Ukrainian seaports are the main gates for the country’s exports and imports.

Last year, these gates seemed open and inviting, as the ports hit a historic record of 160 million tons in cargo turnover in 2019.

Despite such favorable results, however, mismanagement in the state seaports is still high, which strains further growth. High port tariffs and unproductive government policy, in particular, still worry businesses, ship-owners, and foreign investors.

For the past three years, only 20% of what was planned in the port industry was completed, Raivis Veckagans said when leaving his position as acting head of the Ukrainian Sea Ports Authority earlier this year.

“All the wonderful statements and initiatives at a high state level about the need for long-term development of port infrastructure crashed due to the government’s tasks to fill the country’s budget here and now,” said Veckagans back then.

But port professionals see one promising option to develop the country’s ports: concessions to lease these sites of vital economic infrastructure to private companies long term

Main ports

The historic-high turnover in 2019 was possible not because the government helped create favorable conditions and high-quality services in seaports, but because private stevedore companies had worked harder than ever, experts say.

TransInvestService, or TIS, Ukraine’s biggest private terminal operator and stevedore in the Pivdennyi seaport — which sold 51% of its stakes to Dubai’s DP World in June for an undisclosed sum of money — was able to handle 33 million tons of cargo alone last year.

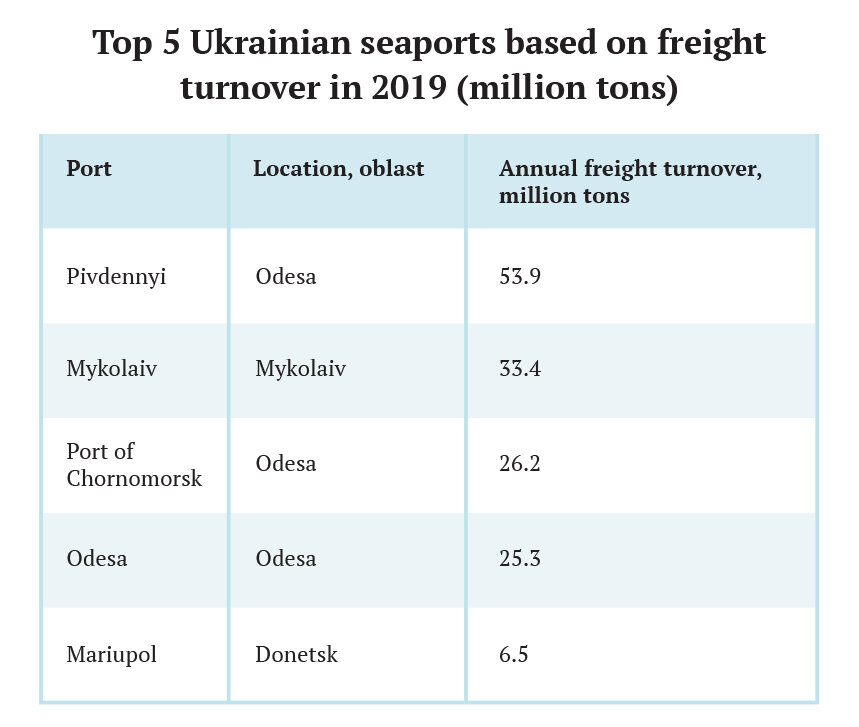

In general, during 2019, the five most productive of the 13 seaports on the Ukrainian mainland remained the same — Pivdennyi, Mykolaiv, Chornomorsk, Odesa and Mariupol.

Three of them are located in Odesa Oblast and were responsible for 65% of the entire seaports cargo turnover last year. The Mykolaiv seaport on the Black Sea and the one in Mariupol, based on the coast of the Azov Sea, handled 25% of the annual cargo flow.

Agrarian products, ore, ferrous metals and coal accounted for 75% of the turnover in these ports.

Meanwhile, the cargo turnover in five Crimean ports, illegally annexed with the whole peninsula by Russia in 2014, halved to 4.3 million tons by the end of 2019.

For the first time in the past decade, the annual freight turnover in Ukraine has exceeded 160 million tons. In Odesa Oblast alone, the number reached 111.1 million tons in 2019, 20.5% more compared to 2018. (Ukraine Sea Ports Authority)

Even though the COVID‑19 pandemic and strict quarantine measures severely hit many businesses across Ukraine, the crisis did not affect the activities of seaport operators.

The volumes of cargo handled in Ukrainian seaports even increased by 12.6% up to 55 million tons in the first four months of 2020 compared to the same period last year. Seaport Pivdenny in Odesa Oblast handled a record of 4.6 million tons of cargo alone.

“The Pivdenny seaport with its workload proved that the coronavirus crisis isn’t just about problems and limitations but also about opportunities,” said Infrastructure Minister Vladyslav Krykliy.

Selling to someone

The 13 Ukrainian ports are state-owned and they charge the highest fees in the world for using them. Over 90% of the collected money — around $200–250 million a year — goes to the state budget. Only a tiny amount of that sum, however, is reinvested into the ports themselves. In 2020, Ukraine put only $20 million into them.

The underinvestment causes further destruction of the already half-ruined berths, as well as other infrastructure in ports. As a result, currently only two berths — out of nearly 260 — are under repair, according to Oleksandr Golodnytskyy, acting head at the Ukrainian Seas Port Authority (USPA).

“This is everything we can afford,” Golodnytskyy said.

Ukrainian state seaports are the main gates for the country’s exports and imports. However, Ukraine invests very little in them and so all 13 of them are in poor condition. (Kyiv Post)

Golodnytskyy agrees it is absurd that ship-owners have to pay the highest tariffs in the world for services in ports, while almost all of this money goes to the state budget.

“We definitely need to do something about it,” said Golodnytskyy. He thinks a healthy compromise would be transferring only 30% to the budget.

He also says that, in general, port tariffs will decrease, but can’t say more because the document on the methodology for port tariffs, previously ordered by Ukraine’s President Volodymyr Zelensky and the Anti-Monopoly Committee, is “still under development.”

In the latest version that was published by the USPA in April 2020, Yuriy Vaskov, director of consulting firm Ukrmara and former deputy infrastructure minister, doesn’t see “any actual methodology.”

“It is just a tariff book (with tariffs that) existed previously,” he said, adding that the document is “unfair” and allows charging different fees in different regions. Thus, fees for ships can range from $2 to $6 per ton in different ports.

High seaports tariffs have hampered exports and imports by scaring some businesses away from using the Ukrainian ports at all, experts say. Vaskov, however, thinks there’s a bigger problem than tariffs — corruption.

“If we look into expenses that exporters and importers spend per one ton of cargo, both official and unofficial, we’ll see that those are many times higher than port tariffs,” Vaskov said during an online forum.

Concessions to rescue

Shota Khajishvili, CEO of Swiss agriculture holding Risoil S. A., agrees. He believes the only way to save Ukrainian seaports is to sell them to private investors or agree on concessions, because the state can’t “reanimate” the ports on its own.

“Collecting billions, the administrations of seaports did not even deign to spend money on basic security of its own berths and ships that are moored,” said Khajishvili. “In any port, whether it be Kherson or Chernomorsk or any other port, fenders on moorings are made of wheels from garbage dumps.”

Khajishvili practices what he preaches. Despite Ukraine’s convoluted bureaucracy — and even court appeals to suspend the results of the concession tender — his Risoil S. A. partnered with Georgian firm Petro Oil and Chemicals and took the Kherson seaport in a 30-year concession on June 26, the first ever concession in Ukraine’s history.

Widely used in the port sector around the world, port concessions mean contracts between a state and private firms, which allow the firm to take control over a port for a long time. The firms claim all the fees for themselves, but have investment obligations, too.

The consortium in Kherson, for example, will have to invest almost $13 million and to ensure at least 1.3 million tons of annual cargo turnover. Last year, the port’s turnover was 3.8 million tons.

Khajishvili said that the consortium “plans to develop the Kherson seaport as a river logistics hub, including to develop a modern river fleet” for it.

Meanwhile, Qatari port operator QTerminals will sign another concession with Ukraine for the Olvia seaport in Mykolaiv Oblast. Under the agreement, the Qatari firm will have to put over $130 million into 180 hectares of the port area over the next five years.

The third concession project will be in the Chornomorsk seaport in Odesa Oblast and, currently, it’s in the preparation phase.

These concessions “will give a powerful impetus to economic development,” said Golodnytskyy from the USPA.

Additionally, the state plans to sell three smaller ports on the Black Sea — Skadovsk, Ust-Dunaysk and Belgorod-Dniester — to private investor as these ports are highly unprofitable and don’t even have money to pay salaries to their employees. The State Property Fund will put two of them up for auction this year — Skadovsk (turnover: 4,700 tons) and Ust-Dunaysk (turnover: 70,800 tons).

“We need to switch the mode from ‘always promising’ and ‘with a lot of potential’ to actually realizing this potential and turning these prospects into successful investment cases,” Dmytro Sennychenko, head of the State Property Fund, said.

Serving more than 500 ships per year and having 18 berths on almost four kilometers, the Mariupol seaport on the Azov Sea handled 5.77 million tons of cargo in 2019, 400,000 tons more than in 2018. However, it is almost three times lower if compared to 2013, before Russia occupied the Kerch Strait in 2014 after illegally annexing the Crimean peninsula. (Kostyantyn Chernichkin)