The old promise that machines would one day do all the work, leaving their owners free to lead a life of leisure, is finally coming to life.

Well – at least for those who have powerful computers and know how to mine Bitcoins and other cryptocurrencies, that is.

Although one has to make a considerable investment in equipment and make a risky bet on the value of a virtual currency that is not backed by any government, ever more Ukrainians are entering the business.

With powerful hardware, one can easily earn about $2,000 a month – quite an income in Ukraine, where the average monthly wage is $250.

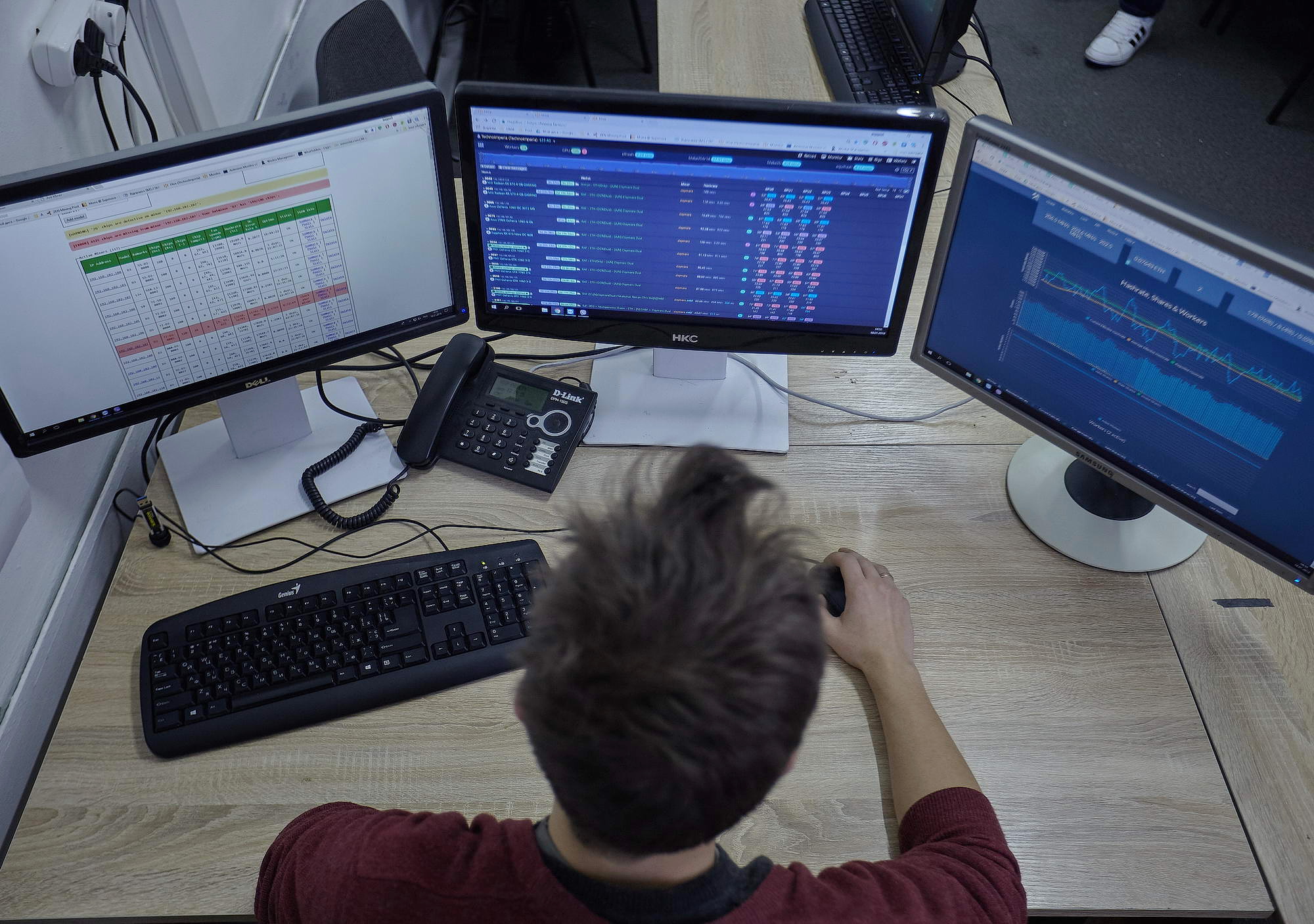

A man installs computers to mine cryptocurrencies at a data center in Kyiv on Jan. 18. These computers are actually video cards that are assembled into blocks dubbed “farms.” (photos by MiningNetUa, exclusively for the Kyiv Post) (Mining.Net.Ua)

How it works

Mining Bitcoins means using a computer to help maintain a distributed ledger of Bitcoin transactions recorded in what is called a blockchain – groups of transactions are recorded in blocks, and blocks are in turn linked to each other to form a chain. This data representation makes it very difficult (practically impossible) to falsify transaction records.

But the creators of the Bitcoin software also made it very difficult to verify transactions, hence the need to have a powerful computer on hand. The reward for helping maintain the Bitcoin ledger is the issue of more Bitcoins (later it will be transaction fees).

The value of this currency has risen from nothing to more than $11,000 over the nine years of its existence.

However, the way the system is set up, it gets harder and harder to mine Bitcoins. It happens because the difficulty of the calculations required to verify a transactions rises in line with the available computing power, which the system measures every two weeks. As a result, Bitcoins continue to be issued at the same rate even though much more computer power is dedicated to the job.

Moreover, only a finite number of Bitcoins, 21 million, will ever be issued. As of January, 16.8 million Bitcoins were in circulation. But with mining becoming more complicated, it is projected that the last Bitcoin will be mined in the year 2140.

Meanwhile, according to Google Trends, “Bitcoin” was the second most popular search worldwide in Google News in 2017, beaten only by “hurricane Irma.”

Meet the miners

One of those trying to cash in on mining Bitcoins (traded as BTC) is Odesa businessman Ivan Sydorenko. His computers, kept in a datacenter of a Kyiv friend, bring him about $50 every day.

In the summer of 2017, Sydorenko invested $6,000 to buy the mining hardware, and has already returned his money. Now he plans to buy at least $12,000 more worth of equipment to boost his profits.

“Anyway, I’ve mined much more than that sum ($12,000) over the last six months,” Sydorenko said, adding that it happened because the price of a Bitcoin grew six times over the period. Indeed, over the last year the value of Bitcoin has grown exponentially, from $800 to $13,000.

Aleksandr Bortnikov, the head of the design agency Rhombus, earns about $60 per day from mining cryptocurrency, but he pays a percentage to the company that hosts his hardware and maintains it for him.

The designer saw the cryptocurrency market as a yet another way “to diversify his investments.”

In summer 2017 he invested $10,000 in equipment, and the money was quickly returned by mining the cryptocurrency Ethereum (traded as ETH). Ethereum’s value has risen from $200 in August to $1,200 now.

The datacenter Bortnikov trusted his initial investment with was MiningNetUa. It helped him to choose hardware, set it up, and maintain it.

Real world

Bortnikov is still mining cryptocurrency, earning about $1,800 a month. But his income is likely to fall, as the math tasks that his computers have to solve are getting harder, and he would have to invest in more computing power to maintain his profits.

He doesn’t plan to, however.

“I’d have to re-invest if I wanted to stay in this, but I’ve got a real-world business and I’ll direct my money to it instead,” Bortnikov said.

As Bortnikov plans to quit MiningNetUa, its CEO Raphael Nersesyan says his job is to make sure everything keeps working for his other 1,000 clients.

“We mine, and the person who invests just gets the money. They can do whatever they want – travel, work – we’ll make sure the mining happens,” Nersesyan told the Kyiv Post. He owns four datacenters, and his company works with people from different countries.

“Basically, they get their money and do nothing,” he said.

MiningNetUa CEO Raphael Nersesyan checks the hardware of his clients at one of his company’s data centers in Kyiv on Jan. 18. Nersesyan says his job is to make sure everything keeps working for his 1,000 clients. (Mining.Net.Ua)

On average, people invest $25,000 in hardware to start mining cryptocurrency, according to Nersesyan, but some “believe in cryptocurrency so much that they are ready to put millions of dollars into this industry.”

Trading up

Not all miners are as open as Bortnikov and Sydorenko about their earnings. Artem Pokutnii, 25, a freelance programmer, would only say that he spent $1,000 on equipment, and he recovered his investment in less than two months.

“This was something new four years ago: coins and algorithms – it was interesting to understand how it works,” Pokutnii told the Kyiv Post.

But recently he stopped mining. Today, Pokutnii sees more promise in trading cryptocurrencies on an exchange, as the volatility of the digital currencies is something traders can play on. For instance, those who bought Bitcoins last January have seen their value grow by 16 times.

“It’s more profitable to buy cryptocurrencies and trade them than mine them, and that’s exactly what I’m doing,” Pokutnii said.

A row of fans cool down video cards, the computer hardware that actually does the computing to collect cryptocurrencies. It recently became impossible, however, to mine Bitcoins just with video cards, and people have started using special equipment that does the work better, and faster, than video cards. They are called ASICs – microchips designed specifically for mining Bitcoins. (Mining.Net.Ua)

Is it legal?

Ukraine has no laws that regulate cryptocurrency. So in the opinion of Artem Afian, a managing partner of law firm Juscutum, mining, using and trading cryptocurrencies is legal in Ukraine.

“It’s legal to do vacuum cleaning naked, to dance salsa, and to mine cryptocurrency,” Afian told the Kyiv Post. “If a particular activity is not forbidden, then it’s allowed.”

If authorities come to a house of a miner and claim otherwise, Afian urges them to go to court and to demand justice.

All the same, the National Bank of Ukraine, Ukraine’s central bank, does not approve of cryptocurrencies, describing them as “money surrogates.”

The ability to use the money anonymously also worries law enforcers as well as regulators: National Security and Defense Council Head Oleksandr Turchynov said that cryptocurrencies could be used to legalize criminal assets, to pay for prohibited goods like drugs and weapons, and finance terrorism.

On Jan. 11, Turchynov urged law enforcers to create a mechanism for monitoring transactions on cryptocurrency exchanges and to disclose customer information at request.

This can prove hard to do. Nowhere in the world have there been any cases of the anonymity of cryptocurrency transactions being broken.

Watchful eyes

While cryptocurrencies promise fast profits, keep all the parties anonymous, and are not regulated by the Ukrainian government, the country’s law enforcement agencies are keeping a close eye on developments in this area.

This attention has resulted in police searches, one of which happened to Anatoly Kaplan, the editor of ForkLog, one of the top publications on the cryptocurrency industry. He’s a Russian citizen who’s been living in Ukraine for five years.

Ukraine’s Security Service, or SBU, accuses Kaplan of money laundering and transferring them to Russia using cryptocurrencies. However, the warrant stated a different reason for the search: illegal forgery of U.S. bank cards and accepting payment in cryptocurrency.

The SBU arrived to Kaplan’s house with this warrant in December, and gained access to Kaplan’s computers and online wallets. The journalist claims the SBU illegally seized cryptocurrencies worth $800,000, transferring the money to their accounts. Another $500,000 worth of his cryptocurrencies was frozen, he said.

“Such groundless searches are common practice (in Ukraine and Russia),” Kaplan told the Kyiv Post via the online messenger app Telegram. He doesn’t have a Ukrainian cell number anymore, because he thinks the police wiretapped him.

Kaplan is sure the search was extortion, pure and simple.

“The SBU looks for spheres that are financially interesting to them. I assume they wanted a bribe from me,” Kaplan said. “My Russian passport just played the role of a red rag in this case.”

SBU spokeswoman Olena Hitlyanska told the Kyiv Post she was not able to give comments further to the SBU’s official statement on the case. As of the time of publication, the SBU has not responded to a Kyiv Post media request for information on this case.

Kaplan said he wanted to bring the case to the European Court of Human Rights and sue the government of Ukraine for the return of his $1.3 million in frozen and seized cryptocurrency.

“I’m sure I’ll win. There are many similar cases that are successful, against Russia and other governments in which the law enforcement systems work against people,” Kaplan said. “Such parasitism of the authorities on the cryptocurrency market destroys the reputation of Ukraine. Billions of dollars will leave Ukraine, or won’t come here.”

The Kyiv Post’s IT coverage is sponsored by Ciklum. The content is independent of the donors.