Ukraine’s hotel market was one of the hardest hit during the COVID‑19 pandemic — hotels across the country reported revenue losses from anywhere between 25–60%.

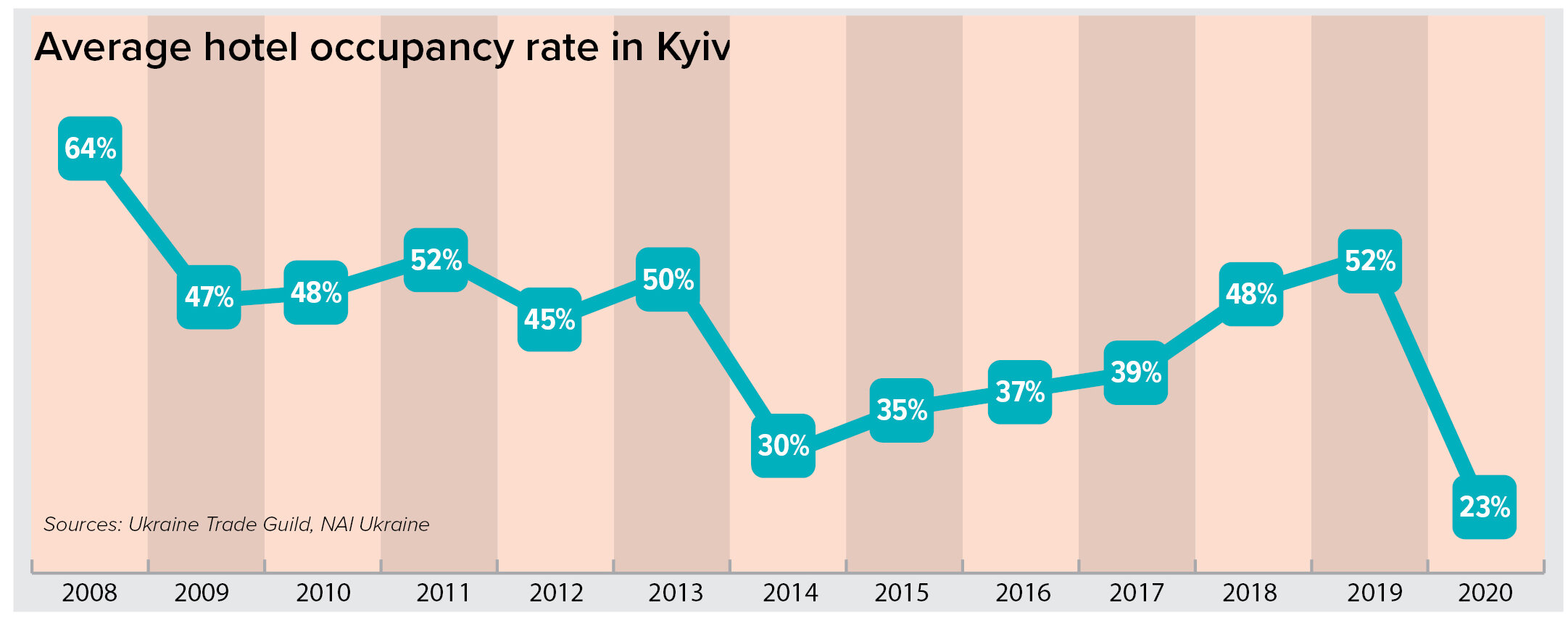

Hit on two fronts by strict travel restrictions and bans on public events, such as conferences and other business events popular at hotels, occupancy in hotels in Ukraine’s major cities plummeted from averages of 35–50% to 20–25%.

During the strictest lockdown in March-May 2020, hotels in Ukraine sat completely empty for two months.

And yet, domestic tourism grew in 2020 as closed borders forced Ukrainians to vacation closer to home, raising revenues at resorts across the country. Urban hoteliers shifted gears and found ways to stay afloat, remaining optimistic for a swift recovery in 2021.

Sergii Kozhukhalov, head of the hospitality department at accountancy firm PKF in Ukraine, says that while occupancy in city hotels, especially in Kyiv, was low over the past year, “demand grew at resort destinations and in the countryside.”

According to geo-analytics of Ukrainian mobile operator Vodafone, domestic tourism at Ukrainian sea resorts grew by 30% in 2020. One small village, Bilosarayska Kosa, about 20 kilometers from the front line city of Mariupol, saw a 177% increase in visitors compared to 2019.

And during the New Year and Christmas holidays Ukrainian resort hotels recorded almost 100% occupancy, founder of Ribas Hotels Group Artur Lupashko told Interfax-Ukraine.

The Ukrainian Hotel and Resort Association found that, in 2020, only countryside hotels reported growing revenues. Kozhukhalov noted that this increase in domestic tourism has become an opportunity for new developments.

Vasily Grogol, executive director of Bursa Hotel in Kyiv, told the Kyiv Post in December that due to this shifting demand, he is working on a new hotel complex outside of Kyiv, designed specifically for local travelers.

Urban hotels

While seaside and countryside resorts enjoyed an uptick in demand, urban hotels had to find new ways of adapting to the pandemic.

Artem Prykhodko, general manager of the InterContinental Kyiv, a five-star hotel in central Kyiv, says they were hit badly by the pandemic, with occupancy rates falling to about 25%.

To survive, the hotel had to reduce costs and staff, while still trying to maintain a luxury level of service — something Prykhodko said was hard to do.

The hotel also used the time off to do some repair work and refurbishing, to do some of the “noisier jobs” that are important, but harder to do when the hotel is open.

InterContinental had the full support of capital investment to maintain the quality and keep the hotel “bright and shiny,” Prykhodko said.

Prykhodko remains optimistic about 2021 and says the hotel is already in a recovery phase. Before the most recent lockdown, the hotel had been hiring 10 new employees per week for the last few weeks.

“If you had asked me in April of 2020 how many hotels will survive, I wasn’t sure everyone would make it, but I am happy to see the main players are still on the market,” he said.

The Ukrainian Hotel & Resort Association says that about 70% of hotels it surveyed, mainly mid-market, plan to continue operating.

So-called apart-hotels have also gained momentum over the year. Although technically considered residential real estate, these are serviced apartment complexes that use a hotel-style booking system.

They already represent around 10% of the overall apartment market and are attractive to investors because they are low risk, Kozhukhalov said.

Hit by strict travel restrictions and bans on public events imposed to curb the spread of the coronavirus, occupancy in hotels in Ukraine’s major cities plummeted to 23% in 2020.

New hotels

According to NAI Ukraine, a commercial real estate brokerage firm, there is no information about the opening of new hotels in 2020.

Kozhukhalov says that many hotels postponed their opening, taking the time to rebuild and rebrand before opening.

And while hotels that managed to survive the pandemic may begin to see some recovery in 2021, Kozhukhalov believes that for new hotels, growth won’t happen until at least 2025.

NAI noted that the law on legalization of gambling could potentially open new horizons for further growth in the hotel industry, as it allows casinos to operate in five-star hotels in tourist areas.