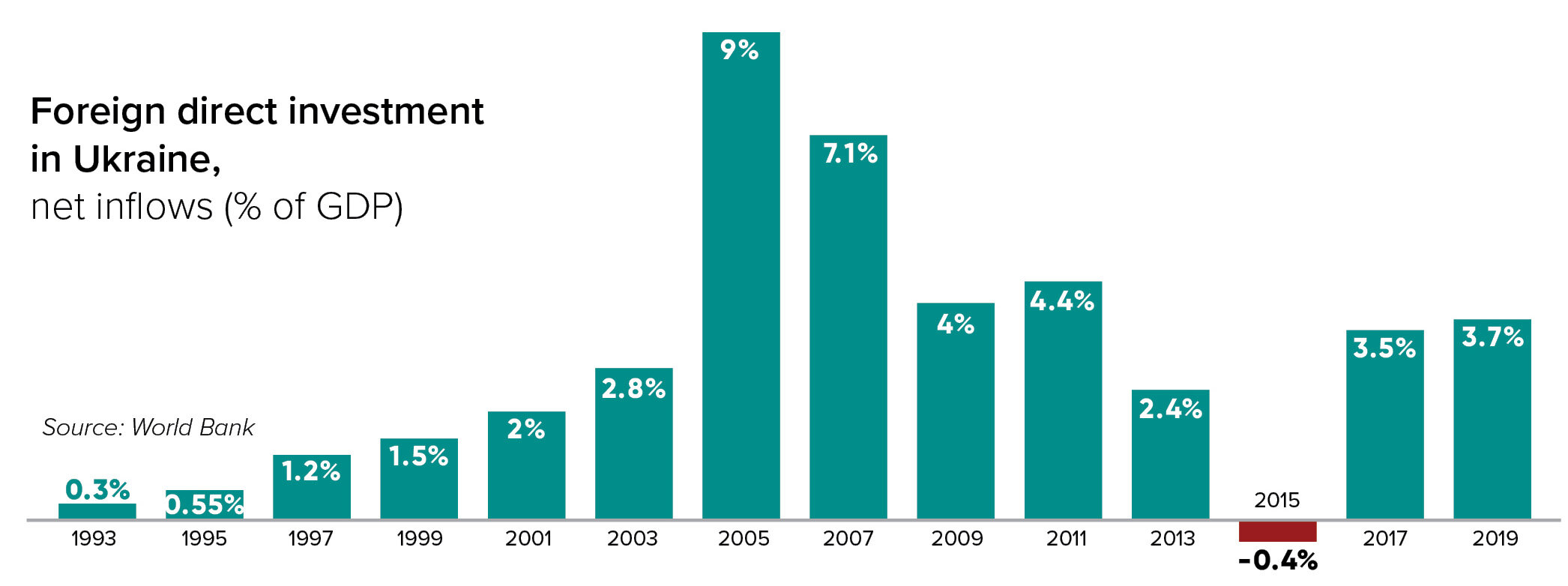

Ukraine’s foreign direct investment, which was never strong, went into negative territory in 2020, with a net outflow of $950 million.

But this didn’t sway the country from its optimistic goal to attract $15 billion in annual FDI by 2025.

Serhiy Fursa, a Kyiv-based investment analyst from Dragon Capital, said Ukraine needs more investment so its economy can catch up with its neighbors such as Poland, but capital spending by both the local people and foreigners is still “very low.”

And the government’s ambitious plan to attract more foreign investors, Fursa said, is “not realistic” because the country lacks a rule of law. Comprehensive judicial reform is needed.

The lack of trust in the judiciary, widespread corruption, and oligarchs’ market monopolies and state capture are among the top obstacles that discourage foreign investment in Ukraine, according to a survey conducted by the European Business Administration, Dragon Capital and the Center for Economic Strategy in November 2020.

Ukraine’s judicial independence ranked 105th out of 141 countries while also placing 104th out of 141 countries in terms of transparency. Russia’s war in the eastern Donbas also drives away potential investors, experts say.

Most countries suffered recessions in 2020 as a result of the coronavirus pandemic. Global foreign direct investment fell by 42% to an estimated $859 billion. But the low prospects of a rebound for developing countries like Ukraine remain “a major concern,” the United Nations Conference on Trade and Development reported in January.

Ukraine saw more inbound than outbound foreign direct investment in 2019. But the situation changed in 2020: FDI went into negative territory, with a net outflow of $950 million.

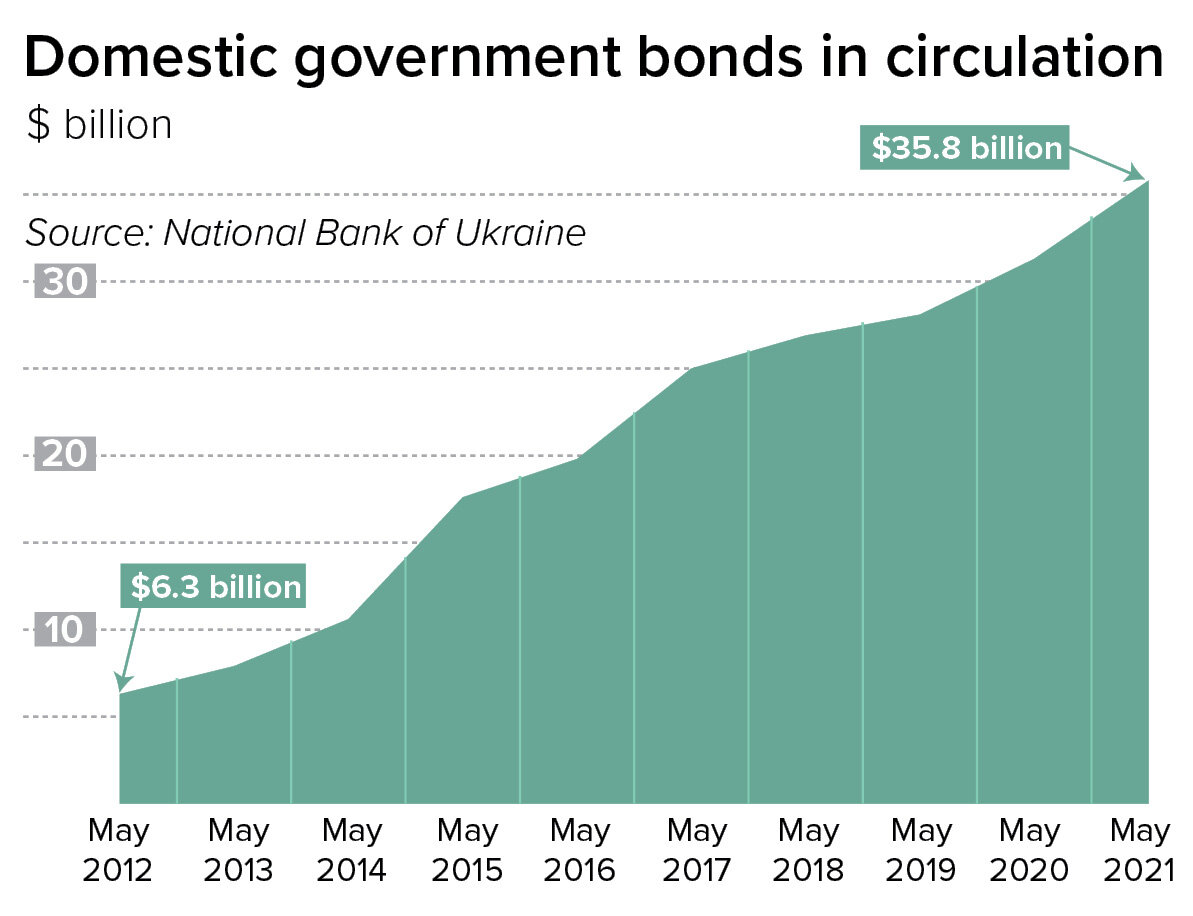

Without foreign investors, Ukrainians will have to shoulder the burden. Fursa said they will start investing more as earnings rise. The most popular investment destinations in Ukraine are domestic government bonds and real estate, although large amounts of money are sitting in bank deposits.

Domestic government bonds are available to both Ukrainian and foreign investors at a wide range of prices. The starting price is Hr 1,000 (around $36), and Fursa sees it as the most accessible, reliable investment option.

The yield for domestic government hryvnia bonds ranges from 8–12% and from 3–4% for dollar bonds, according to the expert. Ukraine’s income tax of 19.5% does not apply to capital gains from debt securities.

As of April 28, the state owes a total of Hr 1 trillion (around $36 billion) to domestic government bondholders, according to the National Bank of Ukraine.

More people now turn to government bonds that are reliable and don’t come with a 19.5% tax that Ukrainians have to pay for the income from deposits, corporate bonds and shares.

Real estate, which has been “traditionally popular among Ukrainians,” is another common investment destination, Fursa said. The yield of an asset turned into a rental property can be up to 10% in central Kyiv or even higher if the property value increases over time.

Mykhaylo Demkiv, a financial analyst at Investment Capital Ukraine, said that “real estate is not a transparent market because most payments are made in cash to avoid paying tax,” and therefore it is difficult to tell how much money is made in this sector.

But Demkiv pointed out that more people began growing their savings in 2020. Ukrainians spent $4.5 billion in the pandemic year, half as much as they spent in 2019, according to the analyst. He explained that this is because fewer people traveled and public places such as restaurants and shops stayed closed for several months during the lockdown.

Placing money into banking institutions for safekeeping has been the most popular investment option among locals, which led bank deposits in Ukraine to grow by 25% last year, according to Fursa. The interest rate is usually around 8%.

In March, deposits by companies and households reached $49 billion, according to the NBU.

Successful reforms “can potentially accelerate growth and boost private investments across the economy,” said Jason Pellmar, International Finance Corporation regional manager for Ukraine, Belarus and Moldova.

Pellmar pointed out that Ukraine’s partnership with the International Monetary Fund will be important not only for macroeconomic stability but as “an indicator for potential investors interested in Ukraine. A swift and sustainable recovery of the country will depend on the current state-led reform agenda.”