Ukraine’s truck market, which took a hit four years ago during the country’s economic crisis, is now rolling toward recovery, experts say, with sales finally nearing pre-crisis levels.

But although trucking is on the upswing, demand has evolved, with transportation businesses making more strategic decisions about their assets and investments.

Meanwhile, bad infrastructure and a worn and pitted road network have made it difficult for Ukraine’s transport sector to fully lift itself out of the rut.

In 2011, Ukraine’s truck sales reached 5,000 per year, according to AutoConsulting informational and analytical group.

Then came Russia’s war against Ukraine in the wake of the EuroMaidan Revolution that on Feb. 22, 2014 ousted President Viktor Yanukovych, whose inner circle stole billions of dollars from the country and pushed it into economic crisis.

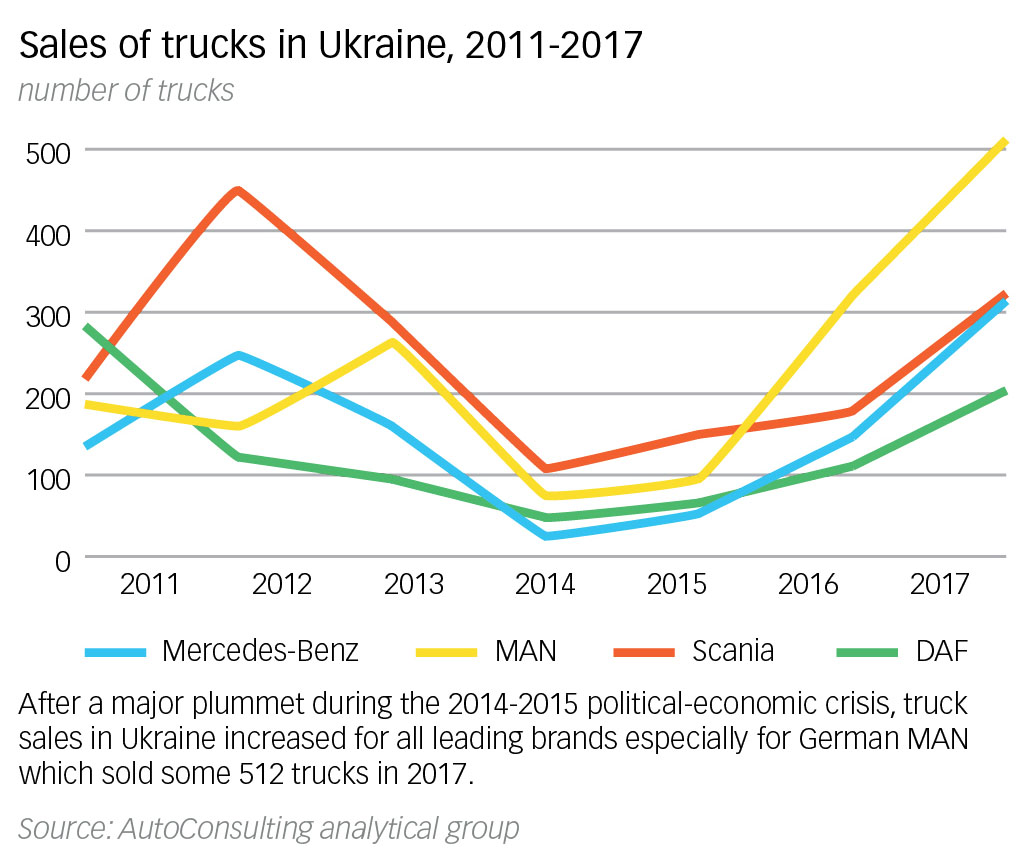

By 2015 the truck sales market had plummeted to about 1,400 units annually. But last year the market made it back to 3,500 new trucks — an 80 percent increase on 2016 — despite fears of economic instability.

But purchasing decisions have changed. Companies in Ukraine are starting to switch to more durable Western trucks, which are far more expensive than post-Soviet brands.

These high-quality trucks, known as premium trucks within the industry, are mostly made by the seven biggest European truck companies — Scania, MAN, Mercedes-Benz, Volvo, Renault, DAF, and Iveco.

Back in 2011, the premium segment accounted for only 25 percent of the market, or 1,256 units. Last year, this segment had doubled, reaching half of the sales market in Ukraine. Most say that what drives this growth is a growing understanding of the advantages of a good truck.

For the past few years, businesses have been thinking longer-term, considering not just the sticker price of the vehicle, but also future fuel and repair expenses, as well as the depreciation value of trucks.

“If you buy a MAN truck for 100,000 euros, then in five years it can be sold for 40,000–50,000 euros. If you take a post-Soviet truck that costs 60,000 euros, then after five years it has no value,” Oleksandr Ostapovych, commercial director of MAN Truck&Bus Ukraine, said.

“It will just be scrap metal.” In 2017, MAN sold 512 trucks in Ukraine, 60 percent more than last year, and taking a 14-percent share of the market.

In turn, last year MercedesBenz sold 290 trucks in Ukraine, five times more than in 2015.

And the same positive trends are seen at Swedish truck company Scania: In 2017, it sold 330 trucks for more than $40 million, which was a 93 percent increase compared to the previous year. Håkan Jyde, the managing director for Scania Ukraine, said that the company was expanding its operations in Ukraine. “

In 2017 we opened new service stations in Poltava, Vinnytsia and Mukachevo, and since the beginning of 2018 we’ve been operating a new dealership of our own in the city of Kramatorsk,” Jyde said.

“We do expect moderate growth in the market for heavy vehicles” this year as well, he said.

Another reason for energetic truck sales is the European Union’s environmental standards, which require trucks to have specific emissions standards, such as the Euro 6 standard.

Trucks in Ukraine have to comply with these standards by 2020 as part of the country’s political-economic association agreement with the EU.

But Ostapovych says that many Ukrainian truck owners can buy such certificates by paying bribes to local environmental regulators.

For example, he says, statistics on trucks that are currently switching from the Euro 2 standard to the Euro 5 “are massively falsified, and the number of imported, commercial, used vehicles from the EU this year will be about 12,000–13,000.”

Road construction

For a big country like Ukraine, which has a vast network of 170,000 kilometers of roads, the size of the truck market is still well below its potential. “In Europe, these figures are ten times more,” said Yaroslav Prygara, CEO of Mercedes-Benz in Ukraine.

In general, the transportation business depends directly on the economic health of a country — if markets grow then the demand for trucks grows.

“When the economy works there is a growing demand for transportation and for new vehicles,” said Yurii Antoniuk, a sales representative for Volvo’s truck segment.

Another reason why truck sales went up is linked to road construction development, as the government has allocated $1.8 billion to upgrading road infrastructure this year.

Road construction companies use trucks to transport a lot of equipment, driving up demand. “After 2013, there were practically no road builders, while this year we sold them everything we had,” Ostapovych said.

But while truck sellers are running out of supply, their customers are running out of qualified drivers as more of them are moving to Poland where salaries are several times higher than in Ukraine. “If before it was alarming, now it’s a massive story,” said Prygara.

And Ukraine’s roads are still in dire condition, which is continuing to act as a brake on truck sales.

“More than half of our service center calls are related to a chassis breaking,” Antoniuk said. “This significantly affects demand, as customers are not prepared to buy a new vehicle and then destroy it on our roads.”

Oleksandr Ostapovych, commercial director of MAN Truck & Bus Ukraine. (Courtesy)