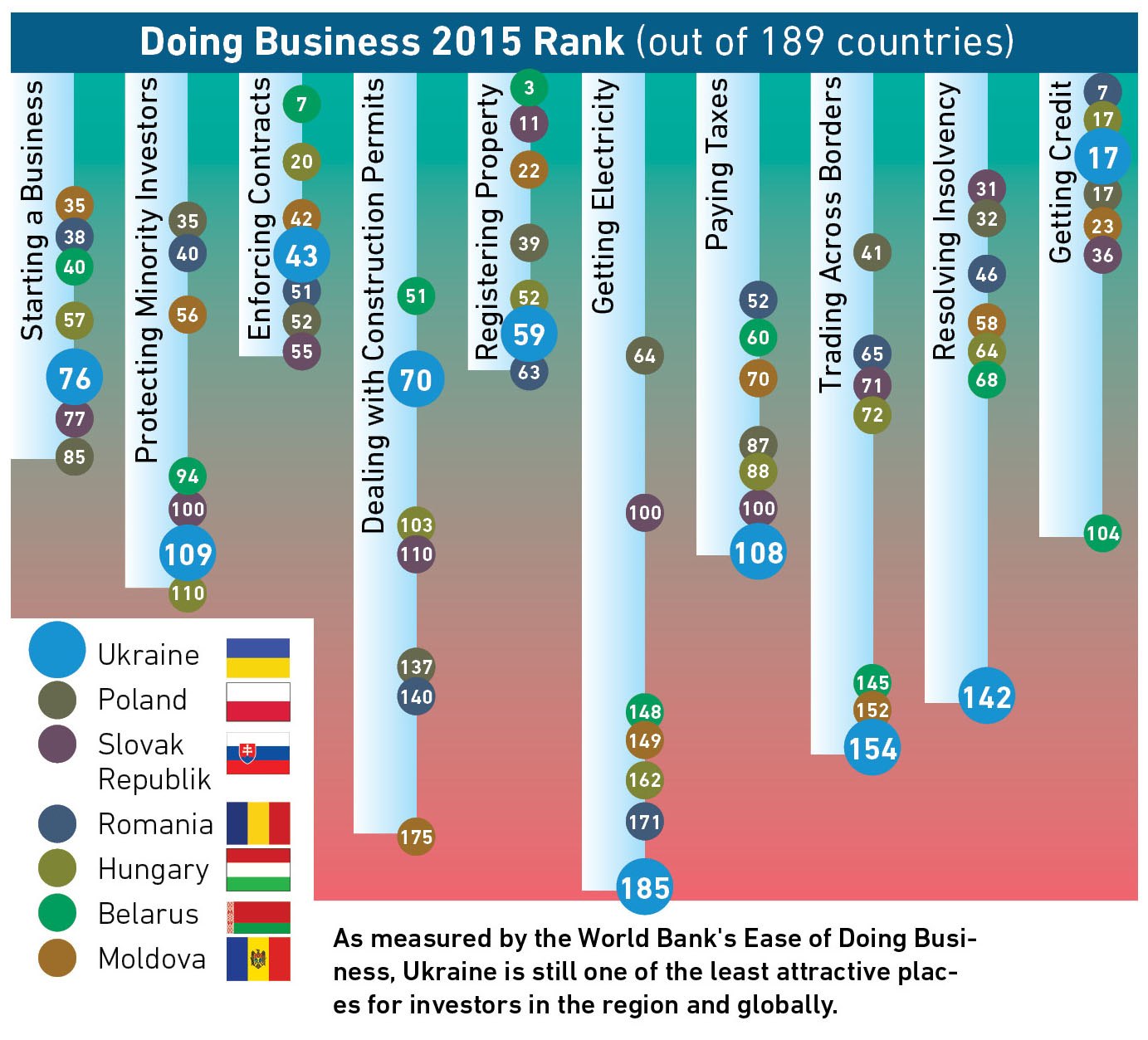

The World Bank's annual Ease of Doing Business ranking compares regulatory environments in 189 economies. In 2015, Ukraine ranked an unspectacular 96th place, but Justice Minister Pavlo Petrenko is shooting for 76th place next year.

A better ranking means more jobs, he said. “It will allow Ukraine to create 50,000-70,000 new working places and attract Hr 30 billion ($1.4 billion) in investments by 2020,” Petrenko said.

The ranking measures progress in 10 categories: electricity, construction permits, registering property, starting a business, protecting minority investors, enforcing contracts, paying taxes, trading across borders, resolving insolvency and getting credit.

For simplification, the Kyiv Post consolidated the categories into four areas – real estate, corporate, tax & trade and banking & finance.

Real estate

Ukraine showed improvement in construction permits and property registration.

Sergiy Portnoy, a legal expert with DLA Piper Ukraine, said the improvement “happened because of simplification of regulatory procedures, a significant reduction of authorization documents and time for consideration by state organs.” Portnoy called the introduction of single Real Estate Register “a major achievement.” By contrast, the index on getting electricity stalled due to overregulation, he said.

Improvement can be made through decentralization. “It is also worth simplifying procedures of allocation of land and registration of real estate,” Portnoy said.

Corporate

“Improvement of Ukraine’s index in starting a business is a predictable outcome of the implementation of successful legislative incentives during 2004-2015,” Maksym Cherkasenko, a partner at Arzinger law firm, said.

The law on deregulation, in force since April 4, may become revolutionary by making registration of business easier and quicker, Cherkasenko said.

In addition, the Verkhovna Rada introduced electronic registration of companies, abolished cumbersome obligations to obtain stamps and get notarized documents submitted to state registrars. It also reduced the number of activities requiring a license, he said.

Little, however, has changed in protecting minority investors and enforcing contracts.

Before Parliament enacted April 7 legislation on the protection of investor rights, the law provided little comfort for minority investors. They could not enforce their rights, such as the right to sue management for damages or to start litigation on behalf of the company, Cherkasenko said. The law is also expected to improve the procedure of mandatory buyouts of minority shareholders by setting rigid requirements for fair price, he said.

The enforcement of contracts index declined because of inefficient and untimely enforcement of court decisions.

Tax & trade

When it comes to paying taxes, Ukraine has nothing to brag about – ranking 108th out of 189 economies. It takes 350 hours per year to complete payment of taxes in Ukraine in contrast to 12 hours in the United Arab Emirates, the top-ranked nation. Similarly, the total tax rate in Ukraine is much higher – 52.9% in contrast to 14.8% in the Emirates.

Vyacheslav Vlasov, a partner at PWC Ukraine, believes simplification of tax reports, reduction of reporting periods and cutting the single tax rate will help. Other pluses will come with automatic issuance of value-added tax reports through electronic accounting.

Similar to paying taxes, trading across borders has too many barriers interfering with export and import of goods.

The elimination of manual customs valuation, introduction of a single customs information system and enhancement of electronic administration will allow optimum use of state resources, reduce corruption and decrease time for customs audit, PWC’s Vlasov said.

Banking & finance

Experts from Gide Loyrette Nouel say Ukraine made great progress in transforming an outdated Soviet-inherited legislation in the last decade.

Putting in place public state registers of ownership rights and encumbrances, adoption of new civil and commercial codes, mortgage and pledge laws, and insolvency legislation are landmark, Bertrand Barrier, partner of Gide Loyrette Nouel, said.

Resolution of insolvency became more flexible because of 2013 amendments to the bankruptcy law. It allowed creditors and the debtor to resolve the issues through out-of-court procedures and offered creditors adequate protection of their rights in bankruptcy proceedings, Igor Krasovskiy, a legal expert with Gide Loyrette Nouel added.

While the legislative framework on bankruptcy is good, poor law enforcement is why Ukraine’s index in resolving insolvency is weak, according to Gide’s experts.

“It allows the debtors acting in bad faith to either unreasonably protract the enforcement or completely escape from their payment obligations,” Krasovskiy said. The bill on the improvement of the business climate is a positive step because it will ease existing insolvency procedures, implement tighter deadlines and grant additional rights to creditors. But it is unlikely to fulfill without more comprehensive state reform, Barrier agreed.