The Ukrainian sky has been virtually empty last year — the air traffic dropped by 58% since 2019. Ukrainian airlines have lost millions of dollars, teetering on the edge of bankruptcy without state support.

Amid this turmoil, Ukraine’s commercial aviation has welcomed a newcomer, lowcoster Bees Airlines.

Founded in summer 2020 and currently employing 65 people, Bees Airlines has already signed two contracts with tour operators for charter flights and is negotiating two more.

Bees Airlines CEO Evgeny Khainatsky agrees that it’s confusing when an airline starts operating during arguably the worst year for the industry, but he thinks the lowcoster can help revive it.

For Bees Airlines, in particular, the future looks cloudless: the company doesn’t owe any rent or refunds for canceled flights and its cheaper to lease a plane amid the pandemic.

Experts think the new low-cost airline can indeed live through the crisis if international flights resume in spring and the company finds its niche.

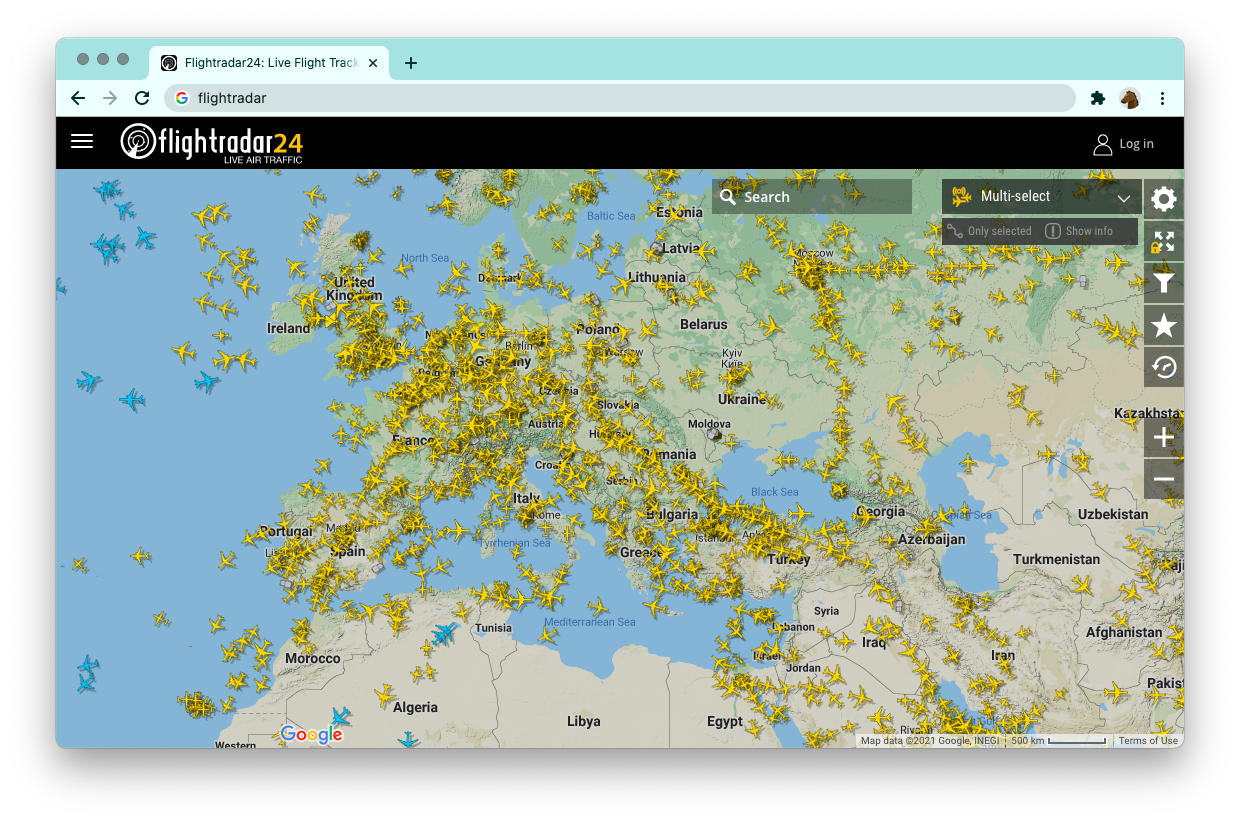

A screenshot of the Flightradar map showing real-time commercial aircraft flight tracking information as of 6 p.m. on Feb. 1. Compared to European Union countries, Ukraine’s air is nearly empty, with only about a dozen aircraft traveling to, from or through Ukraine.

Russian owner?

When Bees Airlines entered the market, the local aviation industry met the newcomer with suspicion.

Industry players claimed that the airline was founded by Russia’s tour operator Tez Tour. Khainatsky dismissed the rumors. He said the company has no patrons and is governed only by its owner, agriculture businessmen Sergey Smirniy.

According to Khainatsky, Smirniy has already invested $1 million and plans to put in $5 million more of his own money.

In December, however, it was Tez Tour with whom Bees Airlines signed its first contract for charter flights. Tez Tour’s local branch is one of the largest tour operators in Ukraine. And Smirniy used to work with Tez Tour’s Ukrainian branch owner Sergey Burtin.

Business strategy

Aviation lost over $118 billion because of travel restrictions in 2020 and experts predict the industry won’t recover until 2024.

Ukraine’s flagship air carrier Ukraine International Airlines (UIA) alone lost nearly $60 million, while lowcoster SkyUp is nearly bankrupt after it lost $30 million in March-August.

But before the pandemic, the picture looked different. In high seasons, the four most popular Ukrainian airlines — Azur Air, SkyUp, UIA and Windrose — couldn’t meet the existing demand.

Tour agencies had to hire less popular carriers with older planes and this often caused delays, according to Pavlo Hryhorash, chief executive of the Ukrainian Travel Agencies Association.

That is why more competition is welcome and will come in handy after the demand bounces back, he said.

For now, Bees Airlines will work as both a low-cost airline with affordable tickets and as a charter airline that organizes irregular flights for tour operators to transport tourists abroad — the strategy that has proved to be effective in Ukraine, according to experts.

The companies that work as charter and low-cost airlines are more flexible. They can sell tickets to both tourists and tour operators, said aviation expert Viktor Logvinenko.

Low-cost airlines also appeared to be more resilient during the pandemic because they could quickly change their routes and save money on flights.

Ukrainians also got accustomed to using lowcosters after Ukraine got a visa-free regime with the European Union. This brought in WizzAir, Ryanair and local SkyUp, according to Andriy Yarmak, head of Ukraine’s air traffic service.

Khainatsky previously worked with SkyUp, which was once the seventh fastest-growing airline in Europe. He later became the company’s chief executive. In June 2020, he left the company and was replaced by Dmitriy Seroukhov, head of Join UP!, SkyUp’s parent company.

SkyUp’s owners were angry at Khainatsky.

“During the quarantine, the whole team worked to save SkyUp from the crisis… But it turned out that Evgeny Khainatsky worked to improve someoone else’s results,” said Seroukhov back in July.

According to Seroukhov, Khainatsky and some other staffers left SkyUp to launch another air carrier.

Khainatsky confirmed to the Kyiv Post that he had helped Smirniy with his business from the beginning but denied working for both companies simultaneously. He said he only “consulted” Bees Airlines.

“I am an open person and if someone needs help I offer it,” he said. “I do not deny that I gave advice to partners from other companies about the development of the airline business.”

Khainatsky said he had never disclosed commercial information that could hurt SkyUp.

Now, as Khainatsky prepares to direct Bees Airlines, he wants to try to replicate SkyUp’s success.

“With Bees Airlines, I go through the same as I did with SkyUp when we began. But the commercial strategy and routes of both companies are different,” Khainatsky said.

According to him, SkyUp was initially created to serve one tour operator — Join UP!, while Bees Airlines is open for partnership with everyone since the start.

Airport and aircraft

Bees Airline’s jets will fly from Kyiv Sikorsky Airport in the southwest of the capital. Khainatsky said he knows this airport because SkyUp also started from there.

Khainatsky said Kyiv Sikorsky Airport is better for lowcosters, because it has a better location than Kyiv Boryspil International Airport, the country’s largest airport, which sits 34 kilometers northeast of Kyiv.

Right now, Bees Airlines fleet consists of two Boeing 737-800 NG jets, which were used by UIA before their contract with U.S. leasing company Aviation Capital Group expired. Bees Airlines was lucky: because of the pandemic, the company rented the planes at a 30% discount.

Khainatsky said it’s cheaper for a new airline to grow during the pandemic.

The big players suffered great losses: UIA’s fleet, for example, had to stay grounded for the entirety of the strict lockdown in March-May, but continued paying leases. The fleet’s downtime cost the company $14.5 million a month.

By the end of 2021, Bees Airlines wants to increase its fleet to four planes. The company will paint them in the brand’s colors — white, yellow, and black — and replace the passenger seats.

The Bees Airlines fleet is much smaller than other local air carriers’. UIA has 35 planes, Windrose has 16 and SkyUp has 11. Some of these companies’ aircraft and equipment are over 20 years old, hampering their speed and safety.

The planes leased by Bees Airlines are newer — just ten years old. Khainatsky said that the airline prioritizes quality over fast growth.

The new generation of Boeing jets (NG) is faster and more fuel-efficient than its forerunner. UIA and SkyUp have already replaced the prior models, according to Logvinenko, and mostly use Boeing 737-800 NG and Boeing-737 NG.

Ukrainian airlines lease these planes for 5-10 years from aircraft leasing companies like Aviation Capital Group. It is too expensive for Ukrainian airlines to buy their own vehicles, said Oleksandr Lanetsky, chief executive of consultancy Friendly Avia Support.

The price of one Boeing 737 jet is nearly $106 million. The lease costs on average $10,000 per day, which is nearly $3.6 million a year.

New routes

Ukrainians can travel to 75 countries as of Feb. 1, including to Turkey, Bulgaria, Cambodia and South Korea. Most of the Western European states remain closed for Ukrainians.

In spring 2021, airlines are expected to gradually resume international flights as more countries reopen, Hryhorash said. However, the future of the air carriers depends on political decisions and vaccination campaigns. Ukraine has yet to start vaccinating its citizens.

Bees Airlines expects demand for international travel to skyrocket in the spring and summer. The company won’t give up profitable destinations like Turkey, Egypt, Greece and Bulgaria when the demand is high but also wants to fly to more exotic places like Kenya and Georgia.

It has already signed contracts with local tour operators Tez Tour and TPG. The airline has scheduled its first flight to Kenya with TPG in April 2021. Ticket prices are coming soon.

Before the pandemic, the Ukrainian aviation market was dominated by foreign airlines like Turkish Airlines, Belarusian Belavia, Hungarian WizzAir and Polish LOT Airlines.

Their ticket prices were higher but they offered more routes and better services. For them, Ukraine is a large and profitable market, Khainatsky said. Meanwhile, Ukrainian airlines are losing money according to experts.

Khainatsky believes the more Ukrainian airlines start flying, the easier it will be to fight off foreign competition in the local market.

“Ukrainian airlines have to work together to fight the dominance of foreign air carriers,” he said. “Otherwise, local companies can disappear.”